- United Kingdom

- /

- Professional Services

- /

- AIM:RTC

Even With A 41% Surge, Cautious Investors Are Not Rewarding RTC Group plc's (LON:RTC) Performance Completely

RTC Group plc (LON:RTC) shares have continued their recent momentum with a 41% gain in the last month alone. This latest share price bounce rounds out a remarkable 494% gain over the last twelve months.

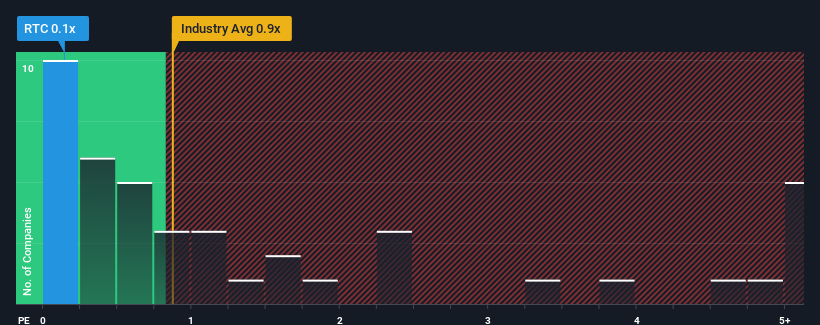

In spite of the firm bounce in price, RTC Group's price-to-sales (or "P/S") ratio of 0.1x might still make it look like a buy right now compared to the Professional Services industry in the United Kingdom, where around half of the companies have P/S ratios above 0.9x and even P/S above 3x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for RTC Group

What Does RTC Group's Recent Performance Look Like?

Recent times have been quite advantageous for RTC Group as its revenue has been rising very briskly. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on RTC Group's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like RTC Group's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 37% last year. The latest three year period has also seen a 21% overall rise in revenue, aided extensively by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 6.1% shows it's about the same on an annualised basis.

With this information, we find it odd that RTC Group is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can maintain recent growth rates.

The Final Word

The latest share price surge wasn't enough to lift RTC Group's P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of RTC Group revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. While recent

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with RTC Group (at least 1 which can't be ignored), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on RTC Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:RTC

RTC Group

Through its subsidiaries, provides recruitment services in the United Kingdom, the United States, and the Middle East.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives