- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:BAB

UK Value Stocks Trading Below Estimated Worth

Reviewed by Simply Wall St

As the FTSE 100 and FTSE 250 indices face downward pressure amid weaker-than-expected trade data from China, investors are closely watching for opportunities in undervalued stocks. In such a challenging market environment, identifying value stocks that are trading below their estimated worth can provide potential for long-term growth and stability.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gaming Realms (AIM:GMR) | £0.362 | £0.66 | 45.2% |

| GlobalData (AIM:DATA) | £1.61 | £3.13 | 48.5% |

| Victrex (LSE:VCT) | £9.64 | £18.31 | 47.3% |

| AstraZeneca (LSE:AZN) | £118.82 | £218.21 | 45.5% |

| Likewise Group (AIM:LIKE) | £0.185 | £0.37 | 49.7% |

| Hochschild Mining (LSE:HOC) | £2.23 | £4.16 | 46.3% |

| Ibstock (LSE:IBST) | £1.67 | £3.07 | 45.5% |

| TI Fluid Systems (LSE:TIFS) | £1.966 | £3.76 | 47.7% |

| Kromek Group (AIM:KMK) | £0.0585 | £0.11 | 48.5% |

| Optima Health (AIM:OPT) | £1.825 | £3.33 | 45.2% |

Here's a peek at a few of the choices from the screener.

Nichols (AIM:NICL)

Overview: Nichols plc, with a market cap of £476.72 million, is involved in supplying soft drinks to retail, wholesale, catering, licensed, and leisure industries across the United Kingdom and internationally including the Middle East and Africa.

Operations: The company's revenue is derived from its Packaged segment, which generated £132.82 million, and its Out of Home segment, which brought in £39.99 million.

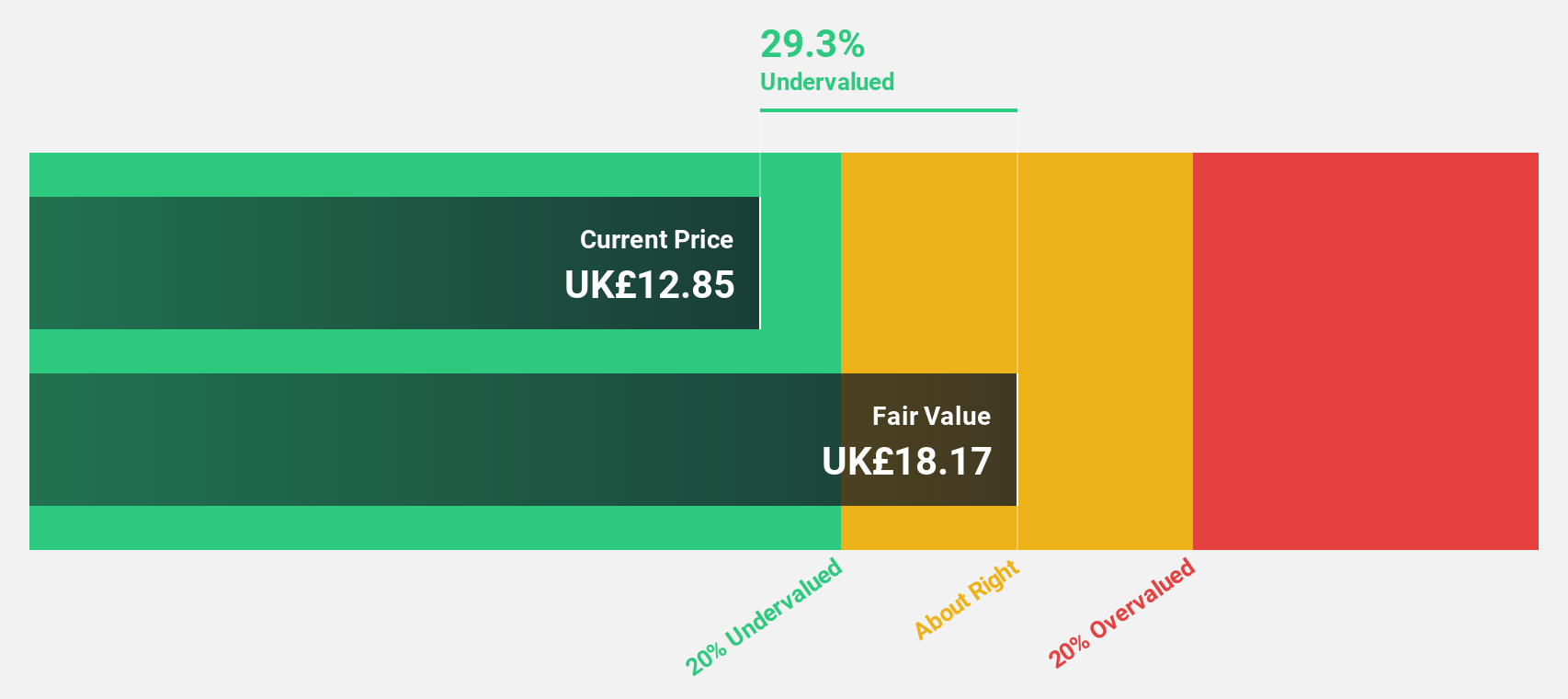

Estimated Discount To Fair Value: 28.8%

Nichols plc appears undervalued, trading 28.8% below its estimated fair value of £18.33, with a current price of £13.05. Despite a slight decline in net income to £17.84 million for 2024, the company maintains strong cash generation, enabling an increased total dividend of 32p per share for the year. Forecasts suggest earnings growth at 14.8% annually, surpassing UK market expectations and indicating potential long-term value despite an unstable dividend track record.

- Our earnings growth report unveils the potential for significant increases in Nichols' future results.

- Click to explore a detailed breakdown of our findings in Nichols' balance sheet health report.

Restore (AIM:RST)

Overview: Restore plc, with a market cap of £308.08 million, offers services to offices and workplaces in both the public and private sectors mainly across the United Kingdom.

Operations: The company generates its revenue from Secure Lifecycle Services (£104.40 million) and Digital & Information Management (£172.50 million).

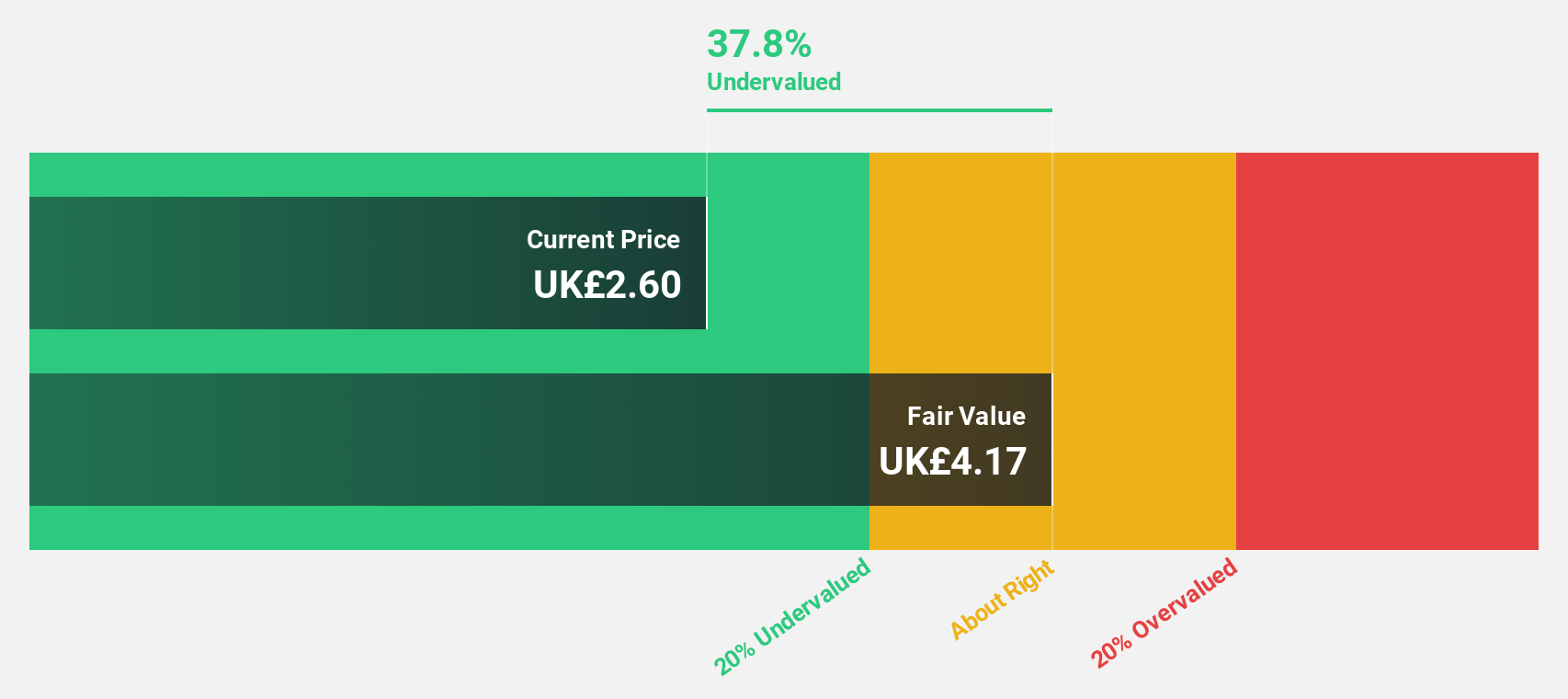

Estimated Discount To Fair Value: 42.6%

Restore plc is trading at £2.25, significantly below its estimated fair value of £3.92, indicating potential undervaluation based on discounted cash flow analysis. Despite interest payments not being well-covered by earnings and a dividend yield of 2.38% that isn't fully supported by profits, earnings are forecast to grow substantially at 37.53% annually over the next three years, outpacing the UK market's growth rate. Recent events include a proposed final dividend increase to 5.8 pence per share for 2024.

- The growth report we've compiled suggests that Restore's future prospects could be on the up.

- Navigate through the intricacies of Restore with our comprehensive financial health report here.

Babcock International Group (LSE:BAB)

Overview: Babcock International Group PLC is involved in the design, development, manufacture, and integration of specialist systems for aerospace, defense, and security across various regions including the United Kingdom and internationally, with a market cap of approximately £3.63 billion.

Operations: The company's revenue is derived from various segments, including Land (£1.14 billion), Marine (£1.47 billion), Nuclear (£1.68 billion), and Aviation (£333.10 million).

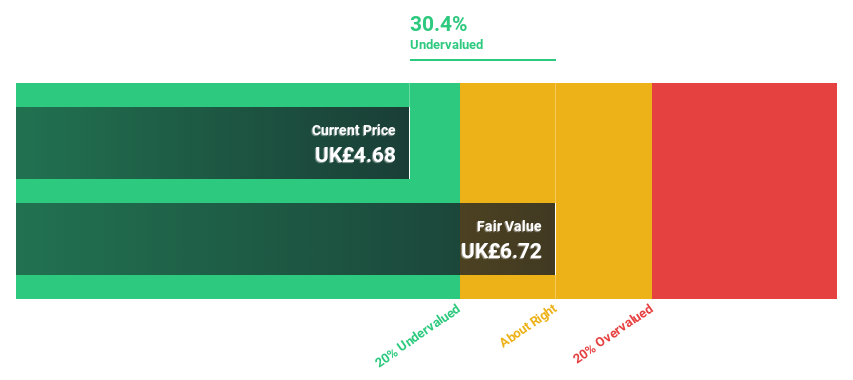

Estimated Discount To Fair Value: 31.4%

Babcock International Group is trading at £7.22, below its estimated fair value of £10.52, reflecting potential undervaluation based on discounted cash flow analysis. The company has upgraded its revenue guidance for fiscal year 2025 to £4.9 billion, driven by strong growth in Nuclear and Marine sectors. Earnings are forecast to grow at 14.88% annually, outpacing the UK market's 14.1% growth rate, while revenue is expected to grow faster than the overall UK market rate of 3.8%.

- Our expertly prepared growth report on Babcock International Group implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Babcock International Group with our detailed financial health report.

Summing It All Up

- Embark on your investment journey to our 53 Undervalued UK Stocks Based On Cash Flows selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Babcock International Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BAB

Babcock International Group

Engages in the design, development, manufacture, and integration of specialist systems for aerospace, defense, and security in the United Kingdom, rest of Europe, Africa, North America, Australasia, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives