- United Kingdom

- /

- Professional Services

- /

- AIM:MHA

Unearthing Three Promising UK Stocks with Solid Foundations

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, highlighting global economic uncertainties. In such a climate, identifying stocks with solid foundations becomes crucial for investors seeking stability and potential growth amidst broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 38.21% | 41.39% | ★★★★★★ |

| BioPharma Credit | NA | 7.22% | 7.91% | ★★★★★★ |

| MS INTERNATIONAL | NA | 13.42% | 56.55% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -7.87% | -8.41% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.08% | 5.03% | ★★★★★★ |

| Nationwide Building Society | 277.32% | 10.61% | 23.42% | ★★★★★☆ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| FW Thorpe | 2.95% | 11.79% | 13.49% | ★★★★★☆ |

| AltynGold | 73.21% | 26.90% | 31.85% | ★★★★☆☆ |

| Law Debenture | 17.80% | 11.81% | 7.59% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Mha (AIM:MHA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mha Plc provides financial and business strategy services to enterprises and individuals, with a market capitalization of £345.79 million.

Operations: Mha Plc generates its revenue primarily from the provision of professional services, amounting to £154.04 million. The company's market capitalization stands at £345.79 million.

MHA, a budding player in the UK market, is trading nearly 29% below its estimated fair value. The company has shown impressive earnings growth of 28% over the past year, outpacing the Professional Services industry average of -0.6%. With more cash than total debt, MHA's financial health appears robust. Recent corporate developments include an IPO raising £98 million and executive changes with Rakesh Shaunak stepping up as CEO and Steven Moore continuing as CFO. Expected revenues for FY25 are around £224 million, marking a significant increase from the previous year's £154 million.

- Unlock comprehensive insights into our analysis of Mha stock in this health report.

Review our historical performance report to gain insights into Mha's's past performance.

BioPharma Credit (LSE:BPCR)

Simply Wall St Value Rating: ★★★★★★

Overview: BioPharma Credit PLC is an investment trust that focuses on investing in interest-bearing debt assets, with a market cap of approximately $993.81 million.

Operations: The company generates revenue primarily from investments in debt assets secured by royalties, amounting to $150.03 million.

BioPharma Credit, a promising player in the UK market, trades at 23.4% below its estimated fair value, indicating potential upside. Over the past year, earnings grew by 12.7%, outpacing the Capital Markets industry growth of 11.1%. The company has maintained a debt-free status for five years, ensuring no concerns about interest coverage or financial leverage. With high-quality earnings and positive free cash flow reaching US$191 million recently, BioPharma Credit seems well-positioned financially. Additionally, it declared an interim dividend of 1.75 cents per share for Q2 2025, reflecting shareholder-friendly policies amidst stable performance metrics.

- Dive into the specifics of BioPharma Credit here with our thorough health report.

Assess BioPharma Credit's past performance with our detailed historical performance reports.

Porvair (LSE:PRV)

Simply Wall St Value Rating: ★★★★★★

Overview: Porvair plc operates in the filtration, laboratory, and environmental technology sectors with a market capitalization of £358.48 million.

Operations: Porvair's primary revenue streams include the Aerospace & Industrial segment generating £84.27 million, followed by the Laboratory segment at £65.84 million, and Metal Melt Quality contributing £44.06 million.

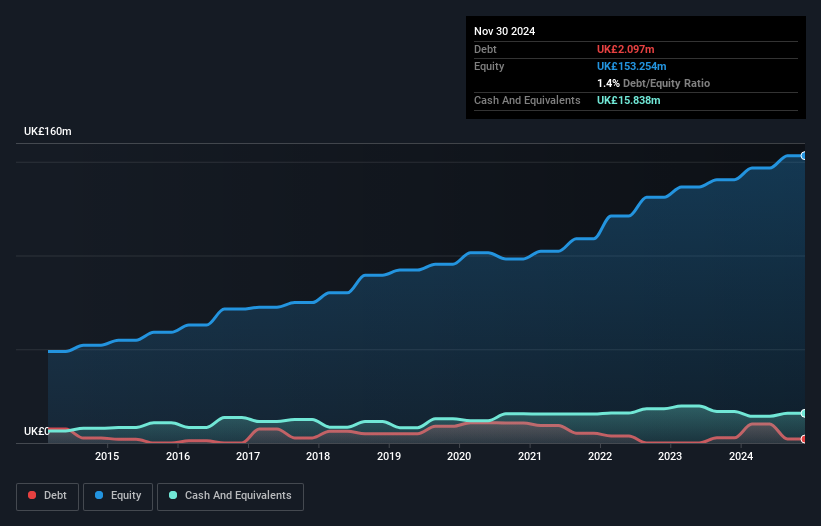

Porvair's strategic focus on niche markets and ESG initiatives positions it well for future growth. The company's debt-to-equity ratio has impressively dropped from 9.3 to 1.4 over five years, signaling improved financial health. Its price-to-earnings ratio of 21.8x is favorable compared to the industry average, suggesting good value in its sector. Earnings have grown by 3% over the past year, outpacing the industry's negative trend of -7%. Porvair's EBIT covers interest payments nearly fifteen times over, indicating robust financial stability despite potential risks from acquisitions and market volatility impacting earnings consistency.

Turning Ideas Into Actions

- Click this link to deep-dive into the 57 companies within our UK Undiscovered Gems With Strong Fundamentals screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MHA

Mha

Offers financial and business strategy services to enterprises and individuals.

Limited growth with very low risk.

Market Insights

Community Narratives