- United Kingdom

- /

- Commercial Services

- /

- AIM:JSG

Here's Why We Think Johnson Service Group (LON:JSG) Is Well Worth Watching

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Johnson Service Group (LON:JSG). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

See our latest analysis for Johnson Service Group

How Fast Is Johnson Service Group Growing?

As one of my mentors once told me, share price follows earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. As a tree reaches steadily for the sky, Johnson Service Group's EPS has grown 19% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

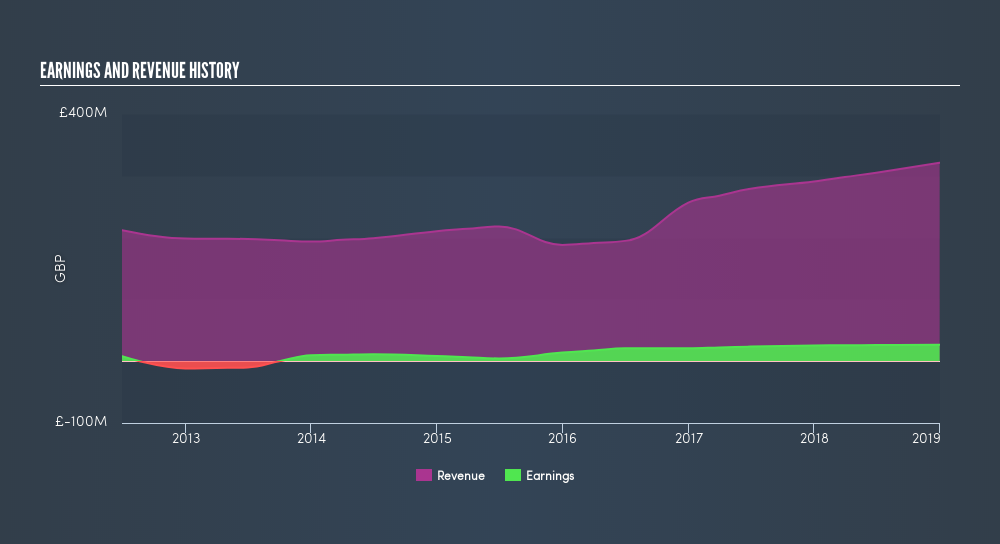

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While we note Johnson Service Group's EBIT margins were flat over the last year, revenue grew by a solid 10% to UK£321m. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Johnson Service Group's future profits.

Are Johnson Service Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One positive for Johnson Service Group, is that company insiders paid UK£21k for shares in the last year. This might not be a huge sum, but it's well worth noting anyway, given the complete lack of selling.

It's me that Johnson Service Group insiders are buying the stock, but that's not the only reason to think leader are fair to shareholders. Specifically, the CEO is paid quite reasonably for a company of this size. I discovered that the median total compensation for the CEOs of companies like Johnson Service Group with market caps between UK£307m and UK£1.2b is about UK£848k.

The CEO of Johnson Service Group only received UK£355k in total compensation for the year ending December 2018. That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Does Johnson Service Group Deserve A Spot On Your Watchlist?

You can't deny that Johnson Service Group has grown its earnings per share at a very impressive rate. That's attractive. And that's not the only positive, either. We have both insider buying and reasonable and remuneration to consider. The message I'd take from this quick rundown is that, yes, this stock is worth investigating further. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Johnson Service Group. You might benefit from giving it a glance today.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Johnson Service Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About AIM:JSG

Johnson Service Group

Provides textile rental and related services in the United Kingdom and Ireland.

Very undervalued with proven track record and pays a dividend.

Market Insights

Community Narratives