- United Kingdom

- /

- Commercial Services

- /

- AIM:FRAN

3 UK Growth Stocks With High Insider Ownership To Watch

Reviewed by Simply Wall St

Over the last 7 days, the United Kingdom market has dropped 3.4%, but it remains up by 4.4% over the past year with earnings forecasted to grow by 14% annually. In this fluctuating environment, growth companies with high insider ownership can offer a unique blend of potential and confidence for investors seeking stability and long-term gains.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Filtronic (AIM:FTC) | 28.6% | 33.5% |

| Plant Health Care (AIM:PHC) | 34.4% | 121.3% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.1% | 74.6% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 23.5% |

| Foresight Group Holdings (LSE:FSG) | 31.9% | 27.9% |

| Helios Underwriting (AIM:HUW) | 23.9% | 14.7% |

| LSL Property Services (LSE:LSL) | 10.8% | 33.3% |

| Belluscura (AIM:BELL) | 39.5% | 117.8% |

| Velocity Composites (AIM:VEL) | 27.6% | 173.3% |

| Hochschild Mining (LSE:HOC) | 38.4% | 53.8% |

We'll examine a selection from our screener results.

Franchise Brands (AIM:FRAN)

Simply Wall St Growth Rating: ★★★★☆☆

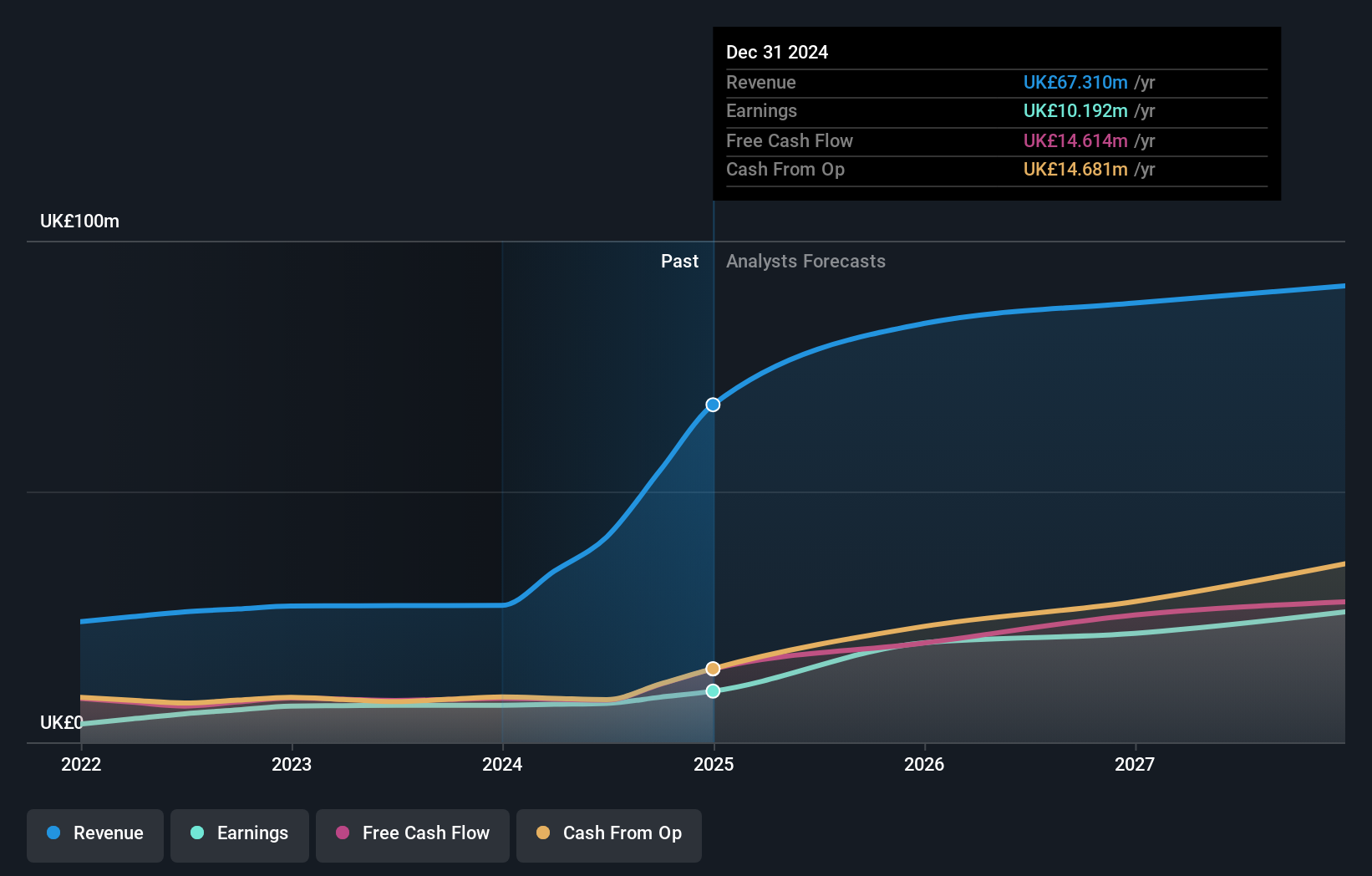

Overview: Franchise Brands plc, with a market cap of £334.47 million, operates through its subsidiaries in franchising and related activities across the United Kingdom, North America, and Europe.

Operations: The company's revenue segments include Azura (£0.75 million), Pirtek (£41.95 million), B2C Division (£6.11 million), Water & Waste (£48.88 million), and Filta International (£27.12 million).

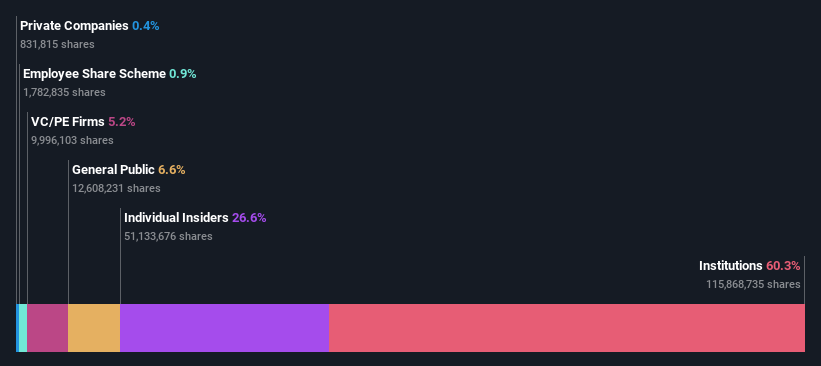

Insider Ownership: 29.8%

Revenue Growth Forecast: 11.5% p.a.

Franchise Brands, a growth company with high insider ownership in the UK, is expected to see its earnings grow significantly at 40.7% per year, outpacing the UK market's 13.5%. Revenue is forecast to increase by 11.5% annually. Insiders have been buying more shares recently, indicating confidence despite profit margins declining from 11.6% to 2.5%. The stock trades at a significant discount of 51.6% below estimated fair value and analysts predict an 85.8% price rise.

- Delve into the full analysis future growth report here for a deeper understanding of Franchise Brands.

- In light of our recent valuation report, it seems possible that Franchise Brands is trading behind its estimated value.

Property Franchise Group (AIM:TPFG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: The Property Franchise Group PLC manages and leases residential real estate properties in the United Kingdom, with a market cap of £276.74 million.

Operations: The company generates revenue from two primary segments: Financial Services (£1.50 million) and Property Franchising (£25.78 million).

Insider Ownership: 13.5%

Revenue Growth Forecast: 44.7% p.a.

Property Franchise Group is expected to see substantial earnings growth of 36.71% annually, significantly outpacing the UK market's 13.5%. Revenue is forecast to grow at an impressive 44.7% per year, also surpassing market averages. Despite a recent history of shareholder dilution and an unstable dividend track record, the stock trades at a considerable discount of 61.9% below estimated fair value. Recent CFO retirement plans indicate a well-structured transition period for leadership continuity.

- Get an in-depth perspective on Property Franchise Group's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Property Franchise Group is priced higher than what may be justified by its financials.

LSL Property Services (LSE:LSL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LSL Property Services plc, with a market cap of £347.06 million, provides business-to-business services to mortgage intermediaries and estate agency franchisees, as well as valuation services to lenders in the United Kingdom.

Operations: LSL generates revenue from three primary segments: Financial Services (£51.69 million), Surveying and Valuation (£67.83 million), and Estate Agency (£24.89 million).

Insider Ownership: 10.8%

Revenue Growth Forecast: 11% p.a.

LSL Property Services shows strong growth potential, with earnings forecasted to grow 33.3% annually, significantly outpacing the UK market's 13.5%. Despite a dividend yield of 3.37% not being well covered by earnings or free cash flows, the stock trades at a significant discount of 53.6% below estimated fair value. Recent board changes include appointing Michael Stoop as Non-Executive Director, bringing extensive industry experience from roles at Winkworth and Legal & General.

- Click here and access our complete growth analysis report to understand the dynamics of LSL Property Services.

- The analysis detailed in our LSL Property Services valuation report hints at an inflated share price compared to its estimated value.

Make It Happen

- Click here to access our complete index of 66 Fast Growing UK Companies With High Insider Ownership.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FRAN

Franchise Brands

Through its subsidiaries, engages in franchising and related activities in the United Kingdom, North America, and rest of Europe.

Reasonable growth potential and fair value.