- United Kingdom

- /

- Professional Services

- /

- AIM:ELIX

Discovering 3 Undiscovered Gems in the United Kingdom with Strong Fundamentals

Reviewed by Simply Wall St

Over the last 7 days, the United Kingdom market has dropped 3.4%, but it has risen by 4.4% over the past year, with earnings forecasted to grow by 14% annually. In this fluctuating environment, identifying stocks with strong fundamentals is crucial for finding potential investment opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 1.69% | 3.16% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| London Security | 0.31% | 9.47% | 7.41% | ★★★★★★ |

| Georgia Capital | NA | -27.80% | 18.94% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | -0.35% | 1.18% | ★★★★★★ |

| Fix Price Group | 43.59% | 12.53% | 23.49% | ★★★★★☆ |

| Ros Agro | 57.18% | 16.96% | 18.36% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 6.58% | 9.90% | ★★★★★☆ |

| Mountview Estates | 16.64% | 4.50% | -0.59% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Elixirr International (AIM:ELIX)

Simply Wall St Value Rating: ★★★★★★

Overview: Elixirr International plc, with a market cap of £265.28 million, offers management consultancy services through its subsidiaries in the United Kingdom, the United States, and internationally.

Operations: Elixirr International generates £85.89 million in revenue from management consulting services. The company's financial performance includes a net profit margin of 15%.

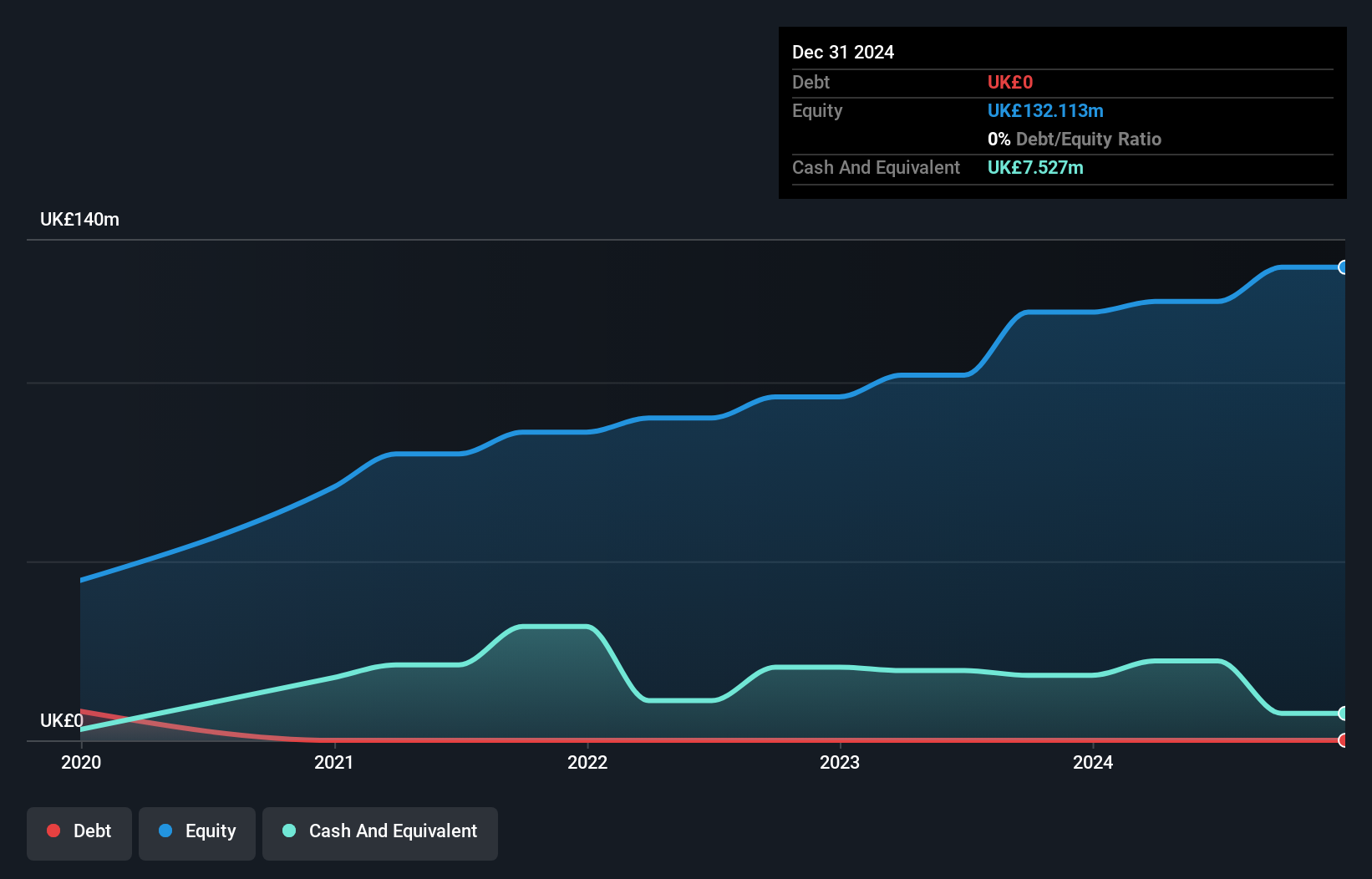

Elixirr International, a small but promising firm, is trading at 62.9% below its estimated fair value. Over the past year, earnings grew by 33.9%, significantly outpacing the Professional Services industry’s -3.9%. Despite recent insider selling and shareholder dilution over the past year, Elixirr remains debt-free with high-quality earnings and positive free cash flow. Future earnings are forecasted to grow by 8.97% annually, indicating potential for continued robust performance in its sector.

London Security (AIM:LSC)

Simply Wall St Value Rating: ★★★★★★

Overview: London Security plc, with a market cap of £478.14 million, manufactures, sells, and rents fire protection equipment across the United Kingdom and several European countries including Belgium, the Netherlands, Austria, France, Germany, Denmark, and Luxembourg.

Operations: London Security plc generates £219.71 million in revenue from the provision and maintenance of fire protection and security equipment across multiple European countries.

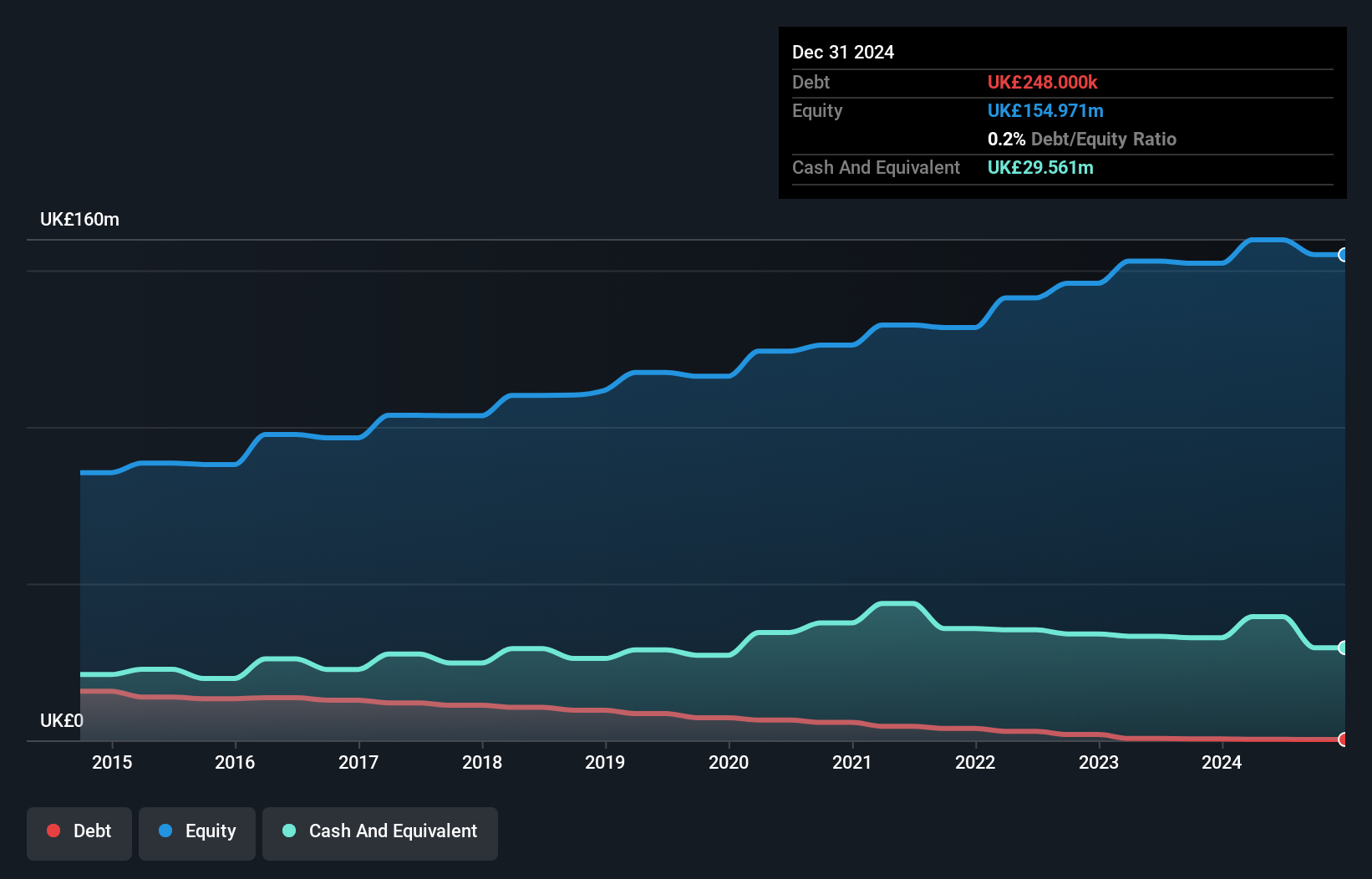

London Security has demonstrated robust financial health, with earnings growing by 15.1% over the past year, outperforming the Machinery industry’s -10.1%. The company’s debt to equity ratio improved significantly from 8.6% to 0.3% over five years, and its interest payments are well covered by EBIT at a staggering 717.9x coverage. Recent events include the retirement of Independent Non-Executive Director Henry Shouler and a recommended final dividend of £0.42 per share for 2023, maintaining investor confidence amidst leadership changes.

- Navigate through the intricacies of London Security with our comprehensive health report here.

Explore historical data to track London Security's performance over time in our Past section.

Wilmington (LSE:WIL)

Simply Wall St Value Rating: ★★★★★★

Overview: Wilmington plc, with a market cap of £356.87 million, provides information, data, training, and education solutions to professional markets in the United Kingdom, Europe, North America, and internationally.

Operations: Wilmington generates revenue primarily from two segments: Intelligence (£57.86 million) and Training & Education (£67.13 million).

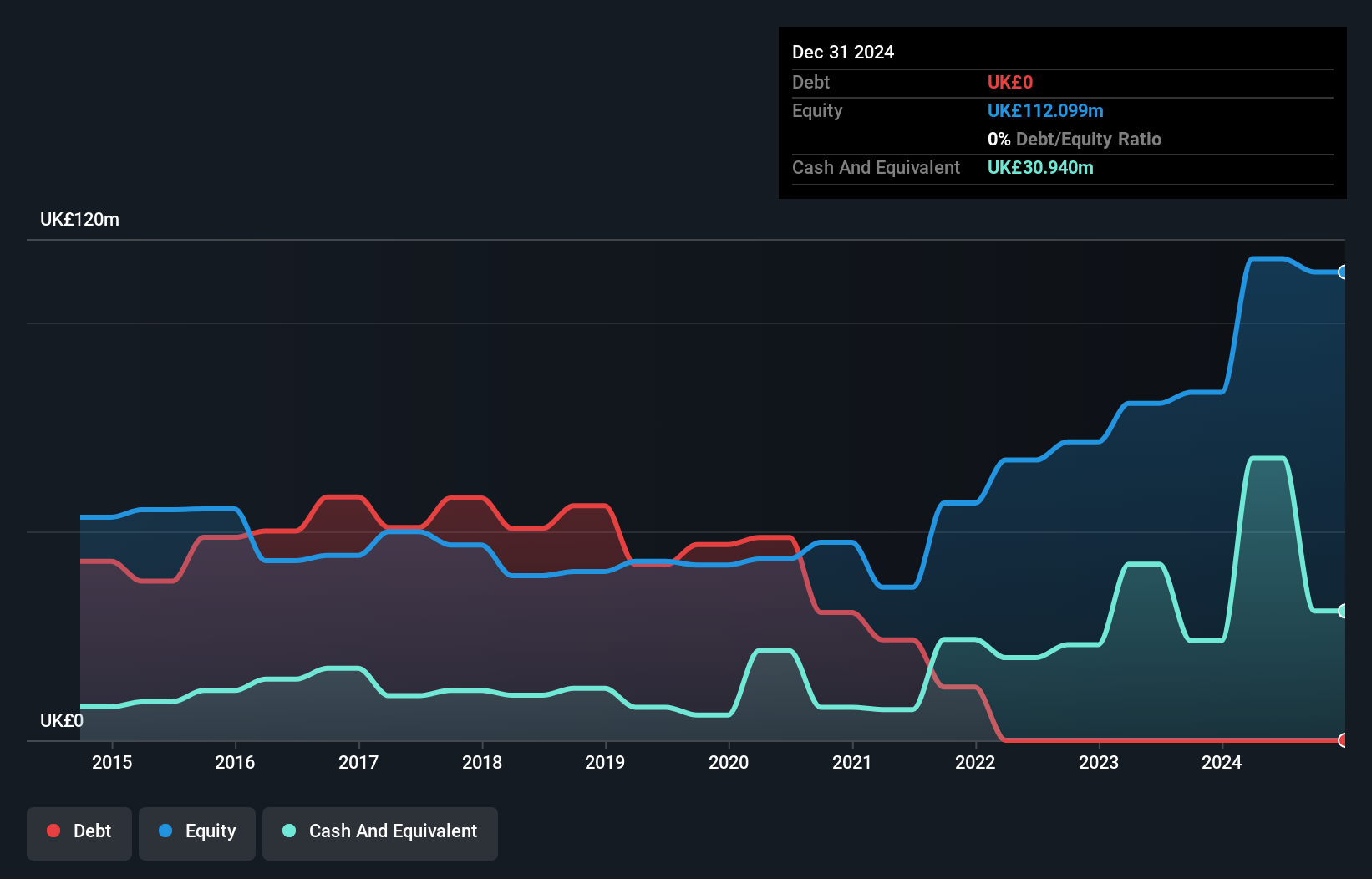

Wilmington, a smaller player in the UK market, has shown robust financial health with no debt currently compared to a 139% debt-to-equity ratio five years ago. Earnings grew by 4.4% over the past year, surpassing the Professional Services industry average of -3.9%. Trading at 36.3% below its estimated fair value, Wilmington offers potential upside despite forecasts indicating a 6.6% annual earnings decline over the next three years.

Turning Ideas Into Actions

- Take a closer look at our UK Undiscovered Gems With Strong Fundamentals list of 79 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elixirr International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ELIX

Elixirr International

Through its subsidiaries, provides management consultancy services in the United Kingdom, the United States, and internationally.

Very undervalued with flawless balance sheet.