Stock Analysis

- United Kingdom

- /

- Professional Services

- /

- AIM:FNTL

Exploring Three UK Growth Companies With High Insider Ownership On The UK Exchange

Reviewed by Simply Wall St

Amid a backdrop of global uncertainty and subdued trading activity, the United Kingdom's market has shown resilience, with the FTSE 100 navigating through turbulent waters marked by political shifts and economic cues. In such an environment, growth companies with high insider ownership can offer investors potential stability as these insiders often have a vested interest in the company’s long-term success.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Plant Health Care (AIM:PHC) | 26.4% | 121.3% |

| Petrofac (LSE:PFC) | 16.6% | 124.5% |

| Getech Group (AIM:GTC) | 17.2% | 86.1% |

| Gulf Keystone Petroleum (LSE:GKP) | 10.7% | 47.6% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 25.5% |

| Spectra Systems (AIM:SPSY) | 23.1% | 26.3% |

| Velocity Composites (AIM:VEL) | 28.5% | 140.4% |

| TEAM (AIM:TEAM) | 25.8% | 58.6% |

| Afentra (AIM:AET) | 38.3% | 99.2% |

| Mothercare (AIM:MTC) | 15.1% | 41.2% |

Let's dive into some prime choices out of from the screener.

Fintel (AIM:FNTL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fintel Plc operates as a provider of intermediary services and distribution channels to the retail financial services sector in the UK, with a market capitalization of approximately £315.77 million.

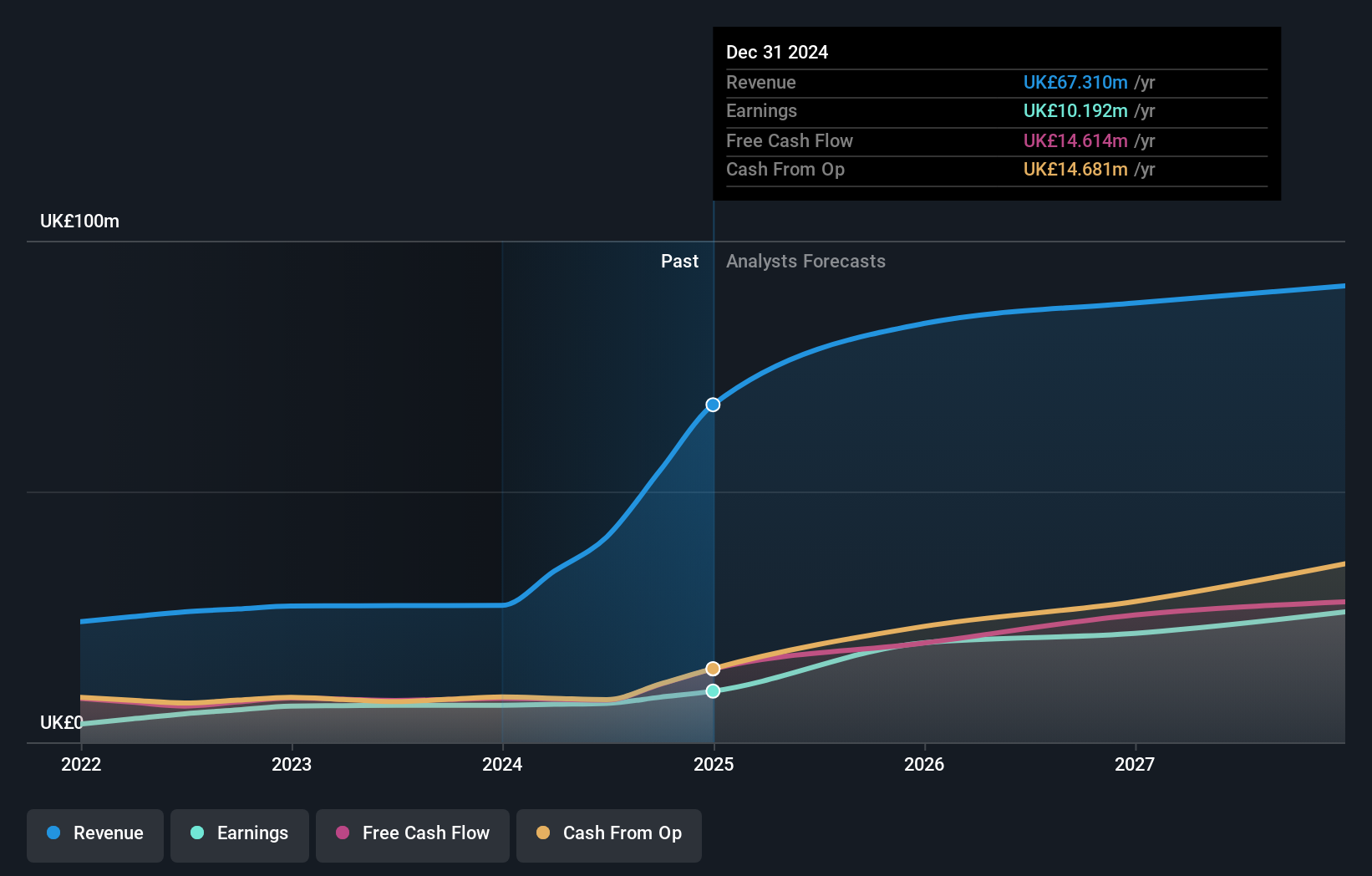

Operations: The company generates revenue through three primary segments: Research & Fintech (£22.30 million), Distribution Channels (£20.20 million), and Intermediary Services (£22.40 million).

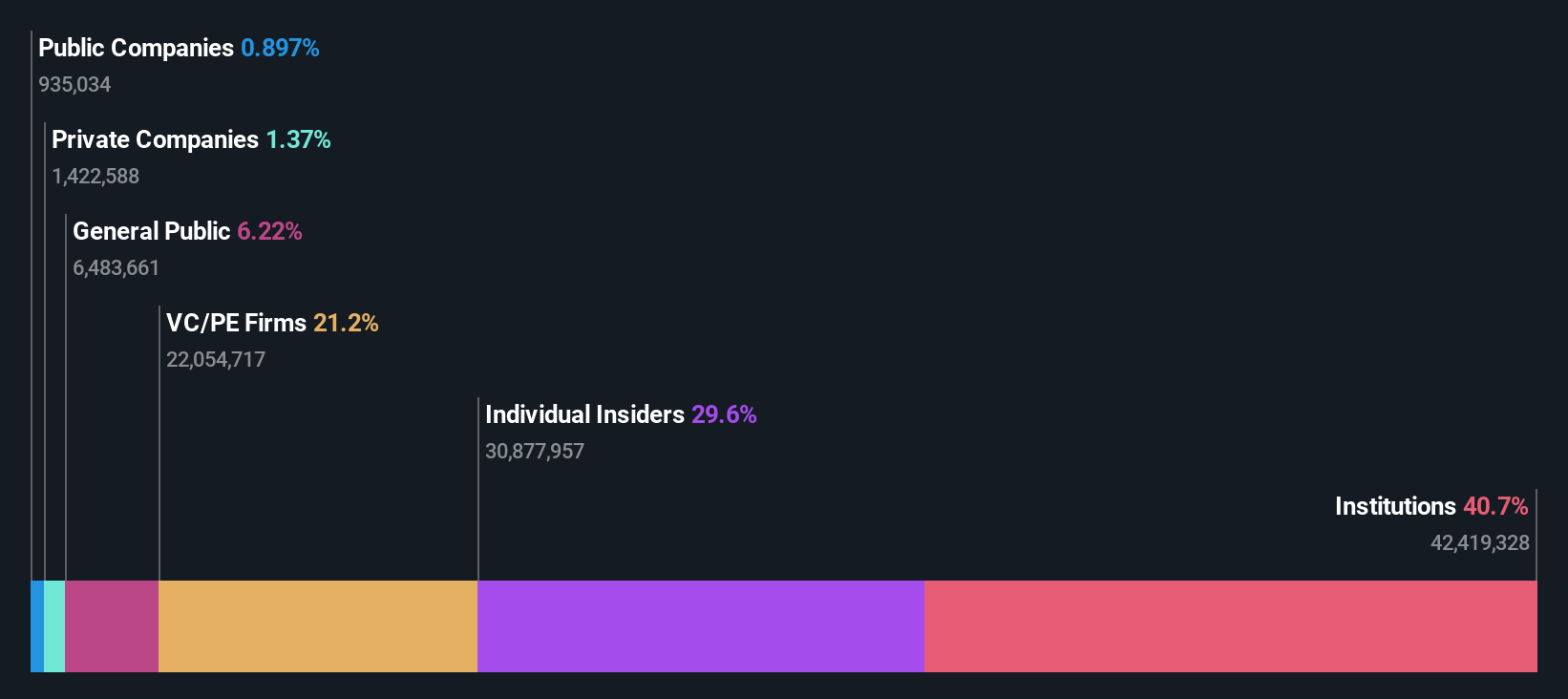

Insider Ownership: 29.7%

Fintel, a UK-based company, demonstrates solid growth with its earnings expected to increase by 23.9% annually, outpacing the UK market's 13.2%. Despite a slight revenue slowdown to 8.6% yearly growth, this still surpasses the UK market average of 3.7%. Recent financials show a dip in net income from £9.8 million to £7.1 million and sales from £66.5 million to £64.9 million in 2023; however, Fintel maintains high insider ownership with more buying than selling activity among insiders over the past three months.

- Dive into the specifics of Fintel here with our thorough growth forecast report.

- The analysis detailed in our Fintel valuation report hints at an inflated share price compared to its estimated value.

Property Franchise Group (AIM:TPFG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: The Property Franchise Group PLC, operating in the United Kingdom, manages and leases residential real estate properties with a market capitalization of approximately £274.87 million.

Operations: The company generates revenue primarily through two segments: Financial Services (£1.50 million) and Property Franchising (£25.78 million).

Insider Ownership: 12.7%

The Property Franchise Group PLC, a UK-based entity, trades at 55.2% below its estimated fair value and is experiencing substantial growth forecasts. Earnings are expected to increase by 36.7% annually over the next three years, significantly outstripping the UK market forecast of 13.2%. Despite this promising outlook, shareholder dilution has occurred in the past year and there's an unstable dividend track record. Additionally, CFO David Raggett announced his retirement plans for late 2025 amidst strategic transitions following recent acquisitions.

- Click here and access our complete growth analysis report to understand the dynamics of Property Franchise Group.

- Upon reviewing our latest valuation report, Property Franchise Group's share price might be too optimistic.

LSL Property Services (LSE:LSL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LSL Property Services plc operates in the UK, offering services to mortgage intermediaries, estate agency franchisees, and valuation services to lenders, with a market capitalization of approximately £334.75 million.

Operations: LSL Property Services generates revenue through three primary segments: Financial Services (£51.69 million), Surveying and Valuation (£67.83 million), and Estate Agency excluding Financial Services (£24.89 million).

Insider Ownership: 10.8%

LSL Property Services, a UK-based company, is poised for significant growth with earnings expected to rise by 33.3% annually, outperforming the UK market's 13.2%. Despite trading at 46.3% below its estimated fair value and having a high forecast Return on Equity of 25.4%, challenges persist with revenue growth projected at only 11% per year—below the desired 20% yet still above the market average of 3.7%. Recent leadership changes include Adrian Collins' appointment as Non-Executive Chair, enhancing governance structures amid ongoing strategic shifts.

- Unlock comprehensive insights into our analysis of LSL Property Services stock in this growth report.

- Our valuation report here indicates LSL Property Services may be overvalued.

Key Takeaways

- Discover the full array of 67 Fast Growing UK Companies With High Insider Ownership right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Fintel is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FNTL

Fintel

Engages in the provision of intermediary services and distribution channels to the retail financial services sector in the United Kingdom.

Excellent balance sheet with reasonable growth potential.