- United Kingdom

- /

- Professional Services

- /

- LSE:ELIX

Optimistic Investors Push Elixirr International plc (LON:ELIX) Shares Up 31%

Elixirr International plc ( LON:ELIX ) shares have had a really impressive month, gaining 31% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 30%.

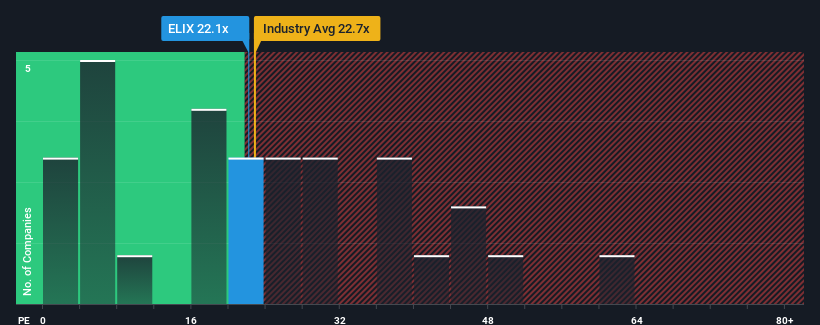

After such a large jump in price, Elixirr International may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 22.1x, since almost half of all companies in the United Kingdom have P/E ratios under 15x and even P/E's lower than 9x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Elixirr International earnings took a small dip after a period of strong growth. Investors are likely expecting this to be a blip, which has kept the P/E from falling. If not then you may be paying a high price per share for the level of earnings the company is expected to deliver. Let's take a closer look.

View our latest analysis for Elixirr International

Want the full picture on analyst estimates for the company? Then our free report on Elixirr International will help you uncover what's on the horizon.

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Elixirr International would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered a 7.3% decrease to the company's earnings per share and a corresponding 5% decrease in net income. Even so, admirably EPS has lifted 58% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 14% each year as estimated by the three analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 16% per annum, which is not materially different.

In light of this, it's curious that Elixirr International's P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now.

The Key Takeaway

The large bounce in Elixirr International's shares has lifted the company's P/E to a fairly high level. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Elixirr International's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. When we see an earnings outlook displaying market-like growth, we would pay attention to the possibility of the share price declining, sending the high P/E lower and more in line with its relative earnings growth rate.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Elixirr International that you need to be mindful of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Elixirr International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:ELIX

Elixirr International

Through its subsidiaries, provides management consultancy services in the United Kingdom, the United States, and internationally.

Undervalued with high growth potential.

Market Insights

Community Narratives