- United Kingdom

- /

- Retail REITs

- /

- LSE:SUPR

UK Value Stock Estimates For October 2024

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index grapples with headwinds from weak trade data out of China, investors are closely monitoring how these global economic challenges might affect domestic markets. Amidst this environment, identifying undervalued stocks becomes crucial as they can offer potential opportunities for long-term growth despite broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| GlobalData (AIM:DATA) | £1.91 | £3.74 | 48.9% |

| S&U (LSE:SUS) | £19.00 | £36.47 | 47.9% |

| AstraZeneca (LSE:AZN) | £116.06 | £220.79 | 47.4% |

| Tracsis (AIM:TRCS) | £5.26 | £9.92 | 47% |

| Watches of Switzerland Group (LSE:WOSG) | £4.56 | £8.60 | 47% |

| Gulf Keystone Petroleum (LSE:GKP) | £1.291 | £2.47 | 47.7% |

| Mpac Group (AIM:MPAC) | £4.55 | £8.95 | 49.2% |

| Foxtons Group (LSE:FOXT) | £0.604 | £1.19 | 49.2% |

| St. James's Place (LSE:STJ) | £8.46 | £16.63 | 49.1% |

| Genel Energy (LSE:GENL) | £0.756 | £1.51 | 49.9% |

Here we highlight a subset of our preferred stocks from the screener.

GlobalData (AIM:DATA)

Overview: GlobalData Plc, along with its subsidiaries, offers business information through proprietary data, analytics, and insights across Europe, North America, and the Asia Pacific regions; it has a market cap of £1.53 billion.

Operations: The company's revenue is derived from its provision of data, analytics, and insights, amounting to £276.80 million.

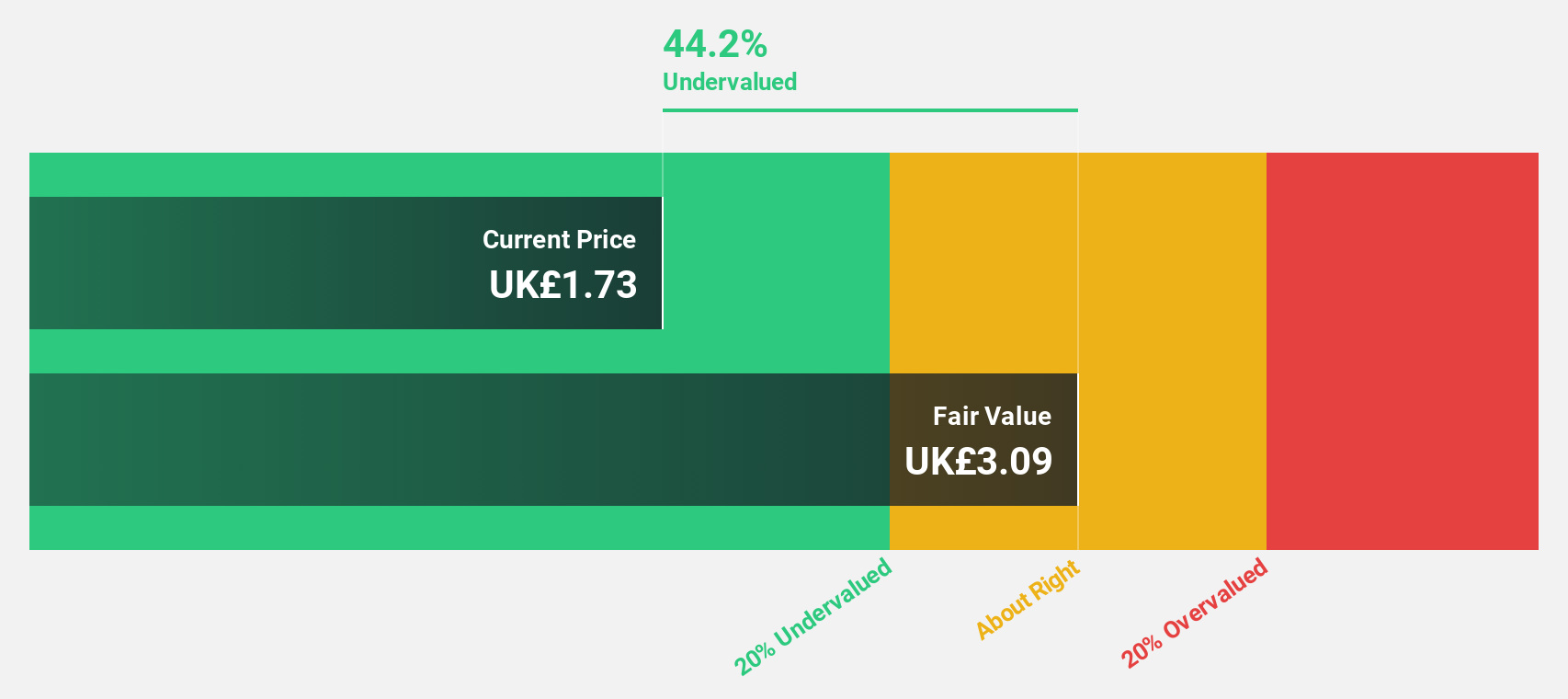

Estimated Discount To Fair Value: 48.9%

GlobalData is trading at a substantial discount, 48.9% below its estimated fair value of £3.74 per share, with current trading at £1.91, suggesting it may be undervalued based on cash flows. Despite significant insider selling recently, analysts expect the stock price to rise by 45.4%. Earnings are projected to grow significantly at 27.7% annually over the next three years, outpacing UK market growth and indicating strong future profitability potential despite a dividend not well covered by earnings.

- Upon reviewing our latest growth report, GlobalData's projected financial performance appears quite optimistic.

- Take a closer look at GlobalData's balance sheet health here in our report.

Supermarket Income REIT (LSE:SUPR)

Overview: Supermarket Income REIT plc (LSE: SUPR) is a real estate investment trust focused on investing in grocery properties within the UK's essential feed the nation infrastructure, with a market cap of £896.05 million.

Operations: The company generates revenue of £107.23 million from its investments in grocery property real estate.

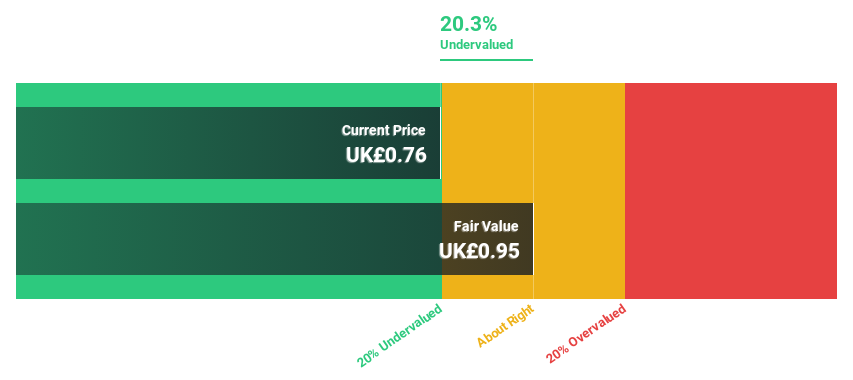

Estimated Discount To Fair Value: 22.9%

Supermarket Income REIT is trading at £0.72, 22.9% below its estimated fair value of £0.93, highlighting potential undervaluation based on cash flows. Revenue growth is expected to outpace the UK market at 5.1% annually, while earnings are forecast to grow significantly by 48.04% per year, with profitability anticipated within three years—above average market growth rates—despite an unstable dividend track record and debt not well covered by operating cash flow.

- Our comprehensive growth report raises the possibility that Supermarket Income REIT is poised for substantial financial growth.

- Click here to discover the nuances of Supermarket Income REIT with our detailed financial health report.

Watches of Switzerland Group (LSE:WOSG)

Overview: Watches of Switzerland Group PLC is a retailer specializing in luxury watches and jewelry, operating in the United Kingdom, Europe, and the United States, with a market cap of £1.09 billion.

Operations: The company's revenue is derived from two main segments: £691.80 million from the US and £846.10 million from the UK and Europe.

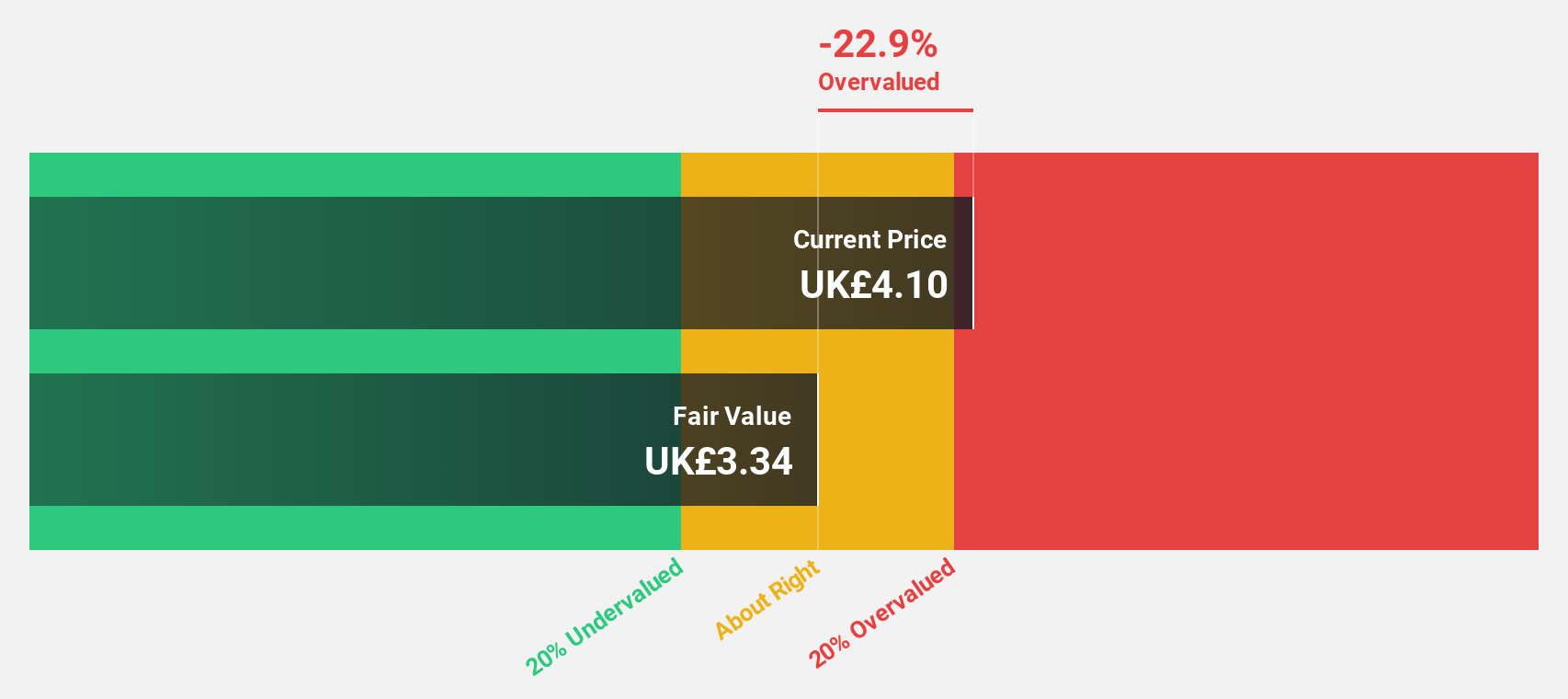

Estimated Discount To Fair Value: 47%

Watches of Switzerland Group is trading at £4.56, significantly below its estimated fair value of £8.6, suggesting undervaluation based on cash flows. Despite recent share price volatility and lower profit margins compared to last year, the company is expected to achieve substantial earnings growth of over 20% annually in the next three years, outpacing the UK market's growth rate. However, revenue growth remains moderate and return on equity forecasts are relatively low.

- In light of our recent growth report, it seems possible that Watches of Switzerland Group's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Watches of Switzerland Group's balance sheet health report.

Key Takeaways

- Get an in-depth perspective on all 61 Undervalued UK Stocks Based On Cash Flows by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SUPR

Supermarket Income REIT

Supermarket Income REIT plc (LSE: SUPR) is a real estate investment trust dedicated to investing in grocery properties which are an essential part of the UK's feed the nation infrastructure.

Reasonable growth potential average dividend payer.