- United Kingdom

- /

- Commercial Services

- /

- AIM:CPP

Here's Why We're Wary Of Buying CPPGroup's (LON:CPP) For Its Upcoming Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that CPPGroup Plc (LON:CPP) is about to go ex-dividend in just three days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade takes at least two business day to settle. Therefore, if you purchase CPPGroup's shares on or after the 2nd of September, you won't be eligible to receive the dividend, when it is paid on the 24th of September.

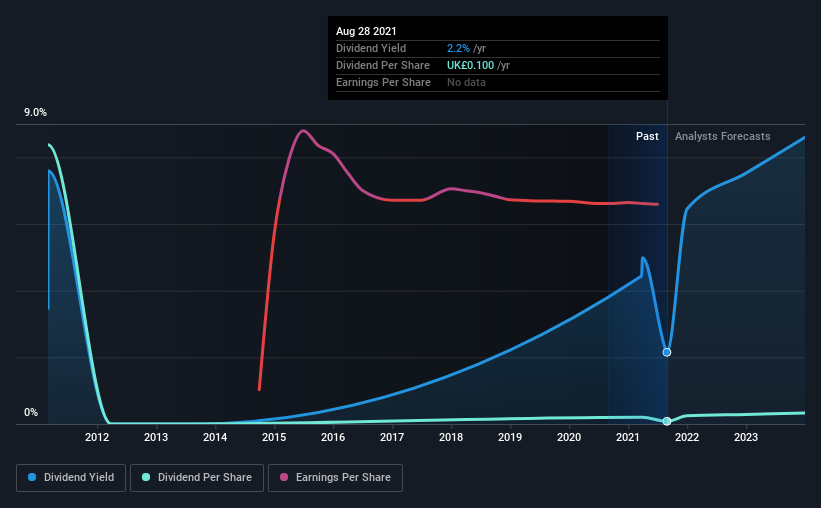

The company's next dividend payment will be UK£0.05 per share, on the back of last year when the company paid a total of UK£0.10 to shareholders. Calculating the last year's worth of payments shows that CPPGroup has a trailing yield of 2.2% on the current share price of £4.65. If you buy this business for its dividend, you should have an idea of whether CPPGroup's dividend is reliable and sustainable. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

See our latest analysis for CPPGroup

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. CPPGroup reported a loss after tax last year, which means it's paying a dividend despite being unprofitable. While this might be a one-off event, this is unlikely to be sustainable in the long term. Given that the company reported a loss last year, we now need to see if it generated enough free cash flow to fund the dividend. If cash earnings don't cover the dividend, the company would have to pay dividends out of cash in the bank, or by borrowing money, neither of which is long-term sustainable. Dividends consumed 62% of the company's free cash flow last year, which is within a normal range for most dividend-paying organisations.

Click here to see how much of its profit CPPGroup paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. CPPGroup was unprofitable last year and, unfortunately, the general trend suggests its earnings have been in decline over the last five years, making us wonder if the dividend is sustainable at all.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. CPPGroup's dividend payments per share have declined at 37% per year on average over the past 10 years, which is uninspiring. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

We update our analysis on CPPGroup every 24 hours, so you can always get the latest insights on its financial health, here.

Final Takeaway

Should investors buy CPPGroup for the upcoming dividend? First, it's not great to see the company paying a dividend despite being loss-making over the last year. On the plus side, the dividend was covered by free cash flow." Overall it doesn't look like the most suitable dividend stock for a long-term buy and hold investor.

Having said that, if you're looking at this stock without much concern for the dividend, you should still be familiar of the risks involved with CPPGroup. To that end, you should learn about the 3 warning signs we've spotted with CPPGroup (including 2 which are concerning).

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade CPPGroup, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:CPP

CPPGroup

Engages in creating embedded and ancillary real-time assistance products and resolution service in the India, Turkey, and internationally.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

EU#6 - From Political Experiment to Global Aerospace Power

Spectral AI: First of Its Kind Automated Wound Healing Prediction

Why EnSilica is Worth Possibly 13x its Current Price

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.