- United Kingdom

- /

- Professional Services

- /

- AIM:AFM

Market Participants Recognise Alpha Financial Markets Consulting plc's (LON:AFM) Earnings Pushing Shares 44% Higher

Alpha Financial Markets Consulting plc (LON:AFM) shareholders would be excited to see that the share price has had a great month, posting a 44% gain and recovering from prior weakness. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

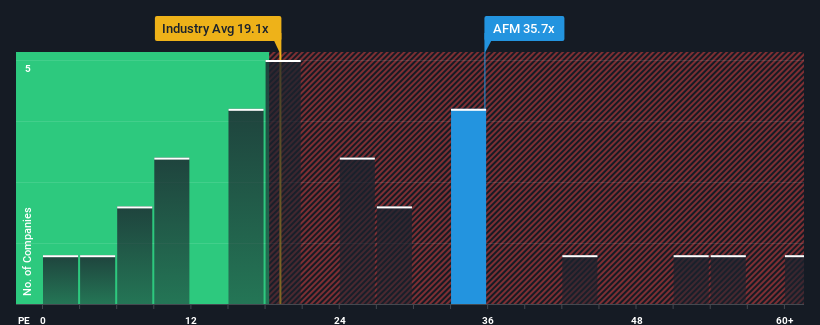

Since its price has surged higher, Alpha Financial Markets Consulting may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 35.7x, since almost half of all companies in the United Kingdom have P/E ratios under 16x and even P/E's lower than 9x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, Alpha Financial Markets Consulting has been very sluggish. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

See our latest analysis for Alpha Financial Markets Consulting

How Is Alpha Financial Markets Consulting's Growth Trending?

In order to justify its P/E ratio, Alpha Financial Markets Consulting would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 18% decrease to the company's bottom line. However, a few very strong years before that means that it was still able to grow EPS by an impressive 136% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 25% per annum as estimated by the five analysts watching the company. That's shaping up to be materially higher than the 14% per annum growth forecast for the broader market.

With this information, we can see why Alpha Financial Markets Consulting is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Alpha Financial Markets Consulting's P/E

Shares in Alpha Financial Markets Consulting have built up some good momentum lately, which has really inflated its P/E. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Alpha Financial Markets Consulting maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Alpha Financial Markets Consulting (1 is a bit concerning!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:AFM

Alpha Financial Markets Consulting

Provides consulting and related services to the asset and wealth management, and insurance industries in the United Kingdom, North America, Europe, and Asia Pacific.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success