- United Kingdom

- /

- Machinery

- /

- LSE:WEIR

We Ran A Stock Scan For Earnings Growth And Weir Group (LON:WEIR) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Weir Group (LON:WEIR). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Weir Group

Weir Group's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Weir Group managed to grow EPS by 14% per year, over three years. That's a good rate of growth, if it can be sustained.

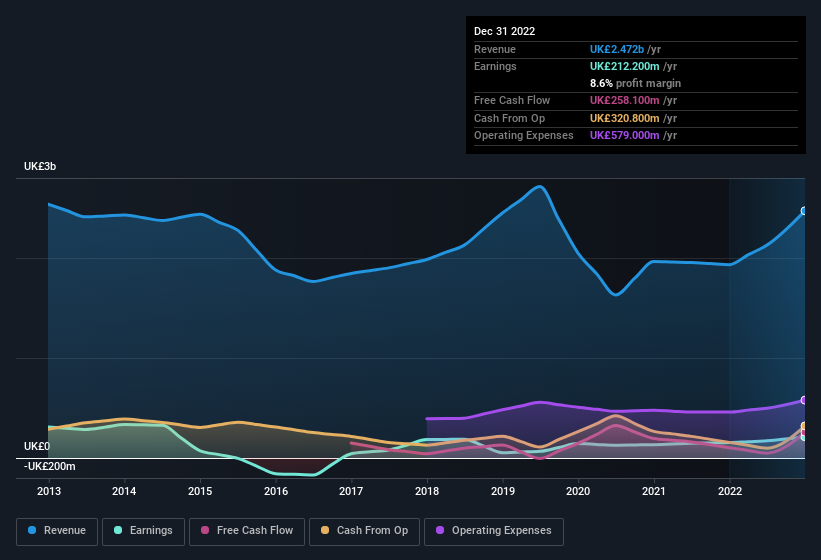

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Weir Group achieved similar EBIT margins to last year, revenue grew by a solid 28% to UK£2.5b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Weir Group's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Weir Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

In the last year insider at Weir Group were both selling and buying shares; but happily, as a group they spent UK£81k more on stock, than they netted from selling it. On balance, that's a good sign. Zooming in, we can see that the biggest insider purchase was by Independent Chairman Barbara Jeremiah for UK£45k worth of shares, at about UK£18.09 per share.

Should You Add Weir Group To Your Watchlist?

One important encouraging feature of Weir Group is that it is growing profits. It's not easy for business to grow EPS, but Weir Group has shown the strengths to do just that. The eye-catcher here is the reecnt insider share acquisitions which are undoubtedly enough to entice some investors to keep watch for the future. You should always think about risks though. Case in point, we've spotted 1 warning sign for Weir Group you should be aware of.

The good news is that Weir Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Weir Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:WEIR

Weir Group

Produces and sells highly engineered original equipment worldwide.

Flawless balance sheet with moderate growth potential.