I've been keeping an eye on The Weir Group PLC (LON:WEIR) because I'm attracted to its fundamentals. Looking at the company as a whole, as a potential stock investment, I believe WEIR has a lot to offer. Basically, it is a company with a an impressive track record of dividend payments as well as a buoyant growth outlook. Below is a brief commentary on these key aspects. For those interested in digger a bit deeper into my commentary, take a look at the report on Weir Group here.

Reasonable growth potential average dividend payer

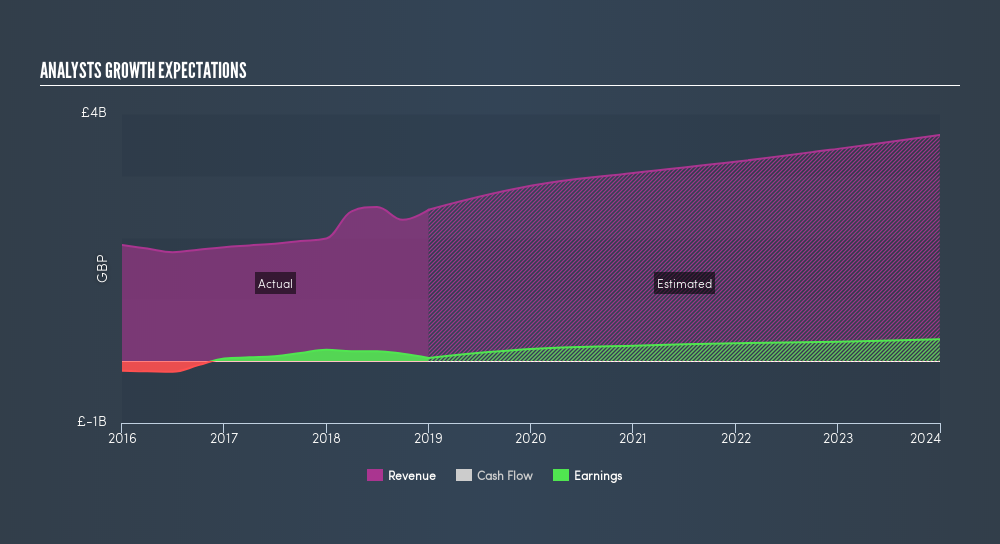

Investors in search for stocks with room to flourish should look no further than WEIR, with its expected earinngs growth of 28%, made up of high-quality, operational cash from its core business, which is expected to increase by 93% next year. This indicates a high-quality bottom-line expansion, as opposed to those driven by unsustainable cost-cutting activities.

WEIR pays a decent dividend yield to its shareholders, exceeding the low-risk savings rate, which is what investors expect when they take on the risk of investing in the stock market. That said, please remember that dividend yields are a function of stock prices and corporate profits, both of which can be volatile.

Next Steps:

For Weir Group, there are three pertinent factors you should look at:

- Historical Performance: What has WEIR's returns been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

- Valuation: What is WEIR worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether WEIR is currently mispriced by the market.

- Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of WEIR? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About LSE:WEIR

Weir Group

Produces and sells highly engineered original equipment worldwide.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion