It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Vesuvius (LON:VSVS). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Vesuvius with the means to add long-term value to shareholders.

See our latest analysis for Vesuvius

How Fast Is Vesuvius Growing Its Earnings Per Share?

Even when EPS earnings per share (EPS) growth is unexceptional, company value can be created if this rate is sustained each year. So EPS growth can certainly encourage an investor to take note of a stock. In impressive fashion, Vesuvius' EPS grew from UK£0.23 to UK£0.52, over the previous 12 months. It's not often a company can achieve year-on-year growth of 127%.

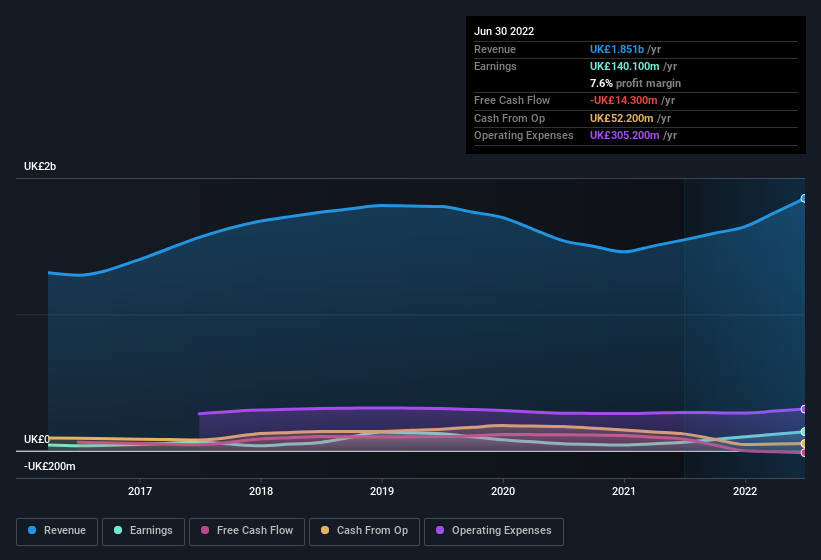

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of Vesuvius shareholders is that EBIT margins have grown from 7.3% to 10% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Vesuvius' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Vesuvius Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's good to see Vesuvius insiders walking the walk, by spending UK£189k on shares in just twelve months. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. Zooming in, we can see that the biggest insider purchase was by CEO & Executive Director Patrick Georges Andre for UK£104k worth of shares, at about UK£3.48 per share.

Does Vesuvius Deserve A Spot On Your Watchlist?

Vesuvius' earnings have taken off in quite an impressive fashion. Most growth-seeking investors will find it hard to ignore that sort of explosive EPS growth. And in fact, it could well signal a fundamental shift in the business economics. If this is the case, then keeping a watch over Vesuvius could be in your best interest. However, before you get too excited we've discovered 2 warning signs for Vesuvius (1 is a bit unpleasant!) that you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Vesuvius isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:VSVS

Vesuvius

Provides molten metal flow engineering and technology services to steel and foundry casting industries worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives