- United Kingdom

- /

- Machinery

- /

- LSE:TRI

We Discuss Why Trifast plc's (LON:TRI) CEO Compensation May Be Closely Reviewed

Shareholders will probably not be too impressed with the underwhelming results at Trifast plc (LON:TRI) recently. At the upcoming AGM on 28 July 2021, shareholders can hear from the board including their plans for turning around performance. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. From our analysis, we think CEO compensation may need a review in light of the recent performance.

View our latest analysis for Trifast

Comparing Trifast plc's CEO Compensation With the industry

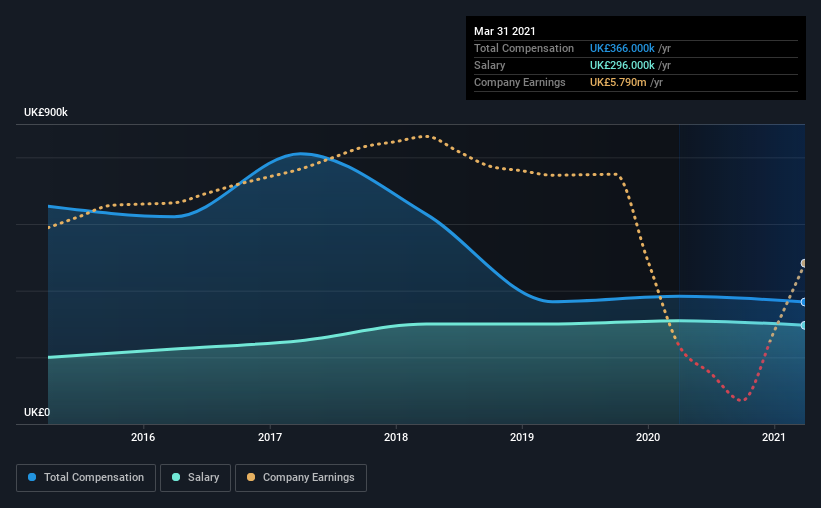

According to our data, Trifast plc has a market capitalization of UK£178m, and paid its CEO total annual compensation worth UK£366k over the year to March 2021. We note that's a small decrease of 4.4% on last year. In particular, the salary of UK£296.0k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between UK£73m and UK£292m had a median total CEO compensation of UK£366k. This suggests that Trifast remunerates its CEO largely in line with the industry average. Furthermore, Mark Belton directly owns UK£58k worth of shares in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | UK£296k | UK£310k | 81% |

| Other | UK£70k | UK£73k | 19% |

| Total Compensation | UK£366k | UK£383k | 100% |

On an industry level, around 69% of total compensation represents salary and 31% is other remuneration. According to our research, Trifast has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Trifast plc's Growth

Over the last three years, Trifast plc has shrunk its earnings per share by 30% per year. It saw its revenue drop 6.0% over the last year.

The decline in EPS is a bit concerning. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Trifast plc Been A Good Investment?

With a total shareholder return of -41% over three years, Trifast plc shareholders would by and large be disappointed. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 1 warning sign for Trifast that investors should think about before committing capital to this stock.

Switching gears from Trifast, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade Trifast, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Trifast might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:TRI

Trifast

Designs, engineers, manufactures, and supplies industrial fasteners and category C components in the United Kingdom, Ireland, Europe, North America, and Asia.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives