- United Kingdom

- /

- Building

- /

- AIM:JHD

Top UK Dividend Stocks For November 2025

Reviewed by Simply Wall St

As the UK market grapples with the impact of weak trade data from China, leading to a faltering FTSE 100 index, investors are increasingly looking for stability amid global economic uncertainties. In such an environment, dividend stocks can offer a reliable income stream and potential cushion against market volatility, making them an attractive choice for those seeking consistent returns.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 3.53% | ★★★★★☆ |

| RS Group (LSE:RS1) | 4.10% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 6.19% | ★★★★★★ |

| OSB Group (LSE:OSB) | 6.37% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.86% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.37% | ★★★★★★ |

| Macfarlane Group (LSE:MACF) | 5.45% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.30% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 5.64% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.66% | ★★★★★★ |

Click here to see the full list of 52 stocks from our Top UK Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

James Halstead (AIM:JHD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: James Halstead plc is a company that manufactures and supplies flooring products for both commercial and domestic uses across various international markets, with a market cap of £581.42 million.

Operations: The company's revenue is derived entirely from the manufacture and distribution of flooring products, amounting to £261.97 million.

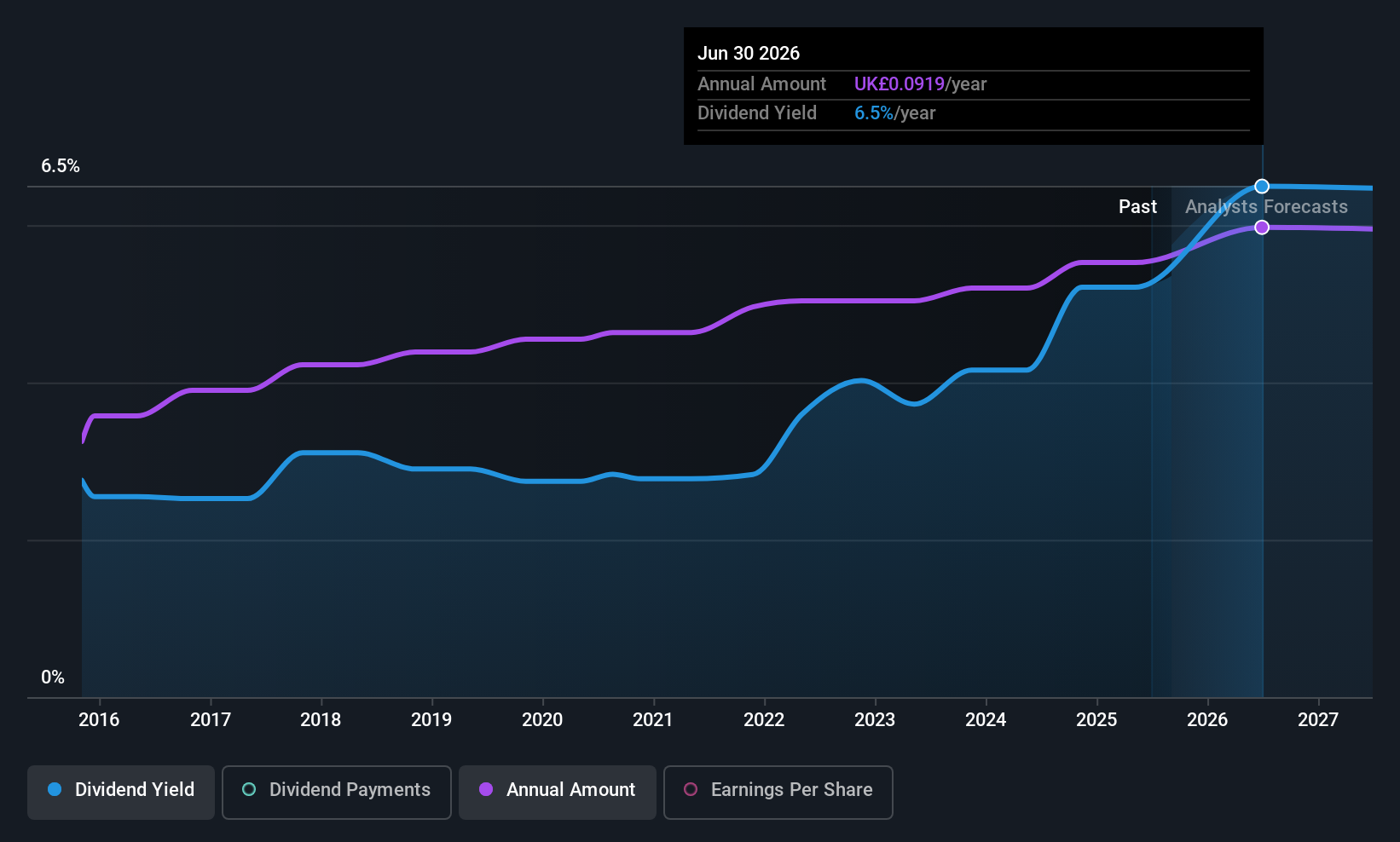

Dividend Yield: 6.3%

James Halstead has consistently increased dividends for 49 years, with the latest annual dividend reaching a record 8.80 pence. Despite its stable and reliable dividend history, the payout ratio is high at 90.3%, suggesting dividends are not well covered by earnings or cash flows, as indicated by a cash payout ratio of 115.2%. The company reported a slight decrease in sales and net income for the fiscal year ended June 2025 but remains valued below its fair market estimate.

- Take a closer look at James Halstead's potential here in our dividend report.

- Our expertly prepared valuation report James Halstead implies its share price may be lower than expected.

Drax Group (LSE:DRX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Drax Group plc, with a market cap of £2.45 billion, operates in the United Kingdom focusing on renewable power generation through its subsidiaries.

Operations: Drax Group plc generates revenue through several segments, including Energy Solutions (£3.14 billion), Pellet Production (£948.80 million), Biomass Generation (£4.58 billion), and Flexible Generation (£191.10 million).

Dividend Yield: 3.8%

Drax Group's dividend payments are well covered by earnings and cash flows, with payout ratios of 24.7% and 18.3%, respectively, indicating sustainability despite a volatile history over the past decade. Although dividends have grown in the last ten years, they remain unreliable due to past fluctuations exceeding 20%. The dividend yield of 3.82% is below the top UK payers' average of 5.45%. Drax trades at a significant discount to its estimated fair value but carries high debt levels.

- Get an in-depth perspective on Drax Group's performance by reading our dividend report here.

- According our valuation report, there's an indication that Drax Group's share price might be on the cheaper side.

RS Group (LSE:RS1)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: RS Group plc is a global distributor of maintenance, repair, and operations products and service solutions, operating in markets such as the UK, US, France, Mexico, Germany, Italy, Switzerland and others internationally with a market cap of approximately £2.56 billion.

Operations: RS Group plc generates revenue primarily from its Other Product and Service Solutions segment, which accounts for approximately £2.50 billion, and its Own-Brand Product and Service Solutions segment, contributing around £400.40 million.

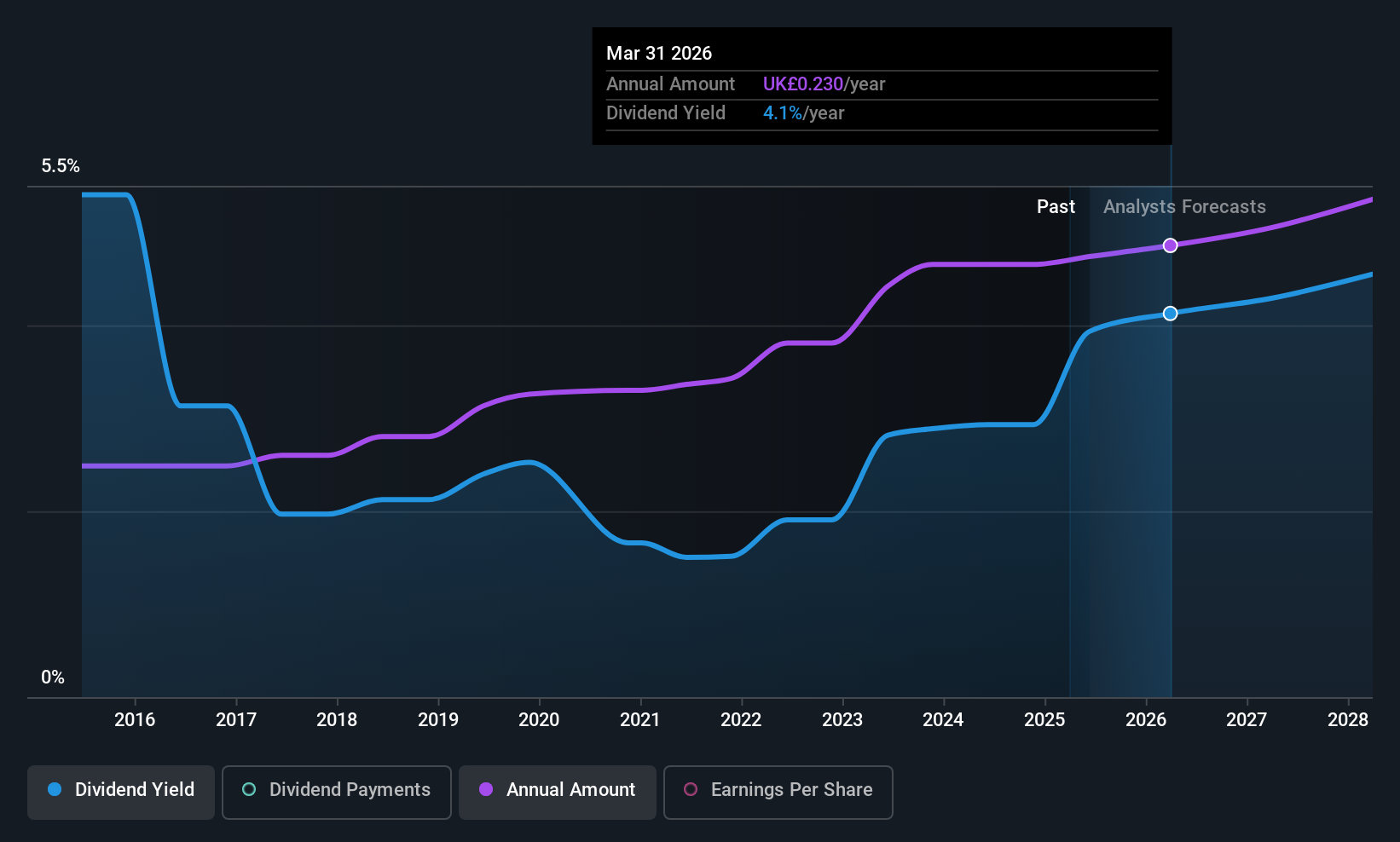

Dividend Yield: 4.1%

RS Group's dividend payments are sustainable, supported by a 69% earnings payout ratio and a 50% cash flow coverage. Over the past decade, dividends have been stable and growing, offering a reliable yield of 4.1%, though below the UK's top payers' average. The stock trades at approximately 20.7% below its fair value estimate, presenting potential value for investors seeking steady income amidst recent strategic partnerships and product innovations enhancing industrial solutions.

- Click to explore a detailed breakdown of our findings in RS Group's dividend report.

- The analysis detailed in our RS Group valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Unlock more gems! Our Top UK Dividend Stocks screener has unearthed 49 more companies for you to explore.Click here to unveil our expertly curated list of 52 Top UK Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:JHD

James Halstead

Manufactures and supplies flooring products for commercial and domestic uses in the United Kingdom, rest of Europe, Scandinavia, Australasia, Asia, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives