- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:RR.

Assessing the Valuation of Rolls-Royce (LSE:RR.) Following Its Sustained Share Price Momentum

Reviewed by Simply Wall St

If you are watching Rolls-Royce Holdings (LSE:RR.), you may have noticed that the stock has turned some heads despite there being no big news or headline-catching developments. Still, a move like this can prompt investors to ask if it is a signal for something deeper at play. It might also be just the kind of quiet shift that makes careful analysis essential for those considering their next steps.

Over the past year, the stock has seen substantial gains, with shares more than doubling. Recent weeks have been less dramatic, but the upward move has continued, building momentum not just this year but over the last three years as well. While no fresh event has grabbed market attention, the stock’s long-term performance stands out against a background of modest near-term change and a history of volatile returns.

The real question now is whether Rolls-Royce Holdings is undervalued at these levels, or if the market’s strong rally already reflects expectations for the future. Could this be a buy, or has the window of opportunity started to close?

Most Popular Narrative: 3.8% Undervalued

According to the most widely followed narrative, Rolls-Royce Holdings is currently seen as undervalued by a small margin, based on forward-looking expectations for revenue and profit growth, as well as execution of key business initiatives. This view incorporates both the company's ambitious project pipeline and the risks that could impact future earnings.

The exceptionally strong financial performance and raised guidance appear to heavily reflect surging demand from the civil aviation aftermarket, especially higher shop visits, aftermarket profitability, and improved contract terms, as well as record aftermarket order intake in Defence. Both of these are influenced by a spike in global air traffic and backlogged demand following the pandemic. There is a risk this recovery pace will normalize, resulting in softer revenue and earnings growth than implied by current market optimism.

Curious what could move the needle next for Rolls-Royce? The narrative is driven by bold expectations, including a transformation in earnings, rapid margin shifts, and industry-beating growth trajectories. Want to know exactly which financial projections underpin this almost premium fair value? You’ll want the full story behind the numbers that could redefine the outlook for this iconic British company.

Result: Fair Value of £11.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, surging costs from supply chain disruptions or slower than expected adoption of new technologies could quickly challenge the bullish outlook for Rolls-Royce.

Find out about the key risks to this Rolls-Royce Holdings narrative.Another View: A Model-Based Valuation

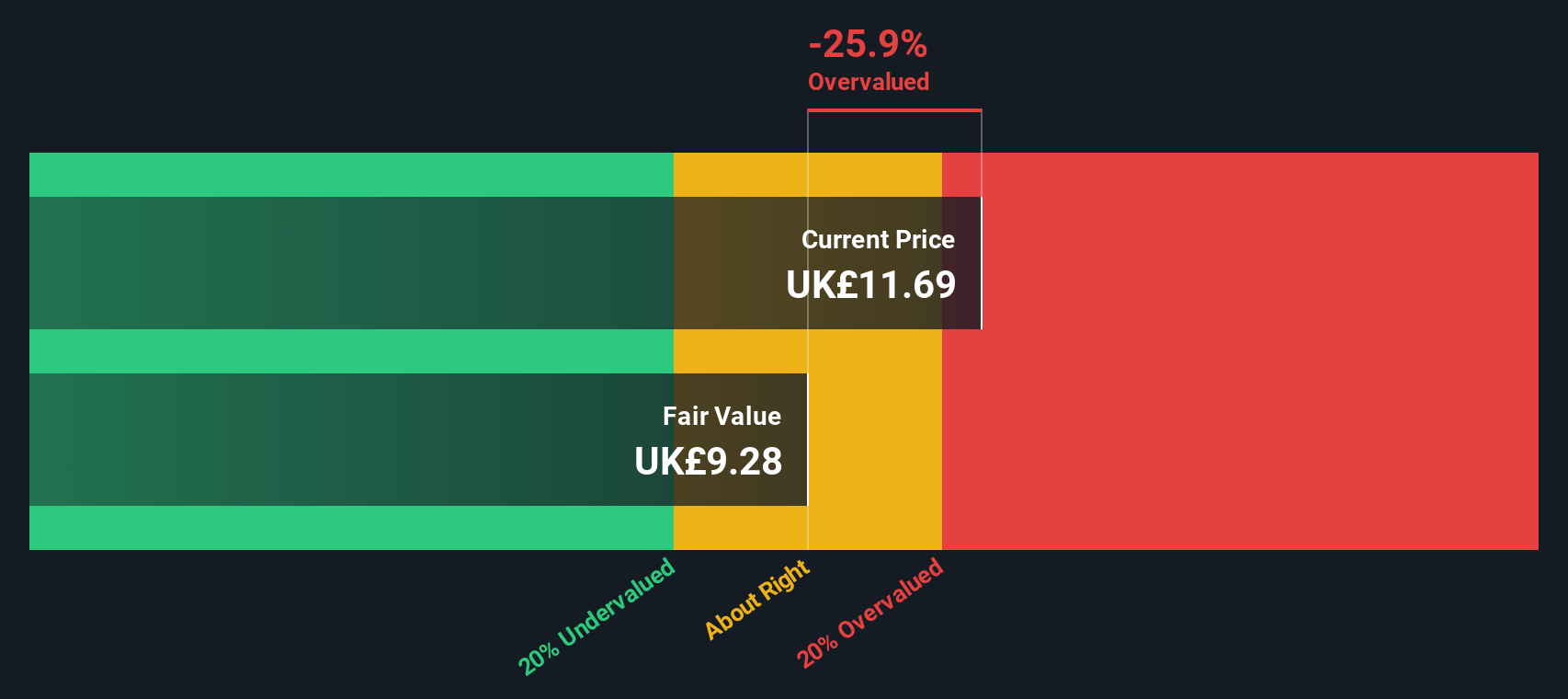

Taking a different approach, the SWS DCF model paints a less optimistic picture than the market-based method. This suggests Rolls-Royce Holdings could actually be overvalued right now. Which perspective will prove more accurate as markets unfold?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Rolls-Royce Holdings Narrative

If you take a different view or want to interpret the data yourself, you can assemble your own perspective with just a few minutes' effort. Do it your way

A great starting point for your Rolls-Royce Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

If you don’t branch out beyond the obvious, you could miss out on top possibilities in today’s fast-moving markets. Make your next move count by using the Simply Wall Street Screener to pinpoint fresh opportunities aligned to what really matters to you.

- Spot value plays that the market has overlooked by checking out undervalued stocks based on cash flows, where potential gems are waiting to be uncovered.

- Tap into the next generation of intelligence. See which companies are harnessing AI for growth with AI penny stocks and position yourself ahead of the curve.

- Strengthen your portfolio with regular income from dividend stocks with yields > 3% and find those stand-out stocks boasting solid dividend yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About LSE:RR.

Rolls-Royce Holdings

Develops and delivers mission-critical power systems in the United Kingdom and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success