- United Kingdom

- /

- Machinery

- /

- LSE:ROR

Is Rotork plc (LON:ROR) Undervalued After Accounting For Its Future Growth?

Growth expectations for Rotork plc (LON:ROR) are high, but many investors are starting to ask whether its last close at £3.083 can still be rationalized by the future potential. Below I will be talking through a basic metric which will help answer this question.

View our latest analysis for Rotork

What are the future expectations?

Analysts are predicting good growth prospects for Rotork over the next couple of years. Expectations from 17 analysts are bullish with earnings per share estimated to rise from today's level of £0.104 to £0.153 over the next three years. This indicates an estimated earnings growth rate of 12% per year, on average, which signals a market-beating outlook in the upcoming years.

Is ROR's share price justifiable by its earnings growth?

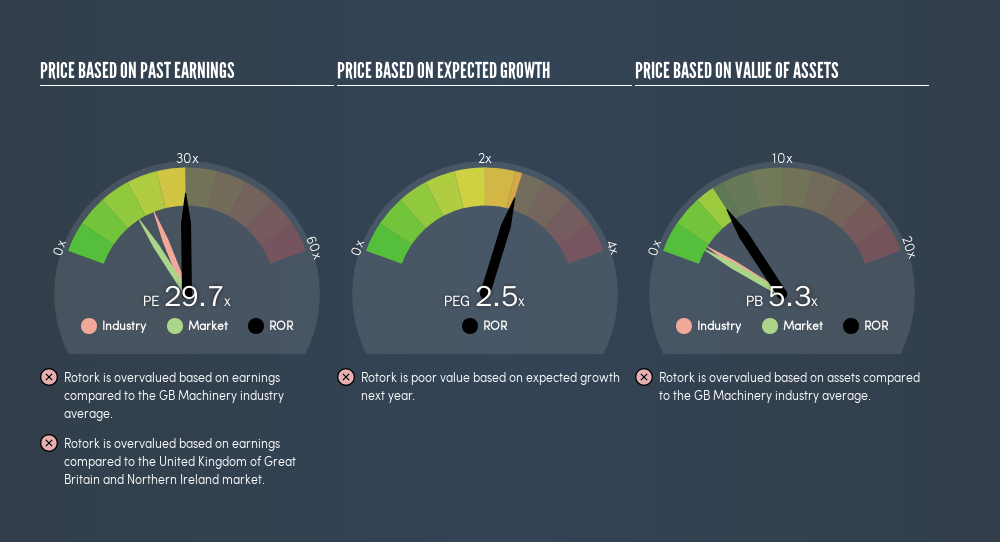

ROR is trading at price-to-earnings (PE) ratio of 29.66x, which suggests that Rotork is overvalued based on current earnings compared to the Machinery industry average of 20.51x , and overvalued compared to the GB market average ratio of 16.02x .

We understand ROR seems to be overvalued based on its current earnings, compared to its industry peers. But, to be able to properly assess the value of a high-growth stock such as Rotork, we must incorporate its earnings growth in our valuation. The PEG ratio is a great calculation to take account of growth in the stock's valuation. A PE ratio of 29.66x and expected year-on-year earnings growth of 12% give Rotork a quite high PEG ratio of 2.49x. This tells us that when we include its growth in our analysis Rotork's stock can be considered overvalued , based on fundamental analysis.

What this means for you:

ROR's current overvaluation could signal a potential selling opportunity to reduce your exposure to the stock, or it you're a potential investor, now may not be the right time to buy. However, basing your investment decision off one metric alone is certainly not sufficient. There are many things I have not taken into account in this article and the PEG ratio is very one-dimensional. If you have not done so already, I urge you to complete your research by taking a look at the following:

- Financial Health: Are ROR’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

- Past Track Record: Has ROR been consistently performing well irrespective of the ups and downs in the market? Go into more detail in the past performance analysis and take a look at the free visual representations of ROR's historicals for more clarity.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About LSE:ROR

Rotork

Designs, manufactures, and markets industrial flow control and instrumentation solutions for the oil and gas, water and wastewater, power, chemical process, and industrial markets in the United Kingdom, Asia Pacific, the United States, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives