- United Kingdom

- /

- Construction

- /

- LSE:MGNS

We Think Morgan Sindall Group (LON:MGNS) Can Stay On Top Of Its Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Morgan Sindall Group plc (LON:MGNS) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Morgan Sindall Group

What Is Morgan Sindall Group's Debt?

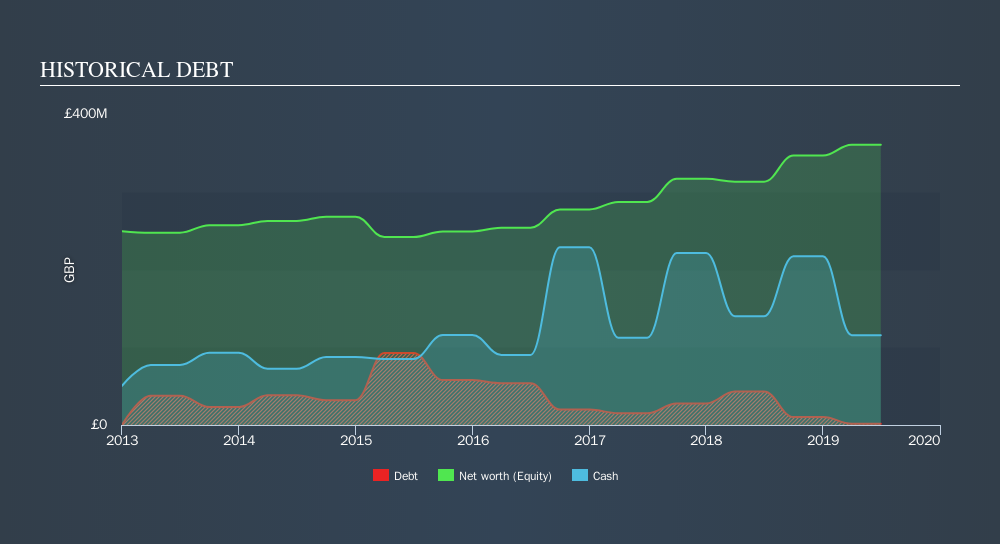

You can click the graphic below for the historical numbers, but it shows that Morgan Sindall Group had UK£1.60m of debt in June 2019, down from UK£87.2m, one year before. But on the other hand it also has UK£115.5m in cash, leading to a UK£113.9m net cash position.

How Strong Is Morgan Sindall Group's Balance Sheet?

The latest balance sheet data shows that Morgan Sindall Group had liabilities of UK£912.6m due within a year, and liabilities of UK£98.1m falling due after that. Offsetting these obligations, it had cash of UK£115.5m as well as receivables valued at UK£496.6m due within 12 months. So it has liabilities totalling UK£398.6m more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of UK£552.6m. This suggests shareholders would heavily diluted if the company needed to shore up its balance sheet in a hurry. Despite its noteworthy liabilities, Morgan Sindall Group boasts net cash, so it's fair to say it does not have a heavy debt load!

And we also note warmly that Morgan Sindall Group grew its EBIT by 17% last year, making its debt load easier to handle. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Morgan Sindall Group's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. Morgan Sindall Group may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Morgan Sindall Group actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing up

Although Morgan Sindall Group's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of UK£113.9m. The cherry on top was that in converted 101% of that EBIT to free cash flow, bringing in UK£48m. So we are not troubled with Morgan Sindall Group's debt use. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check Morgan Sindall Group's dividend history, without delay!

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About LSE:MGNS

Morgan Sindall Group

Operates as a construction and regeneration company in the United Kingdom.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives