- United Kingdom

- /

- Software

- /

- LSE:BYIT

UK Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently experienced a downturn, influenced by weak trade data from China, which highlighted ongoing challenges in the global economic recovery. Amidst these market fluctuations, dividend stocks can offer investors a degree of stability and potential income, making them an attractive consideration for those looking to navigate uncertain economic landscapes.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 9.19% | ★★★★★★ |

| Treatt (LSE:TET) | 3.41% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.81% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 6.01% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.72% | ★★★★★☆ |

| Man Group (LSE:EMG) | 7.36% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.58% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.72% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.95% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.79% | ★★★★★☆ |

Click here to see the full list of 58 stocks from our Top UK Dividend Stocks screener.

We'll examine a selection from our screener results.

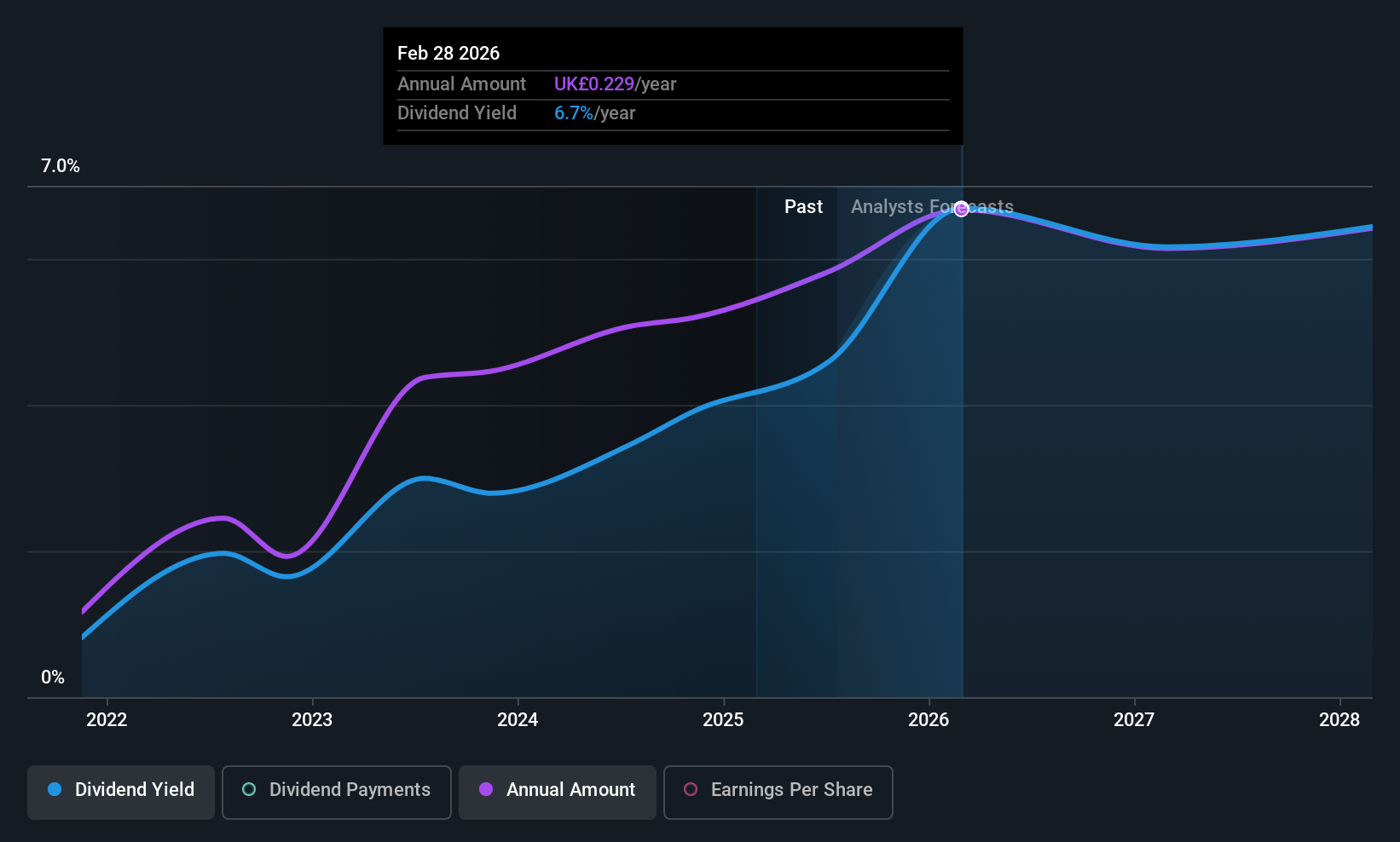

NWF Group (AIM:NWF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: NWF Group plc, with a market cap of £85.04 million, primarily operates in the United Kingdom focusing on the sale and distribution of fuel oils.

Operations: NWF Group plc generates revenue through its three main segments: Food (£82.30 million), Feeds (£204.10 million), and Fuels (£653.10 million).

Dividend Yield: 4.7%

NWF Group offers a reliable dividend yield of 4.72%, though it falls short of the UK's top quartile dividend payers. The company maintains a sustainable payout with earnings and cash flow coverage ratios at 50.1% and 32.4%, respectively, ensuring dividends are well-supported. Despite trading below its estimated fair value, NWF has consistently increased its dividends over the past decade while maintaining stability, although recent profit margins have slightly declined from last year.

- Unlock comprehensive insights into our analysis of NWF Group stock in this dividend report.

- Our comprehensive valuation report raises the possibility that NWF Group is priced higher than what may be justified by its financials.

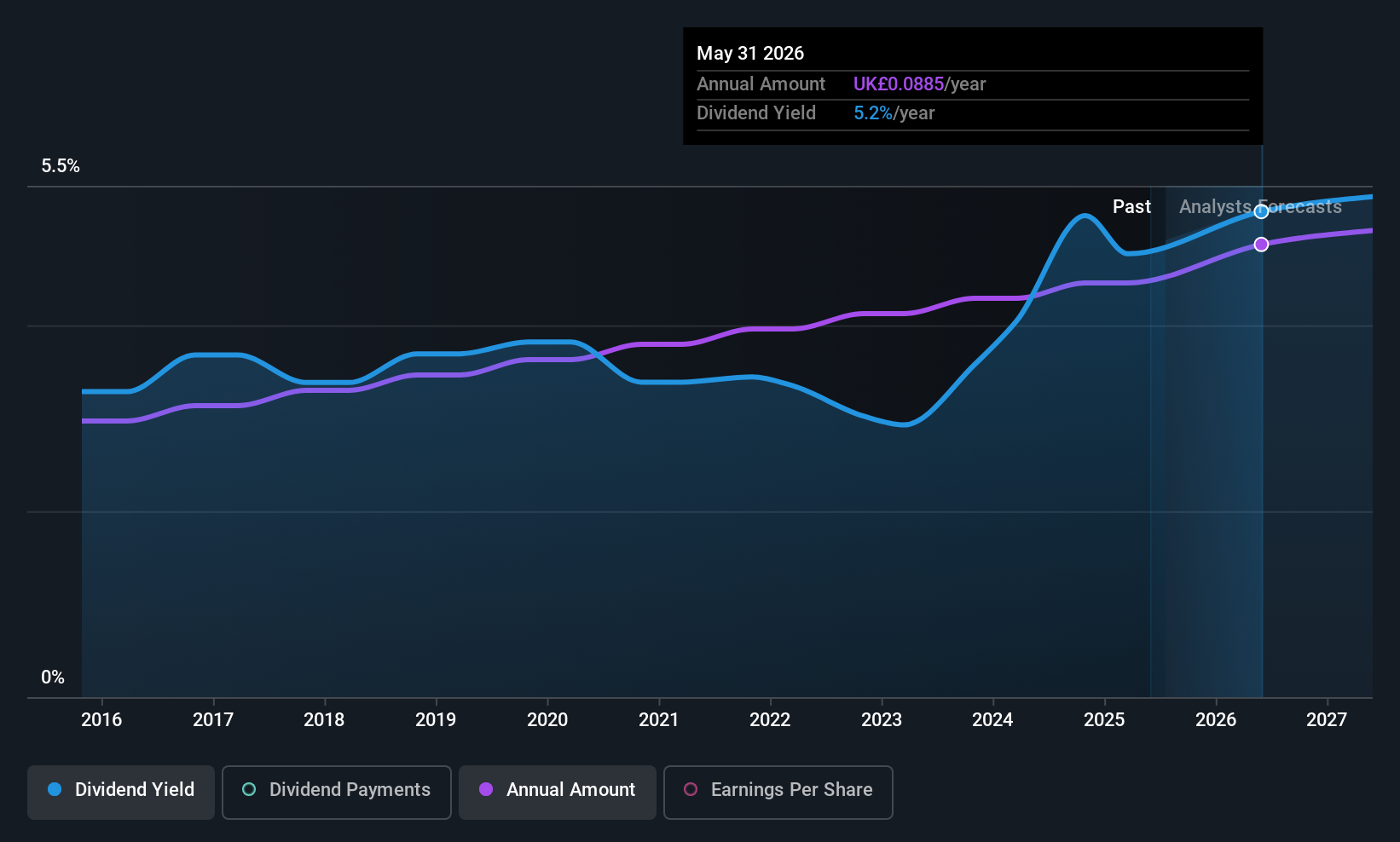

Bytes Technology Group (LSE:BYIT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bytes Technology Group plc provides software, security, AI, and cloud services across the UK, Europe, and internationally with a market cap of £862.24 million.

Operations: Bytes Technology Group plc generates revenue primarily from its IT Solutions Provider segment, amounting to £217.13 million.

Dividend Yield: 5.6%

Bytes Technology Group's dividend yield of 5.63% ranks in the top quartile of UK payers, supported by a low payout ratio of 43.9%. Earnings and cash flows sufficiently cover dividends, despite a volatile payment history over four years. Recent shareholder approval for increased final and special dividends indicates commitment to returns, with £16.6 million set for distribution on July 25, 2025. However, the company's share price has been highly volatile recently, affecting overall dividend reliability perception.

- Navigate through the intricacies of Bytes Technology Group with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Bytes Technology Group shares in the market.

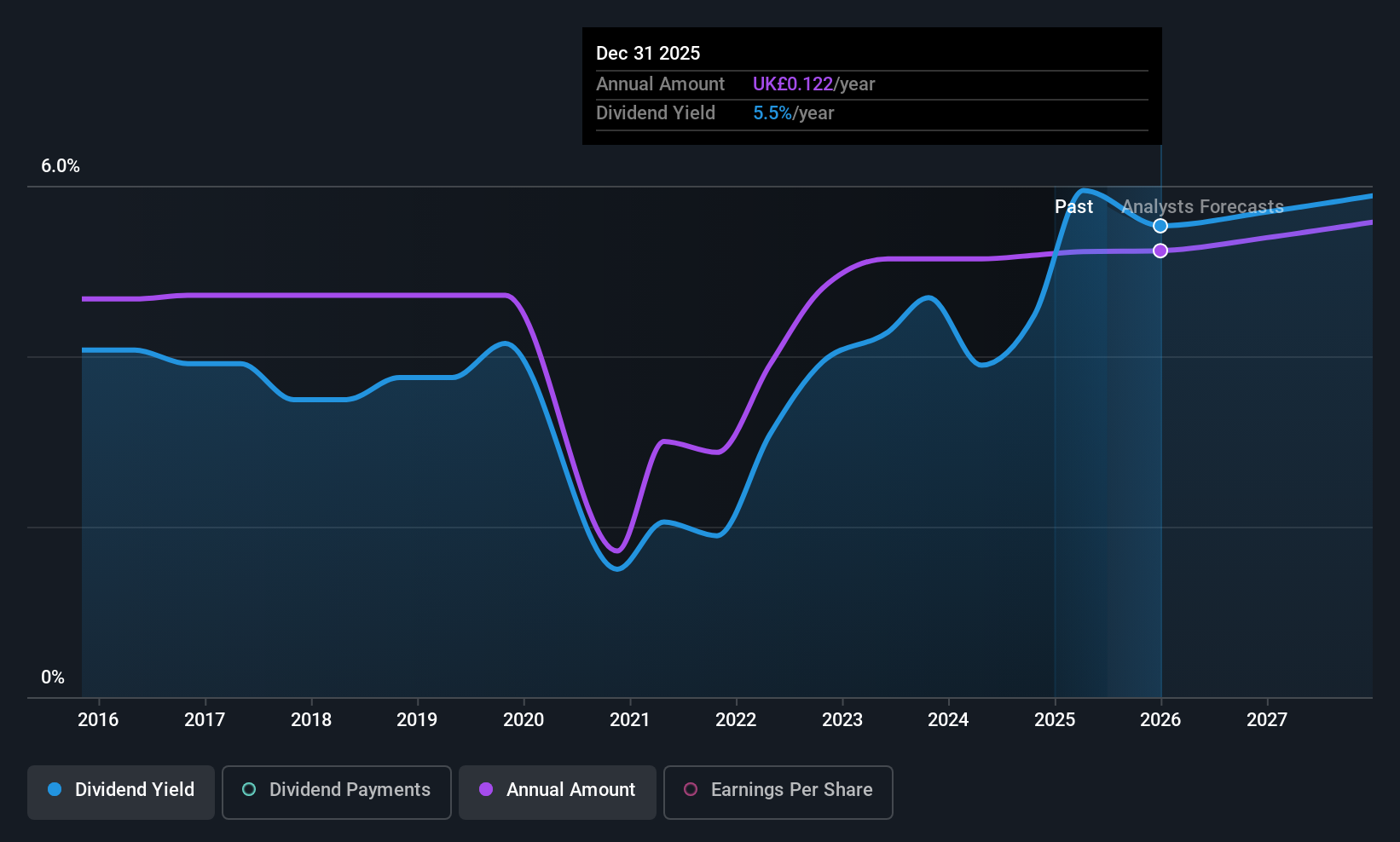

Morgan Advanced Materials (LSE:MGAM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Morgan Advanced Materials plc manufactures and sells various carbon and ceramic products, with a market cap of £610.30 million.

Operations: Morgan Advanced Materials plc generates revenue from its Thermal Products segment (£419.90 million), Performance Carbon segment (£345.70 million), and the Carbon & Technical Ceramics Division - Technical Ceramics segment (£337.80 million).

Dividend Yield: 5.6%

Morgan Advanced Materials offers a dividend yield of 5.58%, placing it among the top UK payers, though its dividends have been volatile over the past decade. The payout ratio is reasonable at 69.1%, but high cash payout ratios indicate poor coverage by free cash flows, raising sustainability concerns. Despite trading at a significant discount to estimated fair value, recent executive changes and substantial one-off items affecting earnings suggest caution for dividend reliability.

- Dive into the specifics of Morgan Advanced Materials here with our thorough dividend report.

- According our valuation report, there's an indication that Morgan Advanced Materials' share price might be on the cheaper side.

Key Takeaways

- Unlock more gems! Our Top UK Dividend Stocks screener has unearthed 55 more companies for you to explore.Click here to unveil our expertly curated list of 58 Top UK Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bytes Technology Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BYIT

Bytes Technology Group

Offers software, security, AI, and cloud services in the United Kingdom, Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives