Stock Analysis

- United Kingdom

- /

- Machinery

- /

- LSE:MGAM

Earnings are growing at Morgan Advanced Materials (LON:MGAM) but shareholders still don't like its prospects

While not a mind-blowing move, it is good to see that the Morgan Advanced Materials plc (LON:MGAM) share price has gained 13% in the last three months. But that doesn't help the fact that the three year return is less impressive. After all, the share price is down 17% in the last three years, significantly under-performing the market.

If the past week is anything to go by, investor sentiment for Morgan Advanced Materials isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for Morgan Advanced Materials

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Although the share price is down over three years, Morgan Advanced Materials actually managed to grow EPS by 94% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

Given the healthiness of the dividend payments, we doubt that they've concerned the market. We like that Morgan Advanced Materials has actually grown its revenue over the last three years. But it's not clear to us why the share price is down. It might be worth diving deeper into the fundamentals, lest an opportunity goes begging.

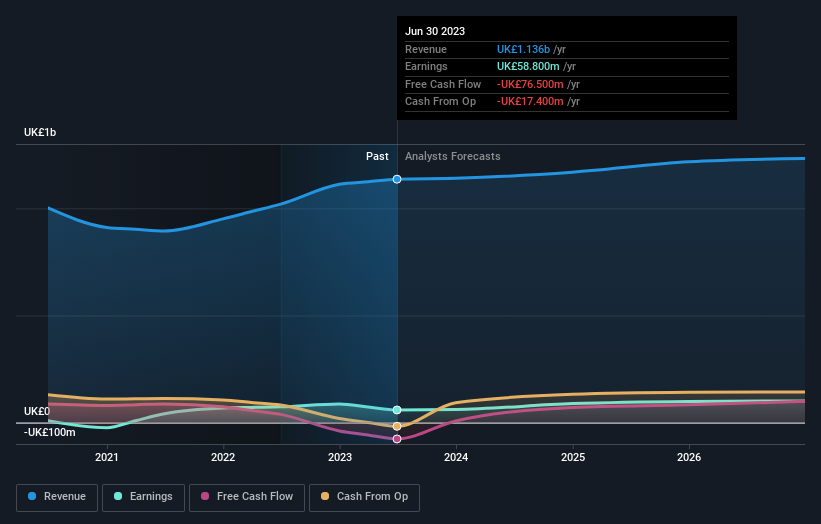

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how Morgan Advanced Materials has grown profits over the years, but the future is more important for shareholders. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Morgan Advanced Materials the TSR over the last 3 years was -7.1%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We regret to report that Morgan Advanced Materials shareholders are down 8.4% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 0.06%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 3% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Morgan Advanced Materials better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with Morgan Advanced Materials (including 2 which shouldn't be ignored) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Morgan Advanced Materials is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:MGAM

Morgan Advanced Materials

Operates as a materials science and application engineering company primarily the United Kingdom.

High growth potential with excellent balance sheet.