- United Kingdom

- /

- Construction

- /

- LSE:KLR

Why It Might Not Make Sense To Buy Keller Group plc (LON:KLR) For Its Upcoming Dividend

It looks like Keller Group plc (LON:KLR) is about to go ex-dividend in the next 3 days. Investors can purchase shares before the 26th of November in order to be eligible for this dividend, which will be paid on the 18th of December.

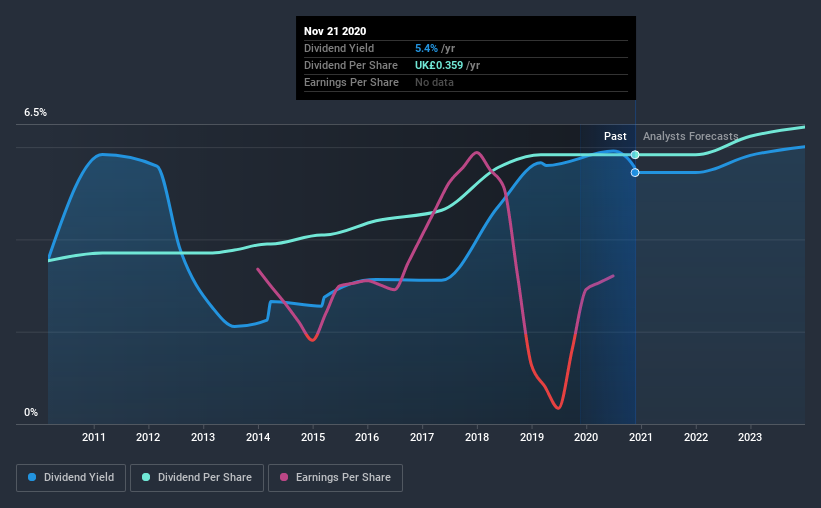

Keller Group's next dividend payment will be UK£0.13 per share, on the back of last year when the company paid a total of UK£0.36 to shareholders. Calculating the last year's worth of payments shows that Keller Group has a trailing yield of 5.4% on the current share price of £6.59. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to investigate whether Keller Group can afford its dividend, and if the dividend could grow.

Check out our latest analysis for Keller Group

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Keller Group paid out 93% of its earnings, which is more than we're comfortable with, unless there are mitigating circumstances. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. The good news is it paid out just 4.6% of its free cash flow in the last year.

It's good to see that while Keller Group's dividends were not well covered by profits, at least they are affordable from a cash perspective. Still, if this were to happen repeatedly, we'd be concerned about whether the dividend is sustainable in a downturn.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If earnings fall far enough, the company could be forced to cut its dividend. Readers will understand then, why we're concerned to see Keller Group's earnings per share have dropped 16% a year over the past five years. When earnings per share fall, the maximum amount of dividends that can be paid also falls.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Keller Group has delivered an average of 5.1% per year annual increase in its dividend, based on the past 10 years of dividend payments. The only way to pay higher dividends when earnings are shrinking is either to pay out a larger percentage of profits, spend cash from the balance sheet, or borrow the money. Keller Group is already paying out a high percentage of its income, so without earnings growth, we're doubtful of whether this dividend will grow much in the future.

Final Takeaway

Is Keller Group an attractive dividend stock, or better left on the shelf? It's never great to see earnings per share declining, especially when a company is paying out 93% of its profit as dividends, which we feel is uncomfortably high. However, the cash payout ratio was much lower - good news from a dividend perspective - which makes us wonder why there is such a mis-match between income and cashflow. With the way things are shaping up from a dividend perspective, we'd be inclined to steer clear of Keller Group.

So if you're still interested in Keller Group despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. In terms of investment risks, we've identified 3 warning signs with Keller Group and understanding them should be part of your investment process.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Keller Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Keller Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About LSE:KLR

Keller Group

Provides specialist geotechnical services in North America, Europe, the Middle East, and the Asia-Pacific.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion