- United Kingdom

- /

- Oil and Gas

- /

- AIM:NWF

Top 3 Dividend Stocks To Watch On The UK Exchange

Reviewed by Simply Wall St

The London markets have faced recent turbulence, with the FTSE 100 closing lower after weak trade data from China signaled ongoing economic struggles. Despite these challenges, dividend stocks remain a compelling option for investors seeking stable returns amidst market volatility. A good dividend stock typically offers consistent payouts and has a strong financial foundation, making it an attractive choice in uncertain times.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 5.90% | ★★★★★★ |

| OSB Group (LSE:OSB) | 8.31% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.30% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 7.23% | ★★★★★☆ |

| Man Group (LSE:EMG) | 5.82% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.79% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.76% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.38% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.48% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.37% | ★★★★★☆ |

Click here to see the full list of 58 stocks from our Top UK Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

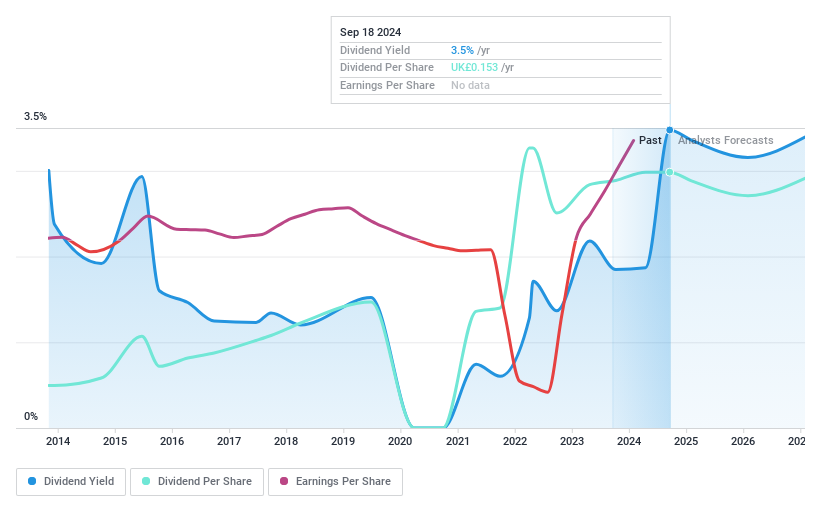

Next 15 Group (AIM:NFG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Next 15 Group plc, with a market cap of £488.83 million, provides communications services across the United Kingdom, Europe, Africa, the United States and the Asia Pacific through its subsidiaries.

Operations: Next 15 Group plc generates revenue through four main segments: Customer Engage (£346.47 million), Customer Insight (£76.53 million), Customer Delivery (£157.91 million), and Business Transformation (£153.76 million).

Dividend Yield: 3.1%

Next 15 Group's dividend payments have been volatile over the past decade, with significant drops exceeding 20% annually at times. Despite this, dividends are well-covered by earnings (payout ratio: 28.8%) and cash flows (cash payout ratio: 21.1%). The company experienced an extraordinary earnings growth of £31.60 billion last year due to large one-off items, but its share price has been highly volatile recently. Currently trading at a substantial discount to its estimated fair value, NFG offers a relatively low dividend yield of 3.12%, below the UK market's top quartile of dividend payers.

- Click here and access our complete dividend analysis report to understand the dynamics of Next 15 Group.

- Upon reviewing our latest valuation report, Next 15 Group's share price might be too pessimistic.

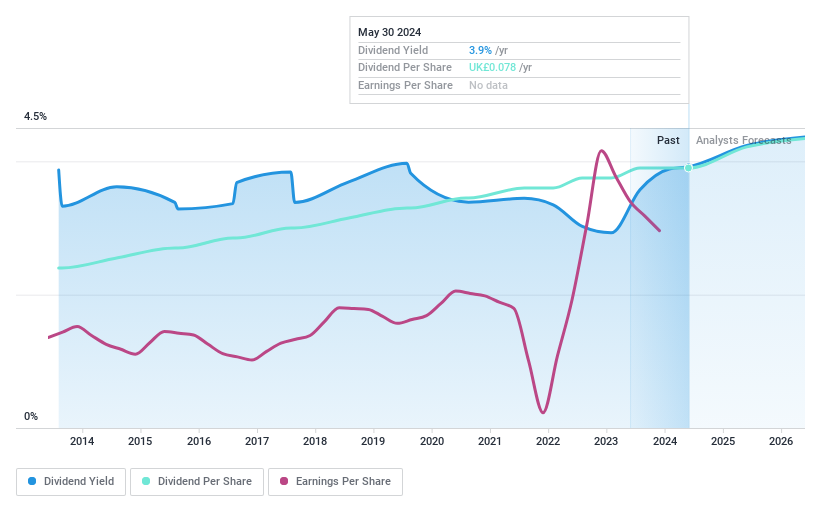

NWF Group (AIM:NWF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: NWF Group plc, with a market cap of £80.60 million, primarily engages in the sale and distribution of fuel oils in the United Kingdom through its subsidiaries.

Operations: NWF Group plc generates revenue from three main segments: Food (£77.80 million), Feeds (£195.10 million), and Fuels (£684.90 million).

Dividend Yield: 5%

NWF Group has demonstrated consistent dividend growth over the past 13 years, with a recent increase to 8.1 pence per share. Despite lower sales (£950.6 million) and net income (£9.1 million) compared to last year, dividends remain well-covered by earnings (payout ratio: 44%) and cash flows (cash payout ratio: 37.8%). The company is actively seeking M&A opportunities to drive future growth, which could support continued dividend stability and potential increases in the long term.

- Click here to discover the nuances of NWF Group with our detailed analytical dividend report.

- The valuation report we've compiled suggests that NWF Group's current price could be quite moderate.

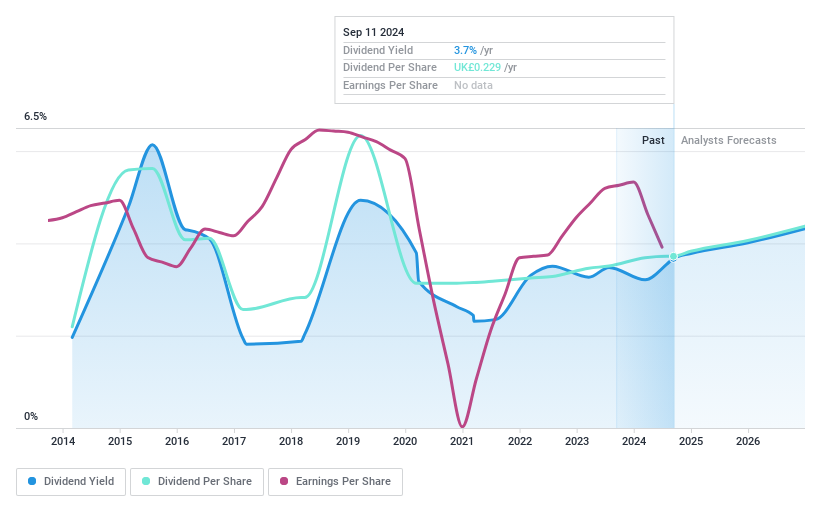

Bodycote (LSE:BOY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bodycote plc offers heat treatment and thermal processing services globally, with a market cap of £1.18 billion.

Operations: Bodycote plc's revenue segments are as follows: Aerospace, Defence & Energy (ADE) - North America: £194.50 million, ADE - Western Europe: £160 million, ADE - Emerging Markets: £8 million; Automotive & General Industrial (AGI) - North America: £97.60 million, AGI - Western Europe: £237.30 million, and AGI - Emerging Markets: £84 million.

Dividend Yield: 3.6%

Bodycote’s dividend payments are covered by earnings (payout ratio: 69%) and cash flows (cash payout ratio: 46%), indicating sustainability. However, the dividend has been volatile over the past decade. Recent financial results show a decline in sales to £399 million and net income to £19.3 million for H1 2024. Despite this, an interim dividend of 6.9 pence was affirmed for November payment, supported by recent share buybacks worth £25.8 million.

- Take a closer look at Bodycote's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Bodycote is trading behind its estimated value.

Seize The Opportunity

- Investigate our full lineup of 58 Top UK Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NWF Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:NWF

NWF Group

Primarily engages in the sale and distribution of fuel oils in the United Kingdom.

Flawless balance sheet established dividend payer.