- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:AVON

Tread With Caution Around Avon Rubber p.l.c.'s (LON:AVON) 0.9% Dividend Yield

Could Avon Rubber p.l.c. (LON:AVON) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

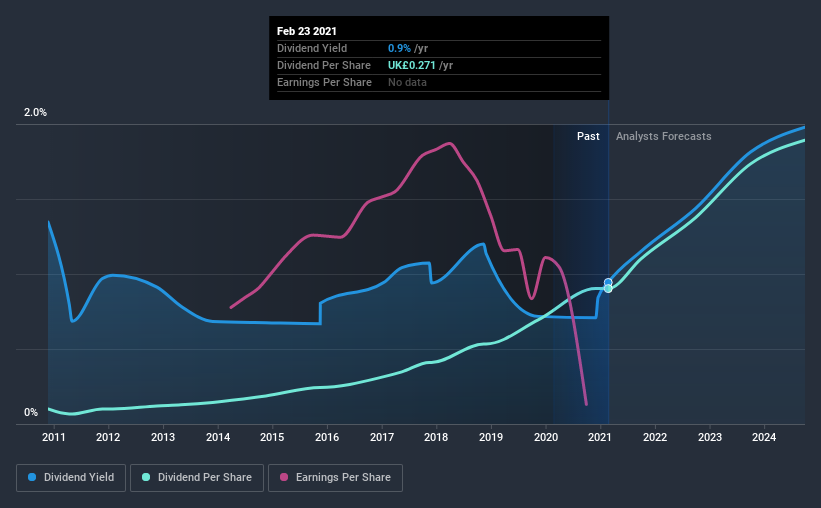

A 0.9% yield is nothing to get excited about, but investors probably think the long payment history suggests Avon Rubber has some staying power. Remember though, given the recent drop in its share price, Avon Rubber's yield will look higher, even though the market may now be expecting a decline in its long-term prospects. Before you buy any stock for its dividend however, you should always remember Warren Buffett's two rules: 1) Don't lose money, and 2) Remember rule #1. We'll run through some checks below to help with this.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. In the last year, Avon Rubber paid out 518% of its profit as dividends. A payout ratio above 100% is definitely an item of concern, unless there are some other circumstances that would justify it.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Last year, Avon Rubber paid a dividend while reporting negative free cash flow. While there may be an explanation, we think this behaviour is generally not sustainable.

While the above analysis focuses on dividends relative to a company's earnings, we do note Avon Rubber's strong net cash position, which will let it pay larger dividends for a time, should it choose.

We update our data on Avon Rubber every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. Avon Rubber has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. The dividend has been cut on at least one occasion historically. During the past 10-year period, the first annual payment was UK£0.03 in 2011, compared to UK£0.3 last year. This works out to be a compound annual growth rate (CAGR) of approximately 25% a year over that time. The dividends haven't grown at precisely 25% every year, but this is a useful way to average out the historical rate of growth.

So, its dividends have grown at a rapid rate over this time, but payments have been cut in the past. The stock may still be worth considering as part of a diversified dividend portfolio.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share (EPS) are growing - it's not worth taking the risk on a dividend getting cut, unless you might be rewarded with larger dividends in future. Avon Rubber's earnings per share have shrunk at 36% a year over the past five years. With this kind of significant decline, we always wonder what has changed in the business. Dividends are about stability, and Avon Rubber's earnings per share, which support the dividend, have been anything but stable.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. We're a bit uncomfortable with Avon Rubber paying out a high percentage of both its cashflow and earnings. Earnings per share are down, and Avon Rubber's dividend has been cut at least once in the past, which is disappointing. In this analysis, Avon Rubber doesn't shape up too well as a dividend stock. We'd find it hard to look past the flaws, and would not be inclined to think of it as a reliable dividend-payer.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Case in point: We've spotted 4 warning signs for Avon Rubber (of which 1 shouldn't be ignored!) you should know about.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you decide to trade Avon Rubber, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:AVON

Avon Technologies

Provides respiratory and head protection products for the military and first responder markets in Europe and the United States.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives