- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:AVON

A Quick Analysis On Avon Rubber's (LON:AVON) CEO Compensation

Paul McDonald has been the CEO of Avon Rubber p.l.c. (LON:AVON) since 2017, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for Avon Rubber

How Does Total Compensation For Paul McDonald Compare With Other Companies In The Industry?

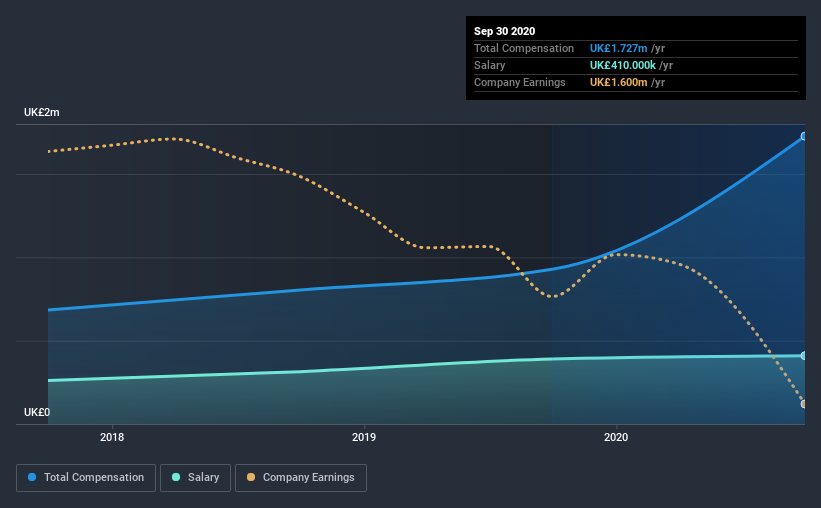

At the time of writing, our data shows that Avon Rubber p.l.c. has a market capitalization of UK£1.0b, and reported total annual CEO compensation of UK£1.7m for the year to September 2020. Notably, that's an increase of 86% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at UK£410k.

In comparison with other companies in the industry with market capitalizations ranging from UK£738m to UK£2.4b, the reported median CEO total compensation was UK£1.6m. So it looks like Avon Rubber compensates Paul McDonald in line with the median for the industry. Furthermore, Paul McDonald directly owns UK£1.3m worth of shares in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | UK£410k | UK£390k | 24% |

| Other | UK£1.3m | UK£538k | 76% |

| Total Compensation | UK£1.7m | UK£928k | 100% |

On an industry level, roughly 42% of total compensation represents salary and 58% is other remuneration. Avon Rubber sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Avon Rubber p.l.c.'s Growth

Over the last three years, Avon Rubber p.l.c. has shrunk its earnings per share by 58% per year. Its revenue is up 30% over the last year.

The reduction in EPS, over three years, is arguably concerning. On the other hand, the strong revenue growth suggests the business is growing. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Avon Rubber p.l.c. Been A Good Investment?

Boasting a total shareholder return of 178% over three years, Avon Rubber p.l.c. has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

As we noted earlier, Avon Rubber pays its CEO in line with similar-sized companies belonging to the same industry. Shareholder returns for the company have been strong for the last three years. Meanwhile, revenues have been increasing recently On a sour note, EPS growth has been negative. Overall, the company's performance hasn't been that disappointing for us to object the CEO compensation.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 3 warning signs for Avon Rubber you should be aware of, and 1 of them shouldn't be ignored.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Avon Rubber or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:AVON

Avon Technologies

Provides respiratory and head protection products for the military and first responder markets in Europe and the United States.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives