- United Kingdom

- /

- Personal Products

- /

- LSE:APN

Discover FW Thorpe And 2 Other Undiscovered Gems in the UK Market

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index faces pressure from weak trade data out of China and falling commodity prices, investors are increasingly on the lookout for opportunities beyond the blue-chip stocks. In this challenging environment, identifying undiscovered gems like FW Thorpe and others in the UK market can provide potential growth prospects, especially when focusing on companies with strong fundamentals and resilience to global economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Livermore Investments Group | NA | 9.92% | 13.65% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| Somero Enterprises | NA | 8.19% | 7.39% | ★★★★★★ |

| VH Global Energy Infrastructure | NA | 18.30% | 20.03% | ★★★★★★ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| FW Thorpe | 5.89% | 11.97% | 12.07% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

FW Thorpe (AIM:TFW)

Simply Wall St Value Rating: ★★★★★☆

Overview: FW Thorpe Plc is a company that designs, manufactures, and supplies professional lighting equipment across various international markets, with a market capitalization of £352.03 million.

Operations: Revenue primarily comes from Thorlux, generating £103.05 million, followed by the Netherlands Companies at £38.16 million, and Zemper Group contributing £19.44 million.

FW Thorpe, a player in the lighting industry, offers a compelling investment narrative with its financial robustness and value proposition. The company boasts more cash than total debt, signaling financial stability. Despite a rise in its debt-to-equity ratio from 1.8% to 5.9% over five years, interest coverage remains strong due to higher earnings relative to interest expenses. Trading at 65% below estimated fair value suggests potential undervaluation opportunities for investors. While recent earnings growth of 10.8% lags behind the Electrical industry's 16.5%, consistent annual profit growth of 12.1% over five years highlights its steady performance trajectory.

- Dive into the specifics of FW Thorpe here with our thorough health report.

Gain insights into FW Thorpe's historical performance by reviewing our past performance report.

Applied Nutrition (LSE:APN)

Simply Wall St Value Rating: ★★★★★★

Overview: Applied Nutrition Plc is involved in the manufacture, wholesale, and retail of sports nutritional products both in the United Kingdom and internationally, with a market cap of £380.50 million.

Operations: Applied Nutrition generates revenue primarily from its Vitamins & Nutrition Products segment, which totals £86.15 million.

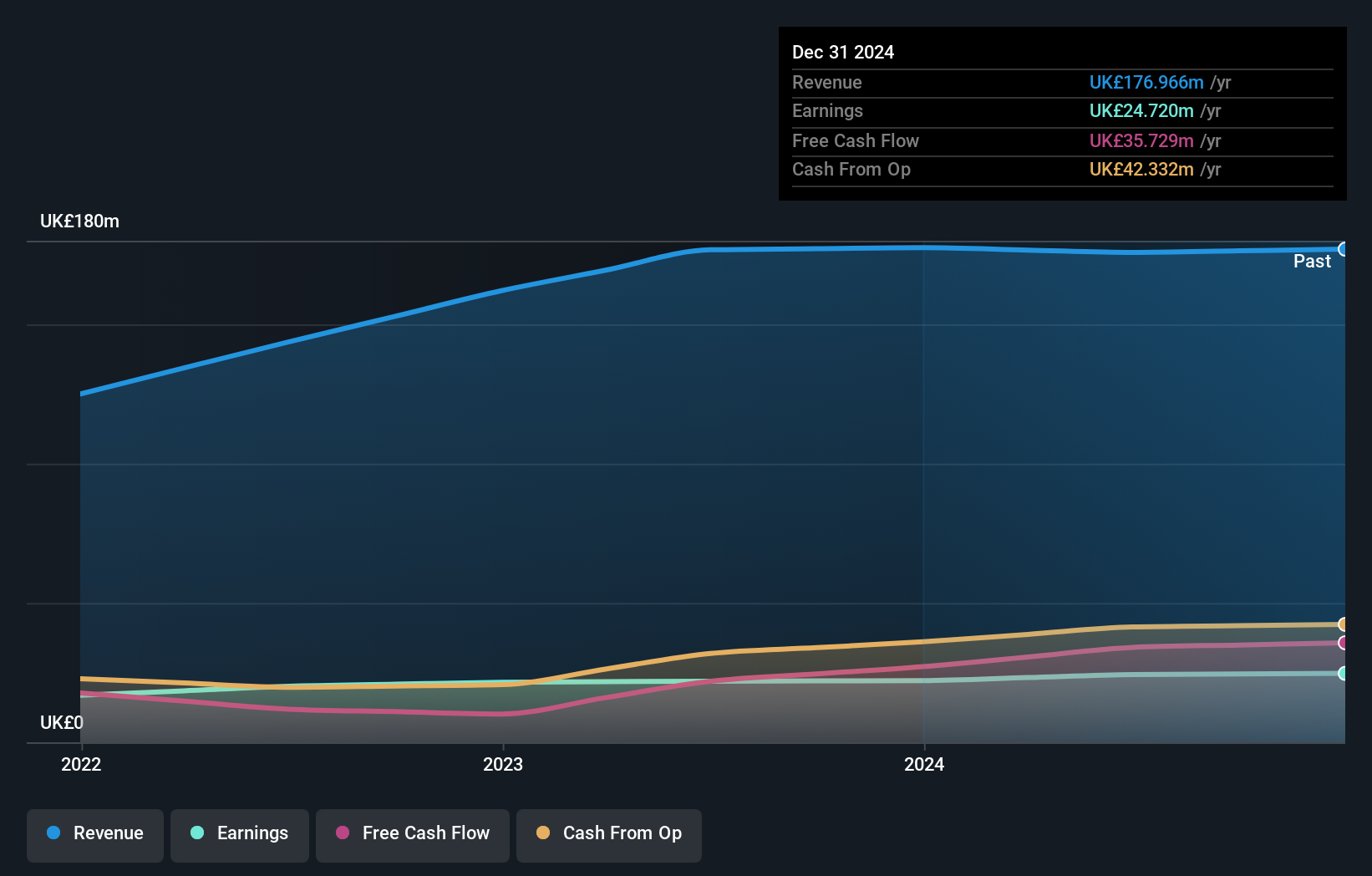

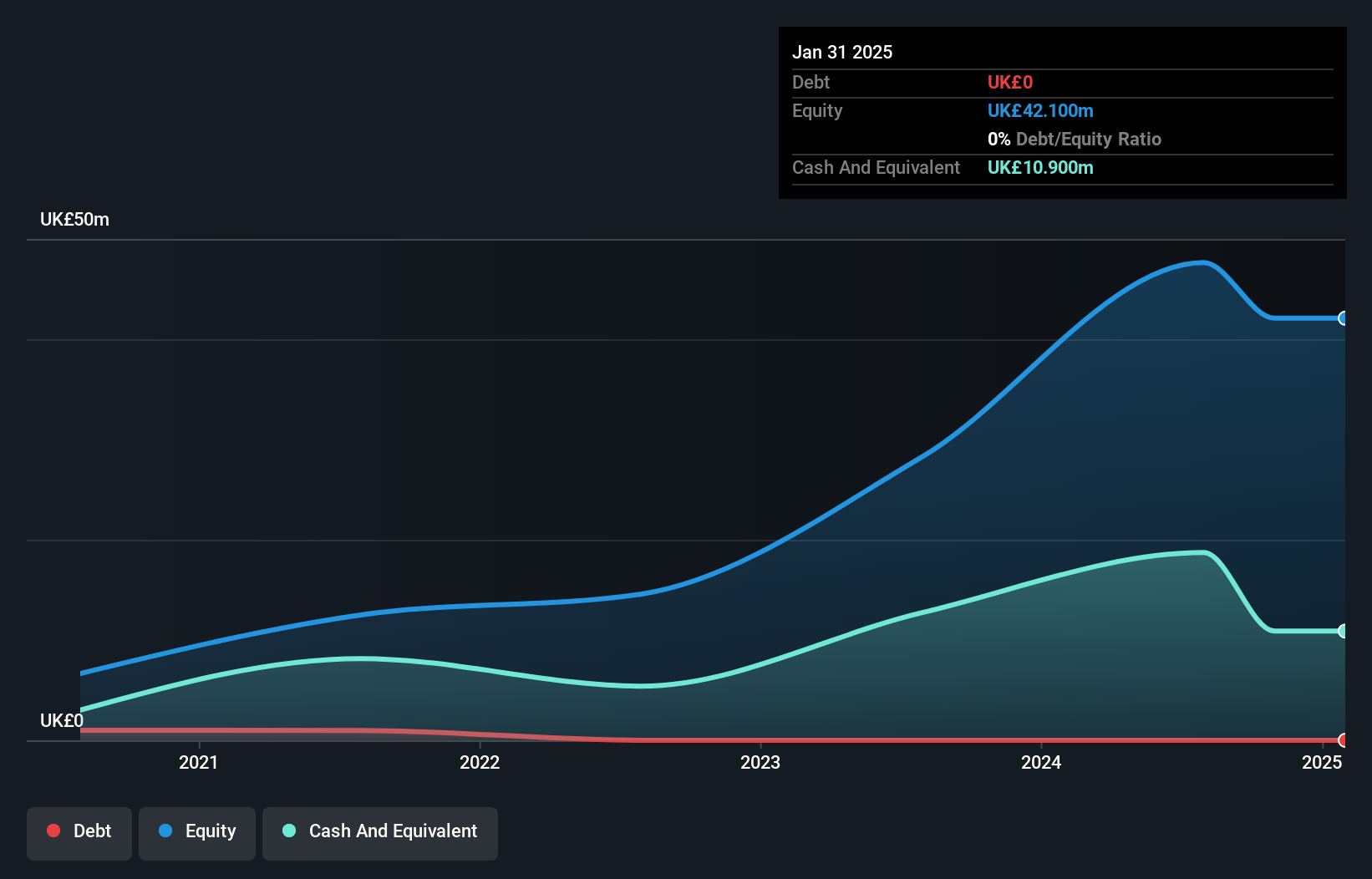

Trading at 30.2% below its estimated fair value, Applied Nutrition showcases an appealing investment opportunity. The company, with a debt-free status for five years, has demonstrated robust earnings growth of 37.5% over the past year, outperforming the industry average of 10.8%. Its levered free cash flow has shown a positive trend, increasing from £2.33 million in 2020 to £7.30 million in 2023 before slightly adjusting to £5.31 million in 2024. Recently added to the FTSE All-Share Index, it seems poised for continued recognition and potential growth within its sector.

- Unlock comprehensive insights into our analysis of Applied Nutrition stock in this health report.

Evaluate Applied Nutrition's historical performance by accessing our past performance report.

Pinewood Technologies Group (LSE:PINE)

Simply Wall St Value Rating: ★★★★★★

Overview: Pinewood Technologies Group PLC is a cloud-based dealer management software provider serving the automotive industry in the UK and internationally, with a market capitalization of £290.16 million.

Operations: Pinewood Technologies Group generates revenue primarily from its software segment, amounting to £22.62 million.

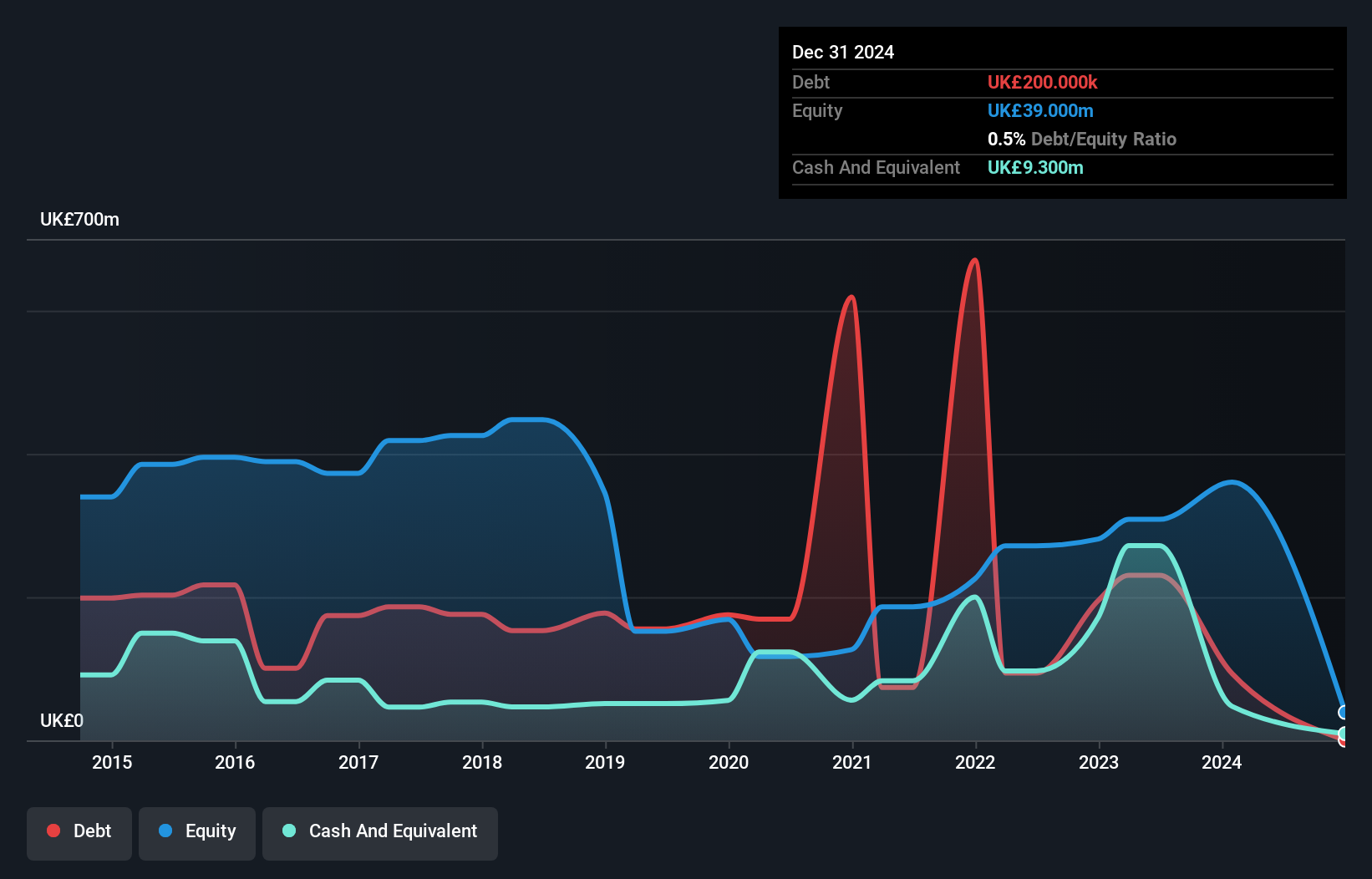

Pinewood Technologies Group, a relatively small player in the UK software sector, has experienced challenges with an earnings drop of 81.6% over the past year, contrasting sharply with the industry's 18% growth average. Despite this setback, its net debt to equity ratio stands at a satisfactory 12.7%, and interest payments are comfortably covered by EBIT at 100 times coverage. Over five years, Pinewood's debt to equity ratio improved from 65.6% to 25.9%. Trading below estimated fair value by about 36%, it offers potential for value seekers despite recent shareholder dilution concerns and insufficient cash runway data for future growth assessments.

Next Steps

- Access the full spectrum of 60 UK Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:APN

Applied Nutrition

Engages in the manufacture, wholesale, and retail of sports nutritional products in the United Kingdom and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives