- United Kingdom

- /

- Food

- /

- AIM:MPE

3 Top UK Dividend Stocks To Watch With Up To 6.8% Yield

Reviewed by Simply Wall St

As the FTSE 100 index faces challenges due to weak trade data from China and fluctuating commodity prices, investors are keeping a close eye on dividend stocks as a potential source of stability and income. In such uncertain market conditions, selecting dividend stocks with strong fundamentals and attractive yields can be an effective strategy for those looking to balance risk while generating consistent returns.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 7.56% | ★★★★★★ |

| Treatt (LSE:TET) | 3.23% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 6.69% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.78% | ★★★★★☆ |

| Man Group (LSE:EMG) | 7.31% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.32% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.90% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.72% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.66% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.06% | ★★★★★☆ |

Click here to see the full list of 61 stocks from our Top UK Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

James Latham (AIM:LTHM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: James Latham plc, with a market cap of £228.59 million, imports and distributes timber, panels, and decorative surfaces across the United Kingdom, the Republic of Ireland, Europe, and internationally.

Operations: James Latham plc generates its revenue primarily from its Timber Importing and Distribution segment, which accounted for £362.22 million.

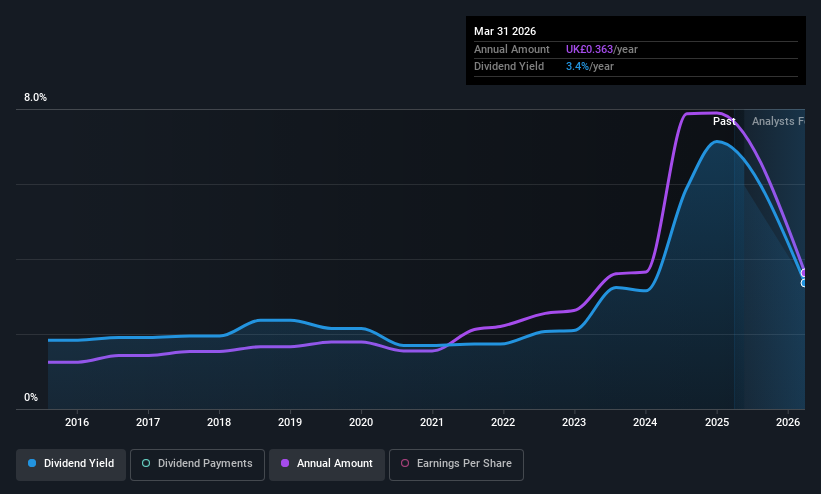

Dividend Yield: 6.9%

James Latham offers a dividend yield of 6.9%, ranking it in the top 25% of UK dividend payers. While dividends have grown steadily over the past decade, concerns arise from its high cash payout ratio of 107%, indicating dividends are not well covered by free cash flows. Despite stable revenue and competitive market conditions, earnings are expected to decline by 1.4% annually over the next three years, challenging future dividend sustainability.

- Click here to discover the nuances of James Latham with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, James Latham's share price might be too pessimistic.

M.P. Evans Group (AIM:MPE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: M.P. Evans Group PLC, with a market cap of £557.20 million, operates through its subsidiaries to own and develop oil palm plantations in Indonesia and Malaysia.

Operations: M.P. Evans Group PLC generates revenue primarily from its oil palm plantations in Indonesia, amounting to $352.84 million.

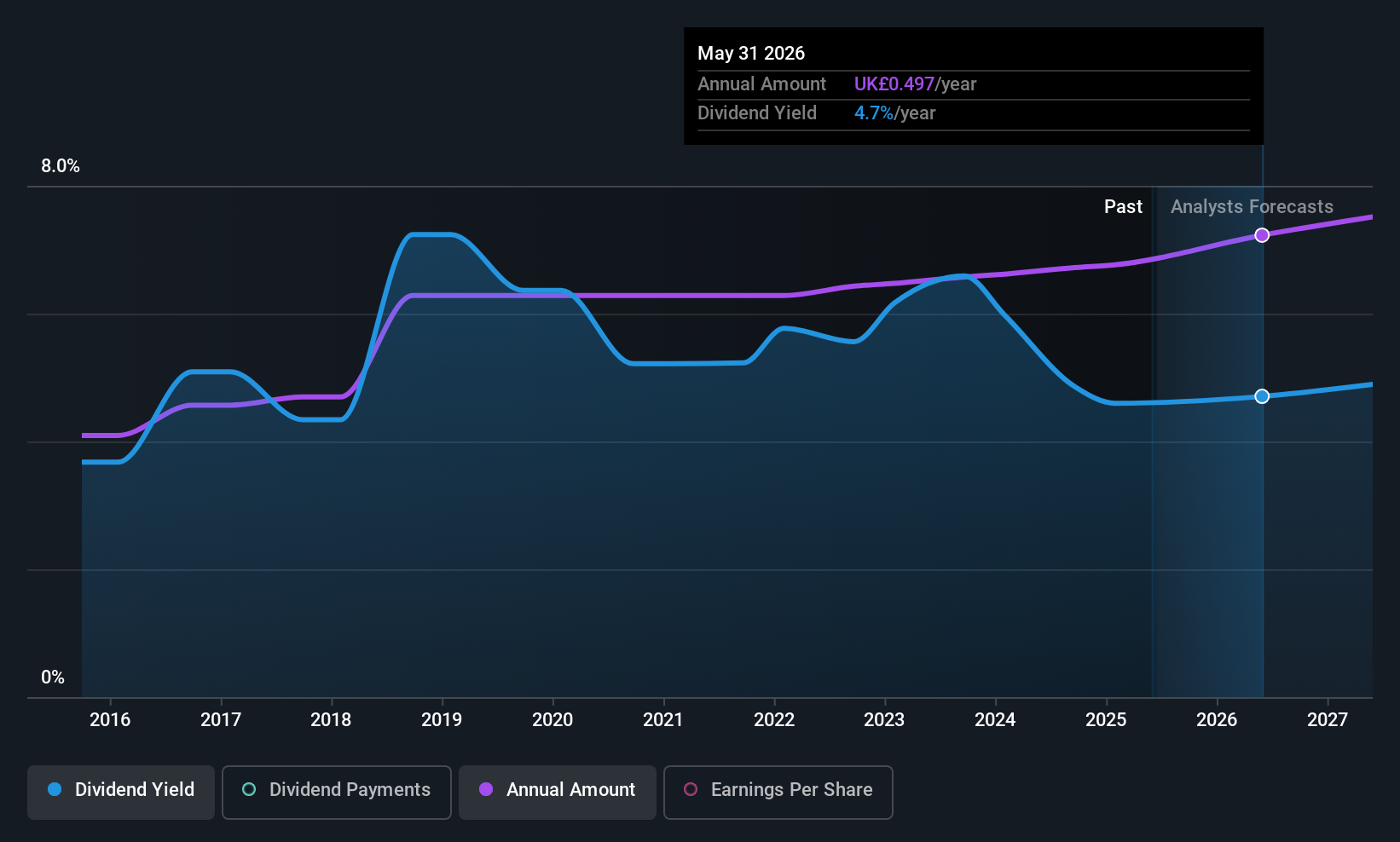

Dividend Yield: 4.6%

M.P. Evans Group's dividend yield of 4.63% is below the top 25% of UK dividend payers, and its dividends have been volatile over the past decade. However, recent increases in dividends reflect a progressive policy, with payments well covered by earnings and cash flows due to low payout ratios (39.6% earnings; 30.3% cash). Despite strong past earnings growth, future declines are forecasted at an average of 2.9% annually over three years, potentially impacting dividend stability.

- Navigate through the intricacies of M.P. Evans Group with our comprehensive dividend report here.

- Our expertly prepared valuation report M.P. Evans Group implies its share price may be lower than expected.

IG Group Holdings (LSE:IGG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IG Group Holdings plc is a fintech company that operates in the online trading business globally, with a market cap of £3.69 billion.

Operations: IG Group Holdings plc generates revenue primarily from its brokerage segment, amounting to £1.01 billion.

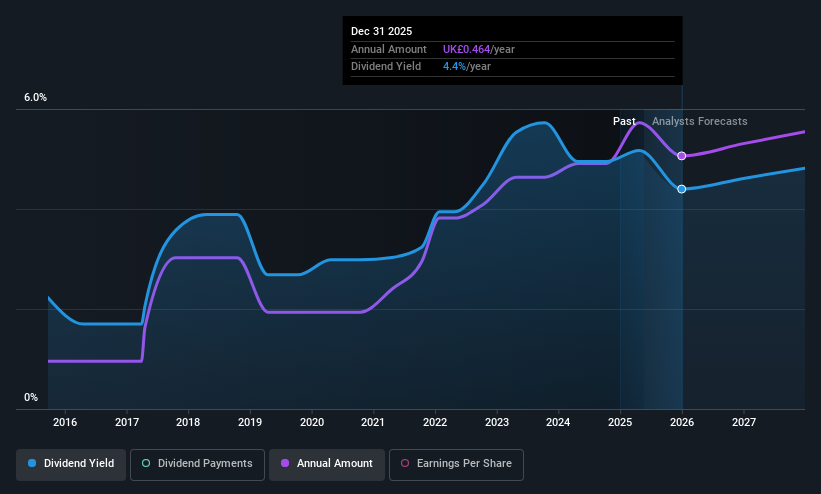

Dividend Yield: 4.4%

IG Group Holdings offers a reliable dividend yield of 4.38%, though it's below the top UK payers. The dividends have grown and remained stable over the past decade, supported by low payout ratios (47.5% earnings; 28.6% cash flow), indicating sustainability. Trading at a significant discount to its estimated fair value, IGG is well-valued relative to peers. Recent guidance suggests revenue may slightly exceed £1.05 billion for FY2025, reflecting potential growth prospects despite modest future revenue forecasts.

- Dive into the specifics of IG Group Holdings here with our thorough dividend report.

- Our valuation report here indicates IG Group Holdings may be undervalued.

Seize The Opportunity

- Click this link to deep-dive into the 61 companies within our Top UK Dividend Stocks screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MPE

M.P. Evans Group

Through its subsidiaries, owns and develops oil palm plantations in Indonesia and Malaysia.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives