- United Kingdom

- /

- Electrical

- /

- AIM:ITM

We Think ITM Power (LON:ITM) Needs To Drive Business Growth Carefully

We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

Given this risk, we thought we'd take a look at whether ITM Power (LON:ITM) shareholders should be worried about its cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

View our latest analysis for ITM Power

SWOT Analysis for ITM Power

- Currently debt free.

- No major weaknesses identified for ITM.

- Forecast to reduce losses next year.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Not expected to become profitable over the next 3 years.

Does ITM Power Have A Long Cash Runway?

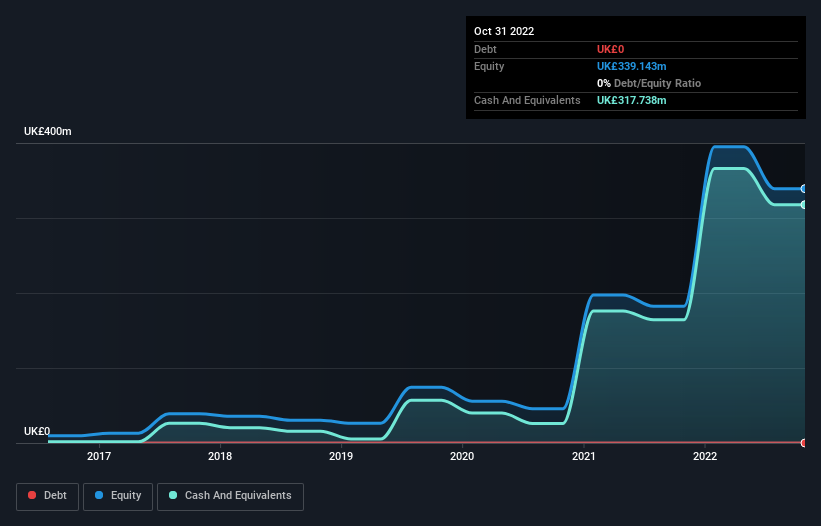

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As at October 2022, ITM Power had cash of UK£318m and no debt. In the last year, its cash burn was UK£86m. Therefore, from October 2022 it had 3.7 years of cash runway. There's no doubt that this is a reassuringly long runway. You can see how its cash balance has changed over time in the image below.

How Well Is ITM Power Growing?

Notably, ITM Power actually ramped up its cash burn very hard and fast in the last year, by 199%, signifying heavy investment in the business. That's pretty alarming given that operating revenue dropped 58% over the last year, though the business is likely attempting a strategic pivot. In light of the above-mentioned, we're pretty wary of the trajectory the company seems to be on. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Easily Can ITM Power Raise Cash?

Even though it seems like ITM Power is developing its business nicely, we still like to consider how easily it could raise more money to accelerate growth. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

ITM Power's cash burn of UK£86m is about 19% of its UK£463m market capitalisation. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

Is ITM Power's Cash Burn A Worry?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought ITM Power's cash runway was relatively promising. Even though we don't think it has a problem with its cash burn, the analysis we've done in this article does suggest that shareholders should give some careful thought to the potential cost of raising more money in the future. Readers need to have a sound understanding of business risks before investing in a stock, and we've spotted 3 warning signs for ITM Power that potential shareholders should take into account before putting money into a stock.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:ITM

ITM Power

Designs and manufactures proton exchange membrane (PEM) electrolysers in the United Kingdom, Germany, rest of Europe, the United States, Australia, and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives