Hercules Plc's (LON:HERC) investors are due to receive a payment of £0.006 per share on 22nd of August. This means that the annual payment will be 3.9% of the current stock price, which is in line with the average for the industry.

Hercules' Projected Earnings Seem Likely To Cover Future Distributions

Solid dividend yields are great, but they only really help us if the payment is sustainable. Before this announcement, Hercules was paying out 75% of earnings, but a comparatively small 63% of free cash flows. In general, cash flows are more important than earnings, so we are comfortable that the dividend will be sustainable going forward, especially with so much cash left over for reinvestment.

Over the next year, EPS is forecast to expand by 31.2%. Assuming the dividend continues along recent trends, we think the payout ratio could be 22% by next year, which is in a pretty sustainable range.

Check out our latest analysis for Hercules

Hercules' Dividend Has Lacked Consistency

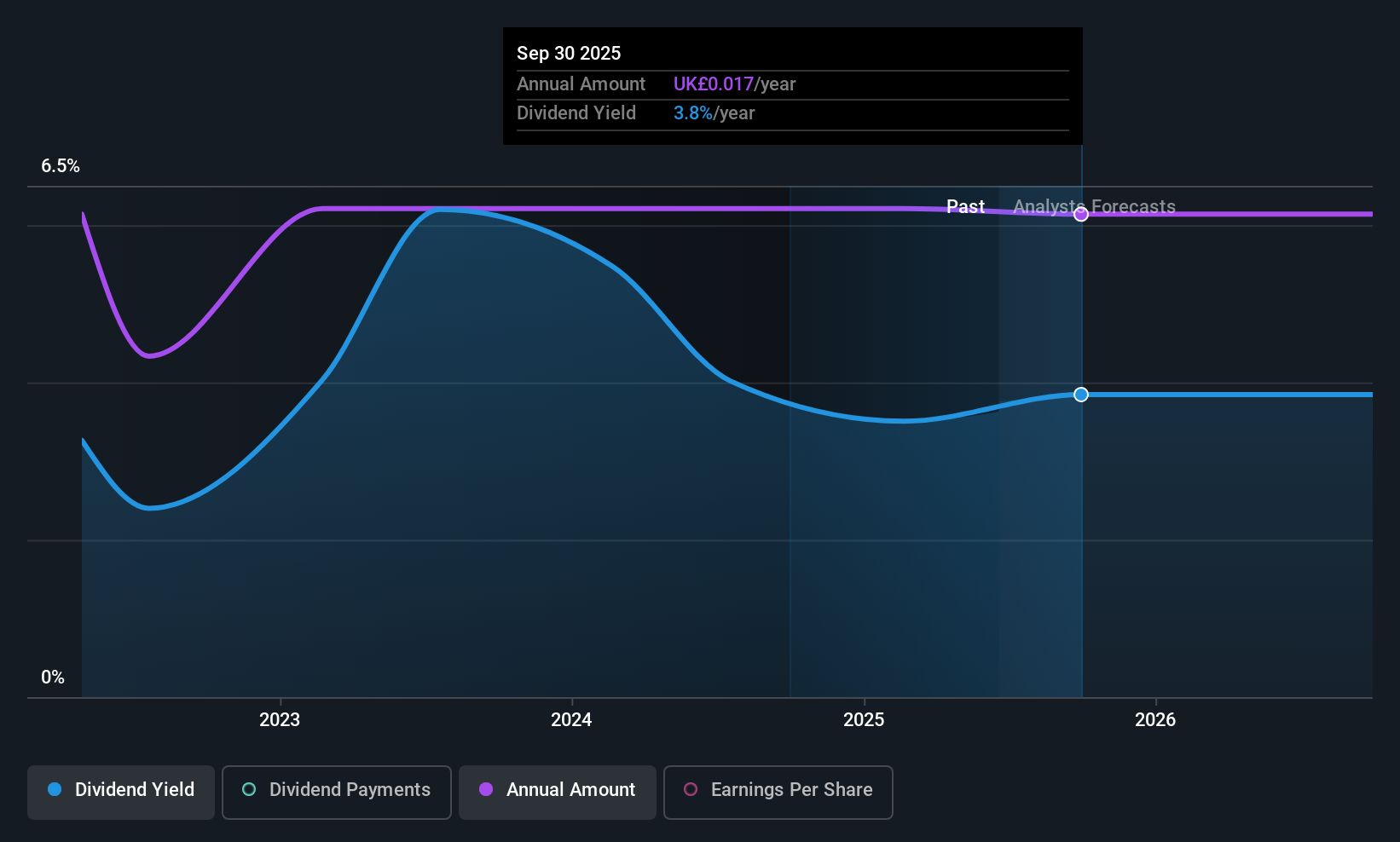

Even in its short history, we have seen the dividend cut. The annual payment during the last 3 years was £0.017 in 2022, and the most recent fiscal year payment was £0.0172. Dividend payments have grown at less than 1% a year over this period. It's encouraging to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth anyway, which makes this less attractive as an income investment.

Dividend Growth Potential Is Shaky

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Hercules' earnings per share has shrunk at 75% a year over the past five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

We should note that Hercules has issued stock equal to 26% of shares outstanding. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Our Thoughts On Hercules' Dividend

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. For instance, we've picked out 4 warning signs for Hercules that investors should take into consideration. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Hercules might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:HERC

Hercules

Engages in general construction and civil engineering businesses in the United Kingdom.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026