- United Kingdom

- /

- Building

- /

- AIM:ETP

Eneraqua Technologies plc (LON:ETP) Soars 30% But It's A Story Of Risk Vs Reward

Eneraqua Technologies plc (LON:ETP) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 38% in the last year.

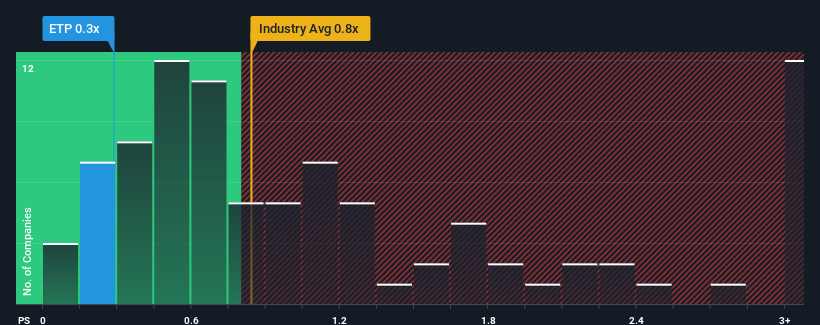

Although its price has surged higher, there still wouldn't be many who think Eneraqua Technologies' price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in the United Kingdom's Building industry is similar at about 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Eneraqua Technologies

How Eneraqua Technologies Has Been Performing

Eneraqua Technologies certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. Perhaps the market is expecting its current strong performance to taper off in accordance to the rest of the industry, which has kept the P/S contained. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Eneraqua Technologies.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Eneraqua Technologies' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. However, a few strong years before that means that it was still able to grow revenue by an impressive 204% in total over the last three years. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Turning to the outlook, the next year should generate growth of 50% as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 8.6%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Eneraqua Technologies' P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does Eneraqua Technologies' P/S Mean For Investors?

Eneraqua Technologies appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite enticing revenue growth figures that outpace the industry, Eneraqua Technologies' P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with Eneraqua Technologies (including 1 which is a bit concerning).

If these risks are making you reconsider your opinion on Eneraqua Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Eneraqua Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:ETP

Eneraqua Technologies

Provides turnkey solutions for water efficiency and decarbonization through district heating and ground source heat pump systems for commercial clients, and social housing and residential sectors.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives