- United Kingdom

- /

- Building

- /

- AIM:EPWN

Epwin Group PLC Just Recorded A 128% EPS Beat: Here's What Analysts Are Forecasting Next

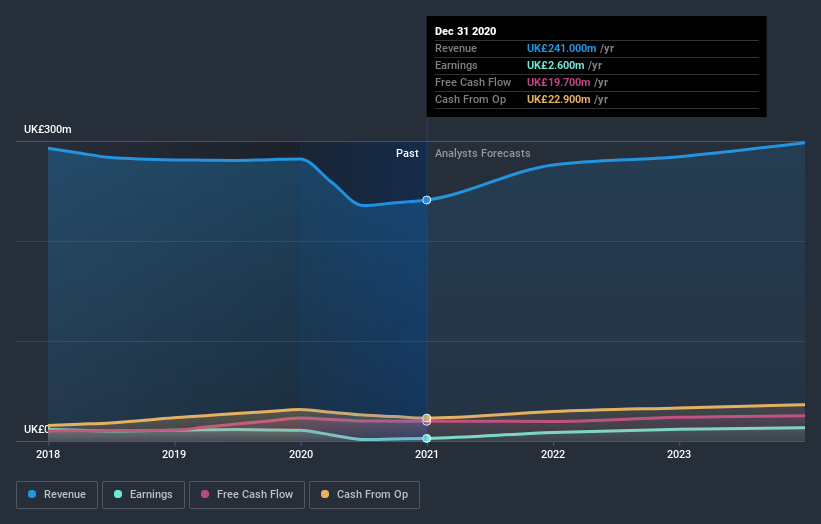

It's been a good week for Epwin Group PLC (LON:EPWN) shareholders, because the company has just released its latest yearly results, and the shares gained 7.0% to UK£1.04. It looks like a credible result overall - although revenues of UK£241m were what the analysts expected, Epwin Group surprised by delivering a (statutory) profit of UK£0.018 per share, an impressive 128% above what was forecast. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

View our latest analysis for Epwin Group

Taking into account the latest results, the current consensus from Epwin Group's four analysts is for revenues of UK£276.0m in 2021, which would reflect a solid 15% increase on its sales over the past 12 months. Statutory earnings per share are predicted to leap 230% to UK£0.06. Before this earnings report, the analysts had been forecasting revenues of UK£261.2m and earnings per share (EPS) of UK£0.051 in 2021. So it seems there's been a definite increase in optimism about Epwin Group's future following the latest results, with a substantial gain in the earnings per share forecasts in particular.

It will come as no surprise to learn that the analysts have increased their price target for Epwin Group 11% to UK£1.16on the back of these upgrades. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on Epwin Group, with the most bullish analyst valuing it at UK£1.21 and the most bearish at UK£1.10 per share. Still, with such a tight range of estimates, it suggeststhe analysts have a pretty good idea of what they think the company is worth.

Of course, another way to look at these forecasts is to place them into context against the industry itself. For example, we noticed that Epwin Group's rate of growth is expected to accelerate meaningfully, with revenues forecast to exhibit 15% growth to the end of 2021 on an annualised basis. That is well above its historical decline of 2.3% a year over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 6.2% annually. Not only are Epwin Group's revenues expected to improve, it seems that the analysts are also expecting it to grow faster than the wider industry.

The Bottom Line

The most important thing here is that the analysts upgraded their earnings per share estimates, suggesting that there has been a clear increase in optimism towards Epwin Group following these results. Pleasantly, they also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow faster than the wider industry. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

With that in mind, we wouldn't be too quick to come to a conclusion on Epwin Group. Long-term earnings power is much more important than next year's profits. We have estimates - from multiple Epwin Group analysts - going out to 2023, and you can see them free on our platform here.

That said, it's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Epwin Group , and understanding this should be part of your investment process.

When trading Epwin Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Epwin Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:EPWN

Epwin Group

Manufactures building products for the repair, maintenance and improvement, social housing, and new build markets in the United Kingdom, Europe, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success