What are the early trends we should look for to identify a stock that could multiply in value over the long term? Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. With that in mind, we've noticed some promising trends at Cohort (LON:CHRT) so let's look a bit deeper.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Cohort, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.12 = UK£26m ÷ (UK£397m - UK£176m) (Based on the trailing twelve months to April 2025).

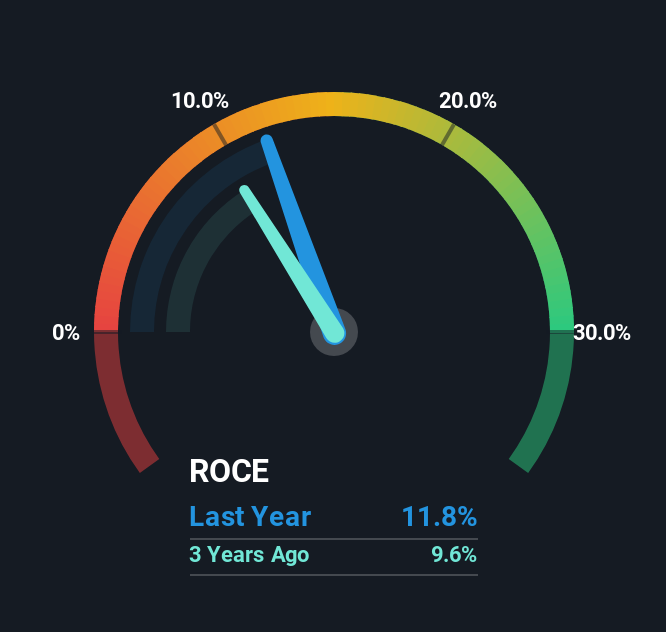

So, Cohort has an ROCE of 12%. In absolute terms, that's a pretty normal return, and it's somewhat close to the Aerospace & Defense industry average of 13%.

Check out our latest analysis for Cohort

In the above chart we have measured Cohort's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Cohort for free.

What Does the ROCE Trend For Cohort Tell Us?

Cohort is displaying some positive trends. The numbers show that in the last five years, the returns generated on capital employed have grown considerably to 12%. Basically the business is earning more per dollar of capital invested and in addition to that, 83% more capital is being employed now too. So we're very much inspired by what we're seeing at Cohort thanks to its ability to profitably reinvest capital.

For the record though, there was a noticeable increase in the company's current liabilities over the period, so we would attribute some of the ROCE growth to that. Essentially the business now has suppliers or short-term creditors funding about 44% of its operations, which isn't ideal. And with current liabilities at those levels, that's pretty high.

The Bottom Line

In summary, it's great to see that Cohort can compound returns by consistently reinvesting capital at increasing rates of return, because these are some of the key ingredients of those highly sought after multi-baggers. And a remarkable 140% total return over the last five years tells us that investors are expecting more good things to come in the future. In light of that, we think it's worth looking further into this stock because if Cohort can keep these trends up, it could have a bright future ahead.

Cohort does have some risks though, and we've spotted 2 warning signs for Cohort that you might be interested in.

While Cohort isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:CHRT

Cohort

Provides various products and services in defense, security, and related markets in the United Kingdom, Germany, Portugal, Australia, North and South America, Asia Pacific, Africa, and other European countries.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success