- United Kingdom

- /

- Trade Distributors

- /

- AIM:BMT

Shareholders Will Most Likely Find Braime Group PLC's (LON:BMT) CEO Compensation Acceptable

The share price of Braime Group PLC (LON:BMT) has increased significantly over the past few years. However, the earnings growth has not kept up with the share price momentum, suggesting that some other factors may be driving the price direction. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 23 June 2021. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

See our latest analysis for Braime Group

How Does Total Compensation For Oliver Nicholas Braime Compare With Other Companies In The Industry?

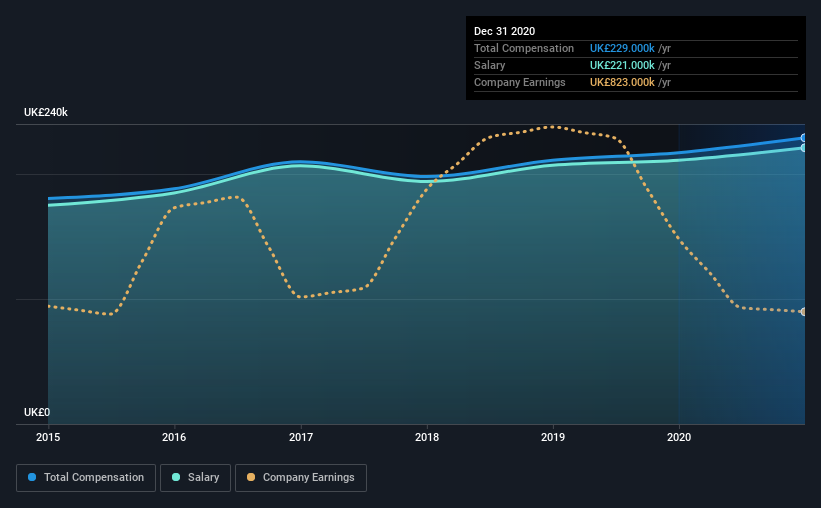

At the time of writing, our data shows that Braime Group PLC has a market capitalization of UK£33m, and reported total annual CEO compensation of UK£229k for the year to December 2020. That's a modest increase of 5.5% on the prior year. We note that the salary portion, which stands at UK£221.0k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below UK£142m, we found that the median total CEO compensation was UK£236k. So it looks like Braime Group compensates Oliver Nicholas Braime in line with the median for the industry. Furthermore, Oliver Nicholas Braime directly owns UK£3.4m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | UK£221k | UK£211k | 97% |

| Other | UK£8.0k | UK£6.0k | 3% |

| Total Compensation | UK£229k | UK£217k | 100% |

On an industry level, around 61% of total compensation represents salary and 39% is other remuneration. Braime Group has gone down a largely traditional route, paying Oliver Nicholas Braime a high salary, giving it preference over non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Braime Group PLC's Growth

Over the last three years, Braime Group PLC has shrunk its earnings per share by 22% per year. It saw its revenue drop 1.9% over the last year.

Overall this is not a very positive result for shareholders. This is compounded by the fact revenue is actually down on last year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Braime Group PLC Been A Good Investment?

Boasting a total shareholder return of 96% over three years, Braime Group PLC has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Oliver Nicholas receives almost all of their compensation through a salary. Despite the strong returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about the stock keeping up its current momentum. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 3 warning signs for Braime Group (of which 1 is a bit concerning!) that you should know about in order to have a holistic understanding of the stock.

Important note: Braime Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade Braime Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Braime Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:BMT

Braime Group

Engages in the distribution of bulk material handling components and monitoring equipment in the United Kingdom, Rest of Europe, the Middle East, the United States, Africa, Australia, and Asia.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives