- United Kingdom

- /

- Banks

- /

- LSE:LLOY

Is Lloyds (LSE:LLOY) Still Undervalued After Its Latest Share Price Surge?

Reviewed by Simply Wall St

Lloyds Banking Group (LSE:LLOY) shares have attracted investor interest recently, building on strong momentum over the past month and past 3 months. The stock has delivered a 5% gain in the past month alone.

See our latest analysis for Lloyds Banking Group.

Momentum has been on Lloyds Banking Group’s side, with 2024 bringing a robust 64.6% year-to-date share price gain and a three-year total shareholder return of 143%. This strong run suggests that investors see improving growth prospects and lower risks, especially as UK banks recover from recent macro headwinds.

Curious which other companies have been gathering steam? Now could be a great moment to discover fast growing stocks with high insider ownership.

With shares climbing sharply and strong financial growth underpinning the rally, the real question now is whether Lloyds Banking Group is undervalued at these levels or if the market has already priced in its future potential.

Most Popular Narrative: 3.8% Undervalued

Compared to its last close of £0.91, the most widely followed narrative suggests Lloyds Banking Group’s shares remain below their estimated fair value of £0.94. This small gap keeps investor attention on the drivers behind the latest fair value call.

Lloyds' significant progress in digital transformation, including expanding mobile-first services for 21 million users, rolling out a new digital remortgage journey, and leveraging AI innovation, continues to drive operating cost reductions and enhances efficiency. This positions the company to support sustained long-term margin expansion and higher earnings.

What powerful assumptions are pushing Lloyds’ valuation beyond today’s price? The narrative banks on rising profits, margin improvements, and cost efficiency breakthroughs that may surprise even bullish investors. Get the details behind these upbeat projections. Could this outlook upend where the stock trades next?

Result: Fair Value of £0.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Lloyds’ progress faces challenges from UK economic headwinds and increased competition from digital banks, both of which could put pressure on future growth and profits.

Find out about the key risks to this Lloyds Banking Group narrative.

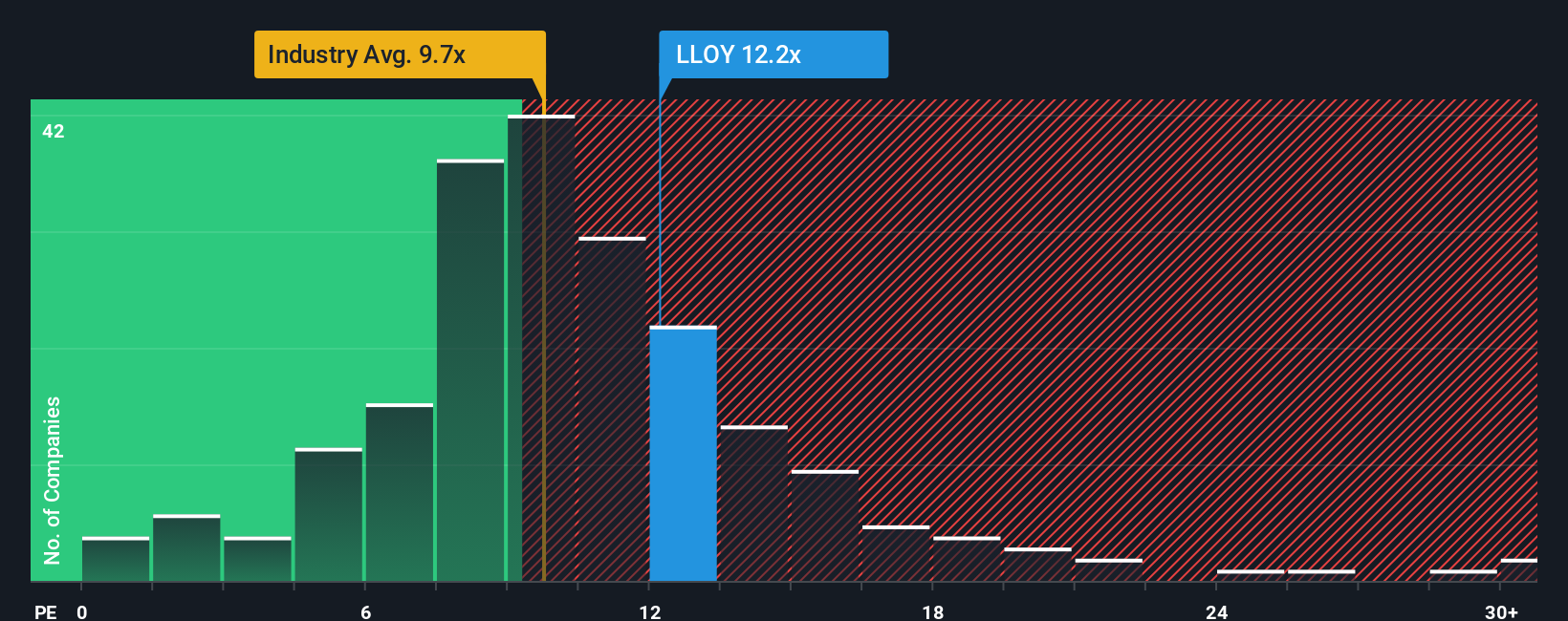

Another View: Market Ratios Raise Questions

But the market does not just move on fair value estimates. Lloyds’ current price-to-earnings ratio stands at 15.5x, noticeably higher than the UK banks sector average of 10.9x and the fair ratio of 9.7x suggested by regression models. This suggests shares may be priced at a premium, adding valuation risk if market sentiment shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lloyds Banking Group Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own investment story in just a few minutes and Do it your way.

A great starting point for your Lloyds Banking Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take your investing to the next level and gain an edge by checking out these dynamic stock opportunities before the crowd catches on.

- Capitalize on tomorrow’s tech breakthroughs by analyzing these 24 AI penny stocks, backed by real business momentum and innovation in artificial intelligence.

- Tap into steady returns with these 16 dividend stocks with yields > 3%, which reward your portfolio through attractive yields and strong financial fundamentals.

- Stay ahead in the fast-moving world of digital assets by evaluating these 82 cryptocurrency and blockchain stocks, a leader in secure payment innovation and blockchain growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:LLOY

Lloyds Banking Group

Provides a range of banking and financial products and services in the United Kingdom and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives