- United Kingdom

- /

- Professional Services

- /

- AIM:BEG

3 UK Dividend Stocks Offering Up To 4.2% Yield

Reviewed by Simply Wall St

In the current landscape, the UK market has been experiencing some turbulence, with the FTSE 100 index recently closing lower due to weak trade data from China impacting investor sentiment. Amid these challenges, dividend stocks can offer a measure of stability and income potential for investors seeking reliable returns in uncertain times.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 9.57% | ★★★★★★ |

| Treatt (LSE:TET) | 3.43% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 5.51% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 5.97% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.76% | ★★★★★☆ |

| Man Group (LSE:EMG) | 7.17% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.58% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.13% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.92% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 4.95% | ★★★★★☆ |

Click here to see the full list of 57 stocks from our Top UK Dividend Stocks screener.

We'll examine a selection from our screener results.

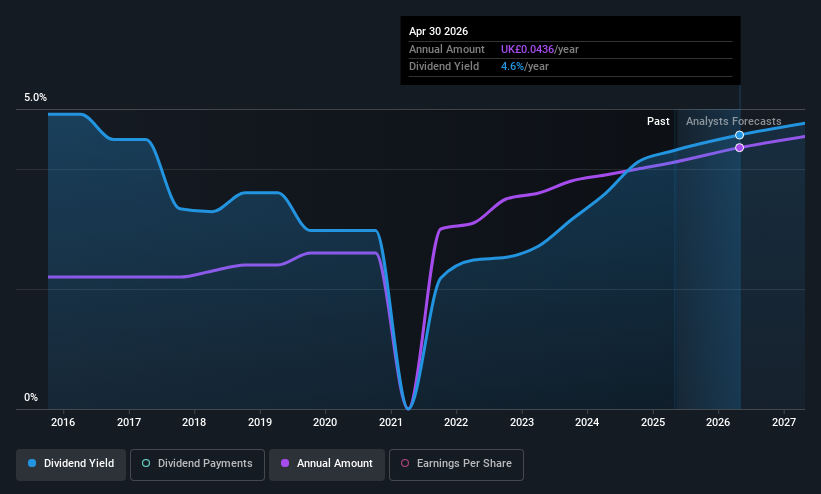

Begbies Traynor Group (AIM:BEG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Begbies Traynor Group plc offers professional services to businesses, advisors, corporations, and financial institutions in the UK, with a market cap of £196.23 million.

Operations: Begbies Traynor Group plc generates revenue through its Property Advisory segment, which contributes £46.40 million, and its Business Recovery and Advisory segment, which accounts for £107.30 million.

Dividend Yield: 3.5%

Begbies Traynor Group's dividend yield of 3.5% is below the UK market's top quartile, and its high payout ratio of 108.5% indicates dividends are not well covered by earnings, though cash flow coverage is reasonable at 51.2%. The company has a stable and growing dividend history over ten years, with a recent increase to 4.3 pence per share for 2025. Recent buybacks and improved earnings suggest positive financial momentum despite sustainability concerns in dividend coverage from profits alone.

- Delve into the full analysis dividend report here for a deeper understanding of Begbies Traynor Group.

- Our expertly prepared valuation report Begbies Traynor Group implies its share price may be lower than expected.

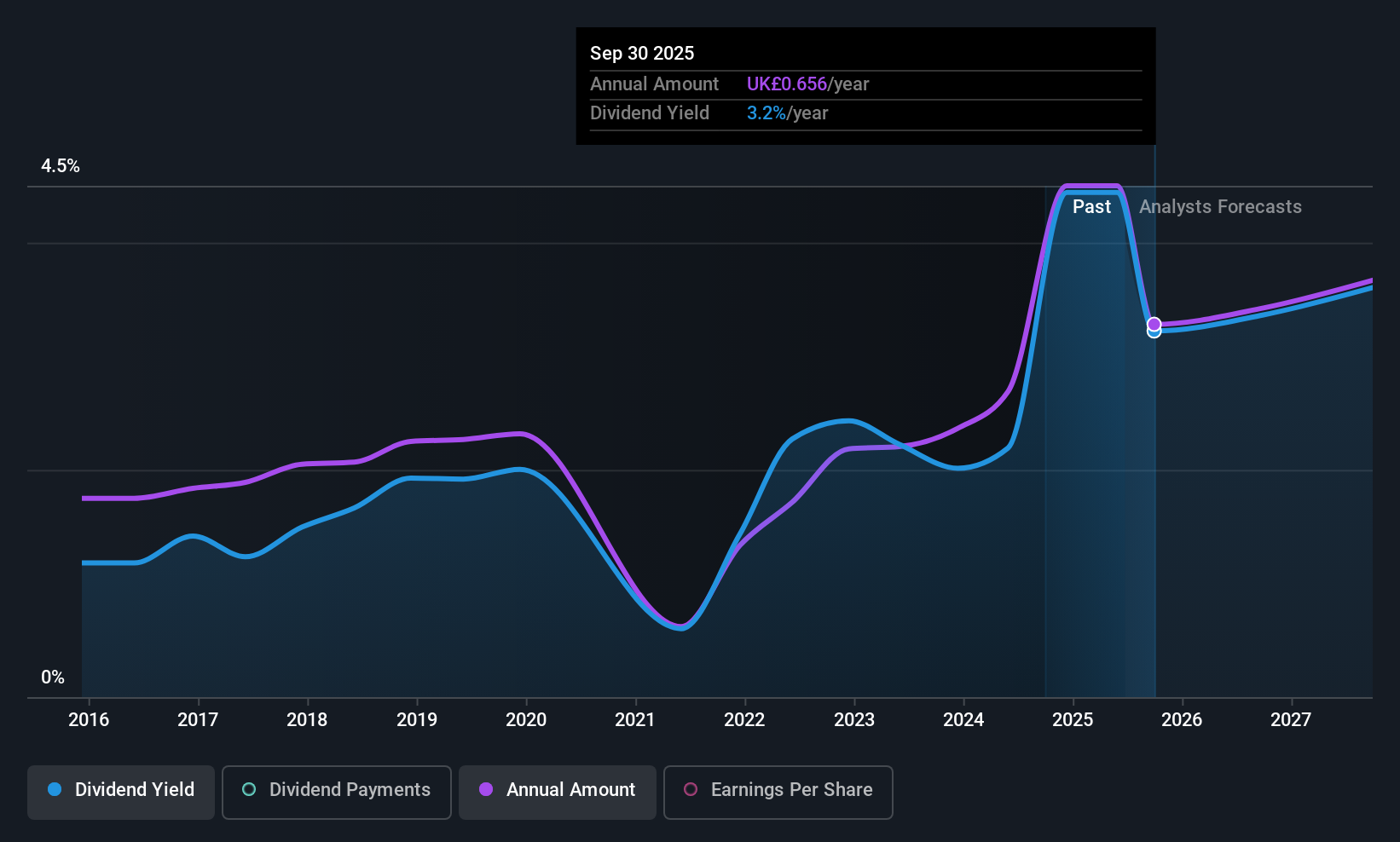

Associated British Foods (LSE:ABF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Associated British Foods plc is a diversified company engaged in food production, ingredients, and retail operations globally, with a market cap of approximately £15.07 billion.

Operations: Associated British Foods plc generates revenue from several segments, including Retail (£9.42 billion), Grocery (£4.21 billion), Sugar (£2.46 billion), Ingredients (£2.11 billion), and Agriculture (£1.62 billion).

Dividend Yield: 4.3%

Associated British Foods offers a dividend yield of 4.26%, which is below the UK's top tier, but its dividends are well-covered by earnings and cash flows with payout ratios of 35.4% and 50.1%, respectively. Despite a history of volatility, recent affirmations suggest stability with an interim dividend set for July 2025. The company is exploring strategic options amid challenging conditions for Allied Bakeries, potentially impacting future financials and dividend sustainability.

- Click here to discover the nuances of Associated British Foods with our detailed analytical dividend report.

- Our valuation report here indicates Associated British Foods may be undervalued.

Lloyds Banking Group (LSE:LLOY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lloyds Banking Group plc, along with its subsidiaries, offers a variety of banking and financial products and services both in the United Kingdom and internationally, with a market cap of £45.39 billion.

Operations: Lloyds Banking Group's revenue segments encompass a diverse array of banking and financial services provided both domestically in the UK and on an international scale.

Dividend Yield: 4.1%

Lloyds Banking Group's dividend yield of 4.15% is modest compared to the UK's top quartile, yet its dividends are covered by earnings with a current payout ratio of 50.6%. Despite a volatile dividend history, future payouts are expected to remain sustainable at a forecasted 38.5% payout ratio in three years. Recent M&A discussions to acquire Curve UK Limited for up to £120 million could influence strategic growth and impact dividend stability moving forward.

- Navigate through the intricacies of Lloyds Banking Group with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Lloyds Banking Group is priced higher than what may be justified by its financials.

Where To Now?

- Navigate through the entire inventory of 57 Top UK Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Begbies Traynor Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:BEG

Begbies Traynor Group

Provides professional services to businesses, professional advisors, large corporations, and financial institutions in the United Kingdom.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives