- United Kingdom

- /

- Banks

- /

- LSE:HSBA

Is HSBC a Bargain After Management Shake-Up and 63% Share Price Jump?

Reviewed by Bailey Pemberton

- Wondering if HSBC Holdings is a bargain, a bubble, or somewhere in between? You are not alone, especially if you are keeping a close eye on what you pay for stocks these days.

- The share price has quietly climbed 0.7% this week, is up 7.7% over the last month, and has delivered a staggering 63.7% gain over the past year. This hints at renewed optimism or perhaps a shifting risk profile beneath the surface.

- Recent headlines have included management shake-ups and strategic moves in key Asian markets, both of which have attracted investor attention. The company’s efforts to refocus its global business and exit underperforming segments have made news, fueling speculation about long-term growth and profitability.

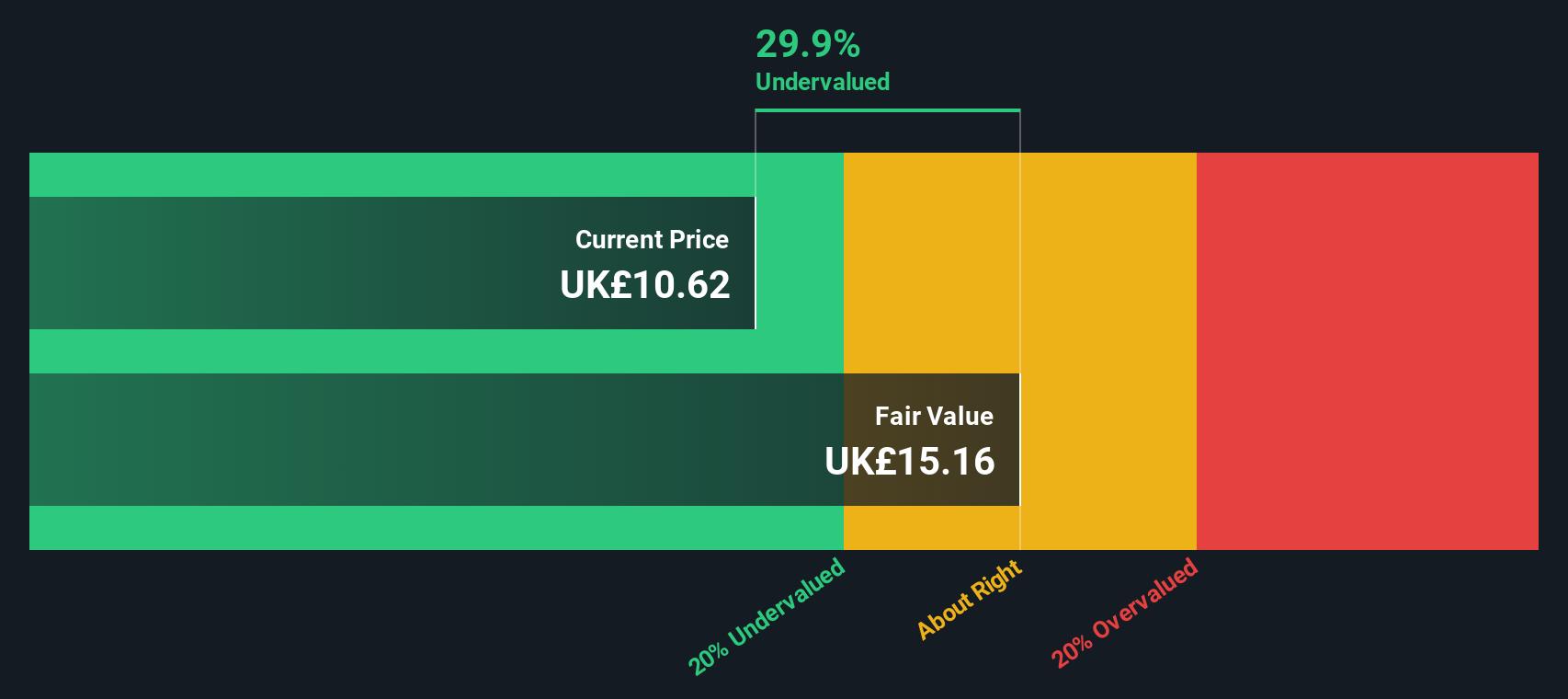

- With a current valuation score of 2 out of 6, there is plenty to unpack regarding how the market is valuing HSBC compared to its fundamentals. In the sections ahead, we will walk through those frameworks, and conclude with an even deeper way to assess value at the end.

HSBC Holdings scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: HSBC Holdings Excess Returns Analysis

The Excess Returns valuation model focuses on how effectively a company is able to generate returns on invested capital above its cost of equity. In simple terms, it measures whether the business is creating additional value relative to what investors require for the risk they are taking on.

For HSBC Holdings, several key metrics stand out. The current Book Value is £9.94 per share, while the projected Stable Book Value is £10.89 per share, both based on estimates from industry analysts. The company’s Stable Earnings Per Share (EPS) are estimated at £1.52, supported by a strong average Return on Equity of 13.99%. The Cost of Equity, representing the return equity investors expect, is £0.92 per share. HSBC’s Excess Return, referring to the value created in excess of this cost, comes out to £0.60 per share.

According to the model’s projection, the resulting intrinsic value for HSBC Holdings is £16.65 per share. Given the current market price, this implies the stock is trading at a 35.7% discount, suggesting substantial undervaluation. If these projections hold, investors may be paying much less than the company’s underlying worth.

Result: UNDERVALUED

Our Excess Returns analysis suggests HSBC Holdings is undervalued by 35.7%. Track this in your watchlist or portfolio, or discover 874 more undervalued stocks based on cash flows.

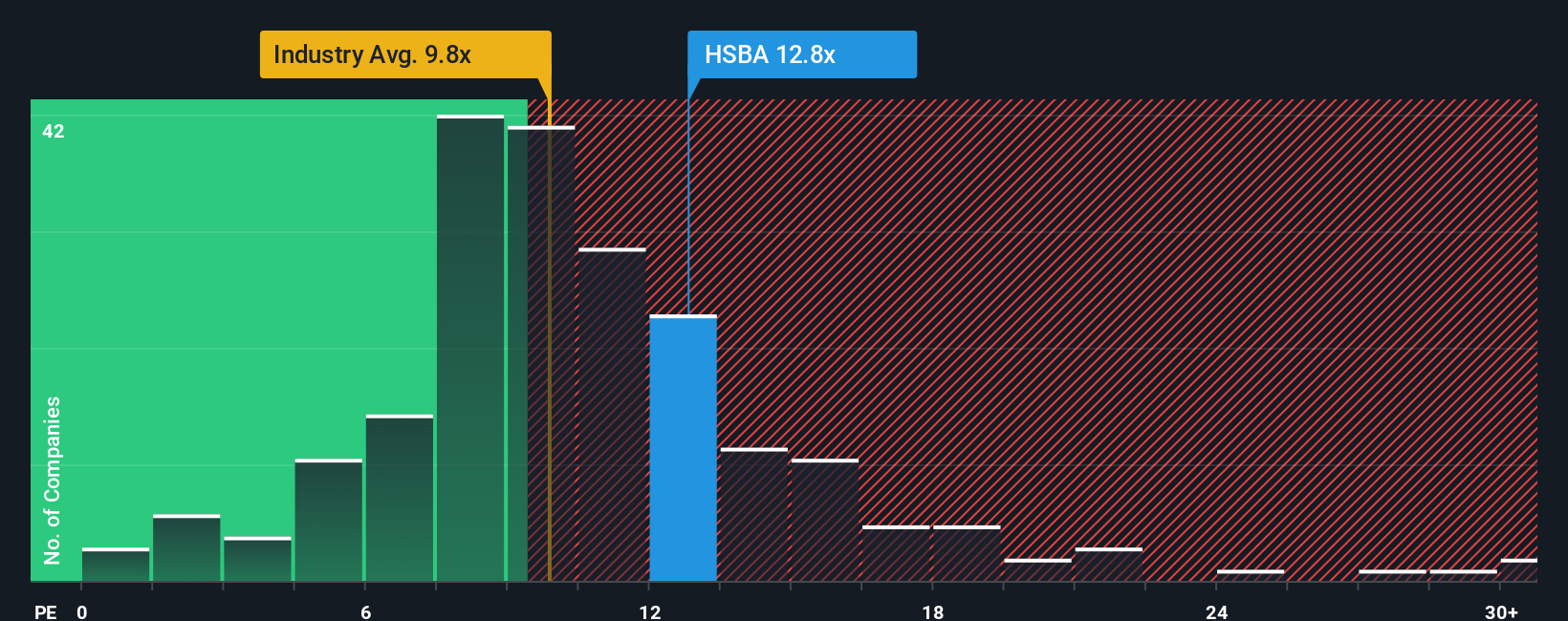

Approach 2: HSBC Holdings Price vs Earnings

The Price-to-Earnings (PE) ratio is a well-established way to value profitable companies like HSBC Holdings. It tells investors how much they are currently paying for each pound of the company’s earnings. For established banks with stable profits, the PE ratio is especially effective as it reflects market expectations of future growth, profitability, and perceived risk.

Generally, a higher PE ratio suggests the market expects stronger future growth, while a lower PE ratio can reflect either lower growth expectations or greater risk. The "right" PE for a stock depends on these factors, as well as its industry context. HSBC Holdings trades at a PE of 14.6x, which is above both the industry average of 10.2x and the peer group average of 11.1x, signaling that the market may be incorporating premium expectations.

To go deeper, Simply Wall St’s "Fair Ratio" is a proprietary calculation of what HSBC’s PE ratio should be, factoring in its unique earnings growth outlook, profit margins, size, and risks, beyond just sector averages. This approach offers a more tailored benchmark than peer or industry comparisons. For HSBC Holdings, the Fair Ratio is 9.7x, notably below its actual PE multiple.

Since HSBC’s PE (14.6x) exceeds the Fair Ratio (9.7x) by a significant margin, this suggests the stock is currently overvalued based on its fundamental profile and risk-adjusted growth prospects.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

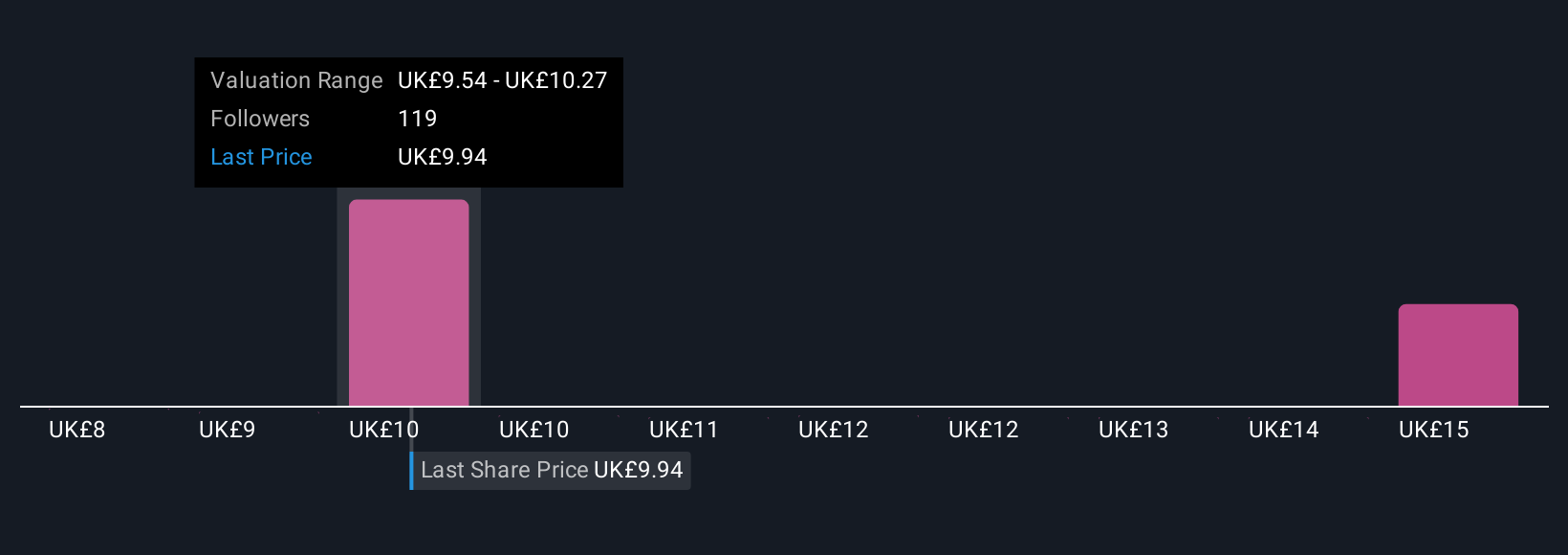

Upgrade Your Decision Making: Choose your HSBC Holdings Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple yet powerful tool that lets you tell your story about a company by combining your own view on its future revenue, earnings, and margins with the numbers, resulting in your personalized fair value estimate.

With Narratives, you link HSBC Holdings’ strategic direction, risks, and opportunities to a forecast. You can then see what price those assumptions justify. This approach is accessible to all investors on Simply Wall St’s Community page and is used by millions to explore, compare, and update perspectives as news and earnings are released.

Narratives make it easy to decide whether now is the time to buy or sell by directly comparing your own Fair Value with the current share price, and these forecasts will automatically adjust as new data becomes available.

For example, when it comes to HSBC Holdings, some investors are optimistic, expecting revenue growth above 8% and fair value closer to £11.29, while others are more cautious, focusing on earnings risks and seeing fair value around £7.93. Narratives let you weigh these outlooks and update your investment view as the story evolves.

Do you think there's more to the story for HSBC Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HSBC Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HSBA

HSBC Holdings

Engages in the provision of banking and financial products and services worldwide.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives