- United Kingdom

- /

- Professional Services

- /

- AIM:SAG

Undervalued European Small Caps With Insider Buying To Consider

Reviewed by Simply Wall St

As European markets experience a boost from easing inflation and supportive monetary policies, small-cap stocks are garnering attention due to their potential for growth in this favorable economic climate. In such an environment, identifying companies with strong fundamentals and strategic insider activity can be key to uncovering promising investment opportunities within the small-cap segment.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 12.0x | 0.5x | 33.67% | ★★★★★☆ |

| Tristel | 29.5x | 4.2x | 8.08% | ★★★★☆☆ |

| AKVA group | 17.3x | 0.8x | 42.85% | ★★★★☆☆ |

| Close Brothers Group | NA | 0.6x | 39.28% | ★★★★☆☆ |

| Absolent Air Care Group | 22.2x | 1.8x | 49.51% | ★★★☆☆☆ |

| Italmobiliare | 11.9x | 1.6x | -218.55% | ★★★☆☆☆ |

| Fuller Smith & Turner | 12.0x | 0.9x | -55.70% | ★★★☆☆☆ |

| SmartCraft | 44.0x | 7.9x | 29.91% | ★★★☆☆☆ |

| H+H International | 32.8x | 0.8x | 45.83% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.2x | 47.54% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

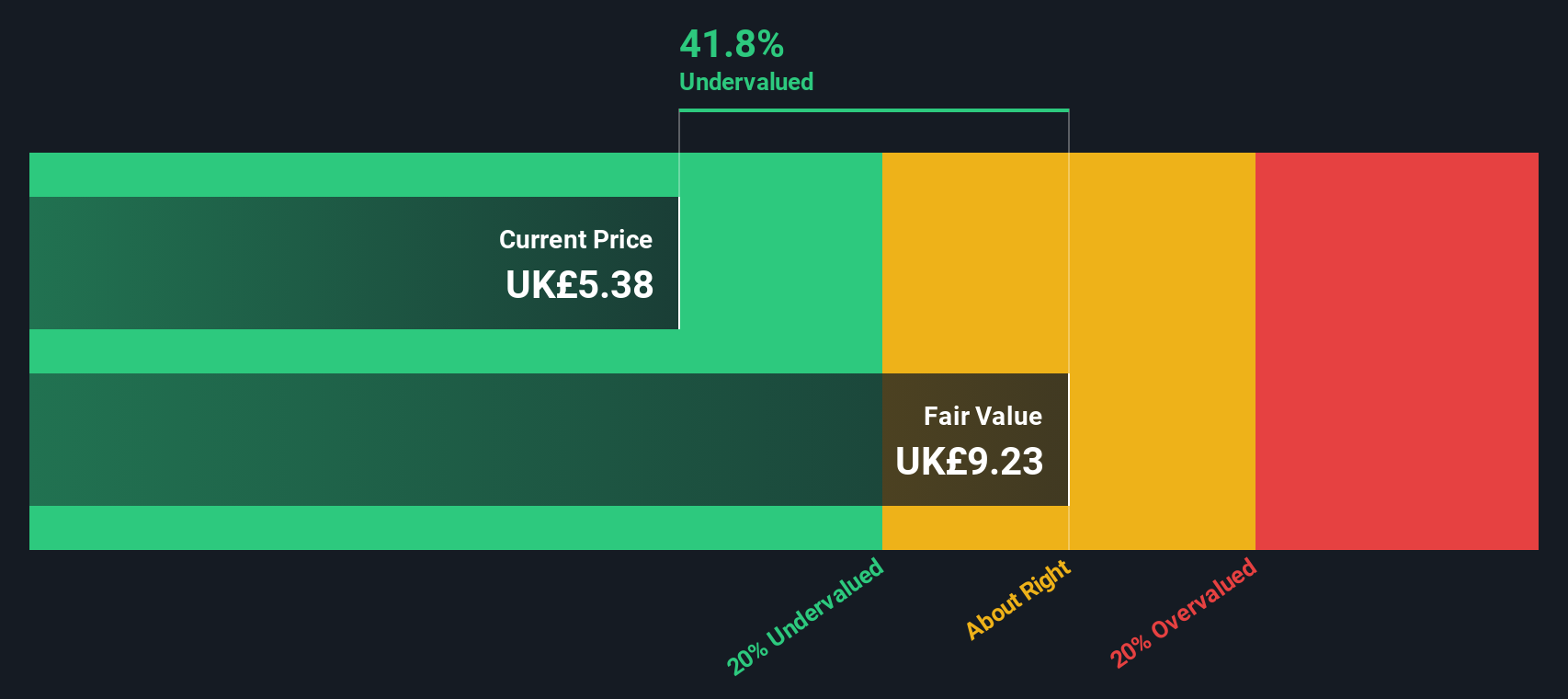

Science Group (AIM:SAG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Science Group is a company engaged in providing consultancy services, developing audio chips and modules, and managing submarine atmospheres, with a market capitalization of approximately £0.19 billion.

Operations: Science Group's primary revenue streams include consultancy services and systems related to audio chips and submarine atmosphere management. Over recent periods, the company has experienced fluctuations in its gross profit margin, reaching 44.89% at its peak before declining to 40.82%. Operating expenses have been a significant component of costs, with general and administrative expenses forming a substantial part of these outlays.

PE: 19.1x

Science Group, a European company with external borrowing as its sole funding source, recently saw insider confidence through share purchases between July and December 2024. They repurchased over 1 million shares for £4.69 million, indicating potential value recognition despite forecasted earnings decline of 0.9% annually over the next three years. For 2024, sales slightly dipped to £110.67 million from the previous year, yet net income more than doubled to £12.02 million, suggesting improved profitability amidst challenging conditions.

- Get an in-depth perspective on Science Group's performance by reading our valuation report here.

Gain insights into Science Group's past trends and performance with our Past report.

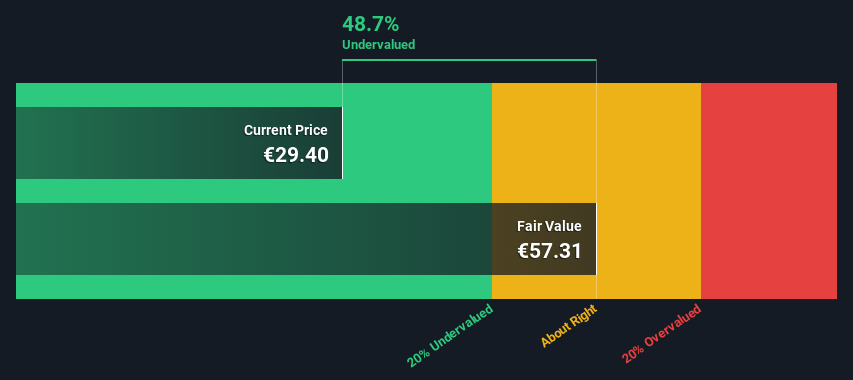

Sanlorenzo (BIT:SL)

Simply Wall St Value Rating: ★★★★★★

Overview: Sanlorenzo is a luxury yacht manufacturer specializing in the production of custom yachts and superyachts, with a market capitalization of €1.32 billion.

Operations: The company's revenue primarily comes from its Yacht, Bluegame, and Superyacht divisions. As of the latest data, it reported a gross profit margin of 29.87%, reflecting its ability to manage costs relative to revenue growth.

PE: 10.4x

Sanlorenzo, a yacht manufacturer in Europe, is drawing attention as an undervalued company. Recent insider confidence was demonstrated when Massimo Perotti purchased 30,000 shares for €842K. This activity suggests belief in the company's potential despite its reliance on external borrowing for funding. Earnings are projected to grow by 4% annually, indicating steady progress. Sanlorenzo's participation in multiple European conferences highlights its proactive engagement with investors and stakeholders, potentially enhancing future growth prospects.

- Click here to discover the nuances of Sanlorenzo with our detailed analytical valuation report.

Explore historical data to track Sanlorenzo's performance over time in our Past section.

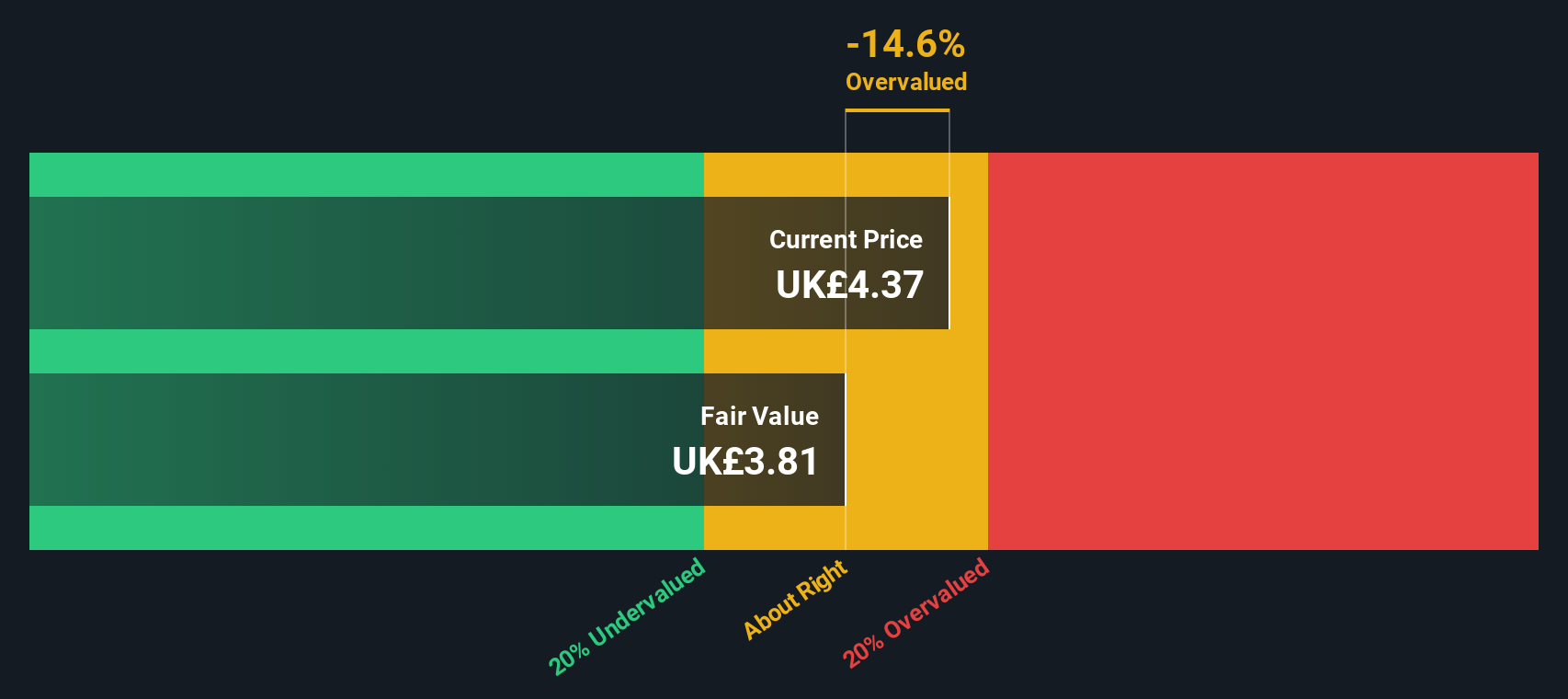

Close Brothers Group (LSE:CBG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Close Brothers Group is a UK-based financial services company that operates through segments including securities, retail banking, property banking, and commercial banking, with a market cap of £1.92 billion.

Operations: Close Brothers Group generates revenue primarily from its Banking segments, with Commercial Banking contributing £480.50 million and Retail Banking £325.30 million. Operating expenses are significant, reaching £961.90 million as of January 2025, impacting net income margins which have shown a decline over recent periods, resulting in a negative net income margin of -10.73% by early 2025.

PE: -5.5x

Close Brothers Group, a European financial services firm, presents an intriguing opportunity among smaller companies. Despite a net loss of £111.8 million for the half-year ending January 31, 2025, compared to last year's profit of £68.8 million, they have been added to multiple FTSE indices in March 2025. Insider confidence is evident with recent share purchases by executives earlier this year, hinting at potential growth as earnings are forecasted to increase by over 84% annually. However, challenges remain with high bad loans at 7.6% and volatile share prices recently observed over three months.

Make It Happen

- Take a closer look at our Undervalued European Small Caps With Insider Buying list of 80 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SAG

Science Group

Operates as a science and technology consultancy and systems businesses in the United Kingdom, other European Countries, North America, and Asia.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives