- United Kingdom

- /

- Auto Components

- /

- AIM:AURR

Revenues Tell The Story For Aurrigo International plc (LON:AURR) As Its Stock Soars 29%

Aurrigo International plc (LON:AURR) shareholders have had their patience rewarded with a 29% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 42% over that time.

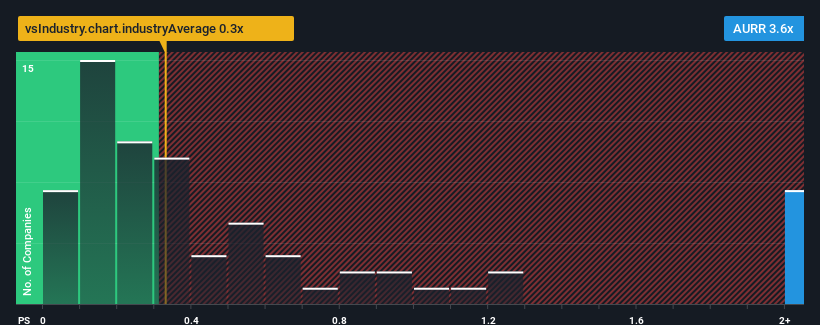

Following the firm bounce in price, when almost half of the companies in the United Kingdom's Auto Components industry have price-to-sales ratios (or "P/S") below 1x, you may consider Aurrigo International as a stock not worth researching with its 3.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

We've discovered 5 warning signs about Aurrigo International. View them for free.View our latest analysis for Aurrigo International

What Does Aurrigo International's Recent Performance Look Like?

Aurrigo International certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. Perhaps the market is expecting the company's future revenue growth to buck the trend of the industry, contributing to a higher P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Aurrigo International will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Aurrigo International would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 34%. The strong recent performance means it was also able to grow revenue by 68% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 36% as estimated by the sole analyst watching the company. That's shaping up to be materially higher than the 3.0% growth forecast for the broader industry.

In light of this, it's understandable that Aurrigo International's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Aurrigo International's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Aurrigo International maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Auto Components industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 5 warning signs for Aurrigo International (3 can't be ignored!) that we have uncovered.

If you're unsure about the strength of Aurrigo International's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:AURR

Aurrigo International

Offers electrical components to the automotive and aviation industry in the United Kingdom, Europe, and internationally.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026