- France

- /

- Renewable Energy

- /

- ENXTPA:VLTSA

Does New Production at Sarimay Solar Plant Enhance Voltalia’s Growth Prospects (ENXTPA:VLTSA)?

Reviewed by Sasha Jovanovic

- Voltalia has announced the first megawatt-hours of production from its 126-megawatt Sarimay solar power plant in the Khorezm region of Uzbekistan, a facility built with over 180,000 bifacial panels and supported by a 25-year power purchase agreement.

- This milestone not only marks a crucial step toward full commissioning but also highlights Voltalia's expanding footprint with new hybrid renewable projects underway in Uzbekistan.

- We'll explore how progress at Sarimay and future renewable projects in Uzbekistan could strengthen Voltalia's outlook and earnings growth potential.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Voltalia Investment Narrative Recap

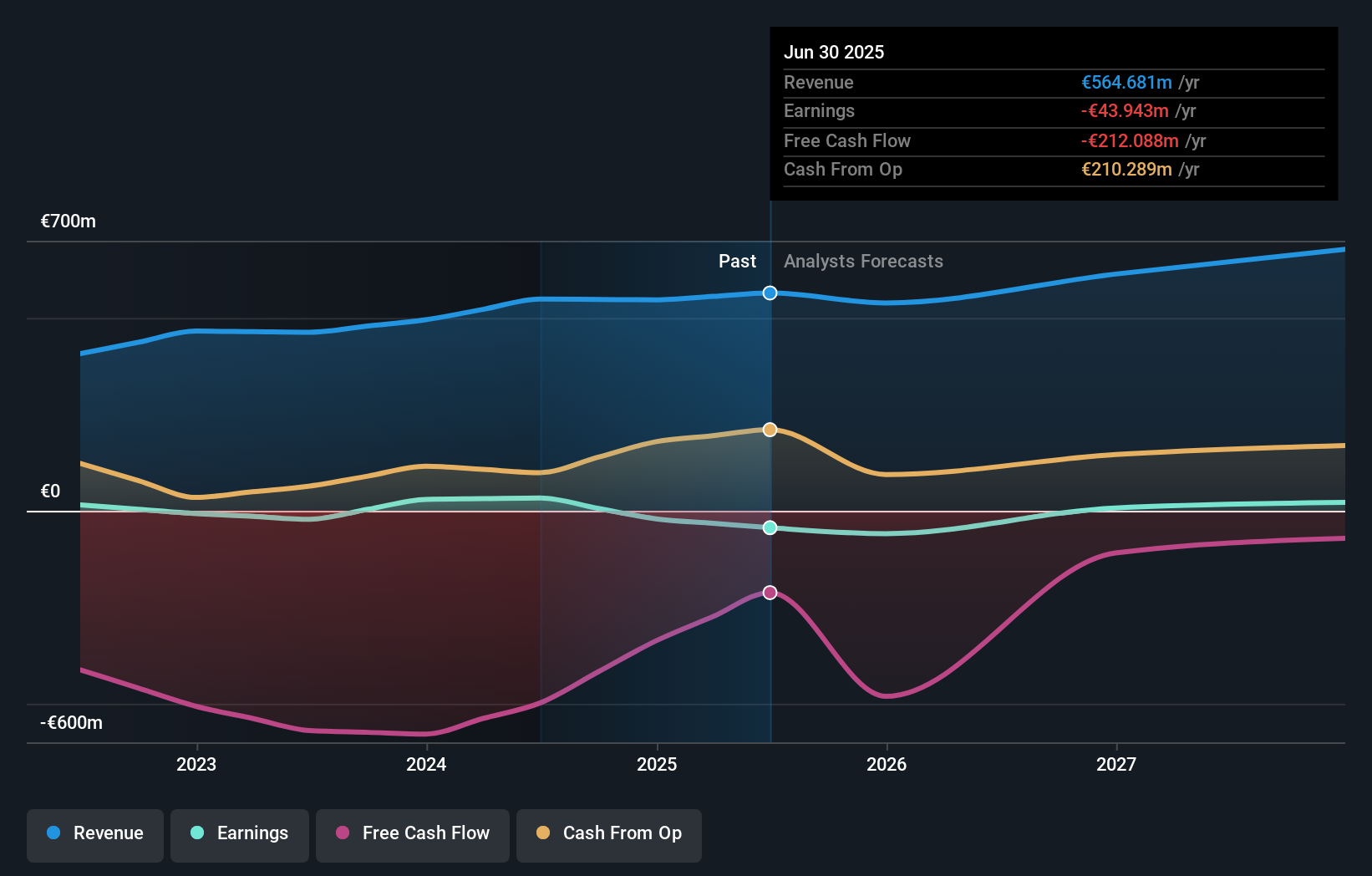

Investors in Voltalia must believe in the company’s ability to scale and manage renewable projects globally, leveraging long-term PPAs for predictable revenues while addressing ongoing financial pressures. The recent Sarimay solar project milestone in Uzbekistan is encouraging for geographic growth, but given persistent net losses and high leverage, it does not significantly alter the most pressing catalyst: Voltalia’s path to sustained profitability, nor does it resolve its chief risk of margin pressure and cash flow constraints in the short term.

Of Voltalia’s recent announcements, the launch of 937 megawatts in third-party maintenance contracts in Brazil stands out, further cementing its service revenue and operational footprint. This expansion may support improved cash flow resilience, which will be crucial as earnings volatility and high financing costs persist alongside ambitious project rollouts.

Yet, despite strong progress in new geographies, investors should remain alert to the challenge of high net debt and how rising interest expenses could...

Read the full narrative on Voltalia (it's free!)

Voltalia's narrative projects €741.2 million revenue and €29.2 million earnings by 2028. This requires 10.7% yearly revenue growth and a €50.2 million earnings increase from the current earnings of €-21.0 million.

Uncover how Voltalia's forecasts yield a €10.99 fair value, a 52% upside to its current price.

Exploring Other Perspectives

All 10 fair value estimates from the Simply Wall St Community cluster at €10.99 per share. As you weigh community consensus, consider persistent net losses and margin headwinds that continue to shape Voltalia’s outlook.

Explore another fair value estimate on Voltalia - why the stock might be worth just €10.99!

Build Your Own Voltalia Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Voltalia research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Voltalia research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Voltalia's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VLTSA

Voltalia

Engages in the production and sale of energy generated by the wind, solar, hydropower, biomass, and storage plants.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives