- France

- /

- Other Utilities

- /

- ENXTPA:VIE

Veolia (ENXTPA:VIE): Assessing Valuation After Securing $700 Million in Australian Water Utility Contracts

Reviewed by Simply Wall St

Veolia Environnement (ENXTPA:VIE) has just secured $700 million in Australian water utility contracts, along with a multi-year extension to manage the Gold Coast Desalination Plant. These wins showcase the company’s ongoing leadership in environmental technology and sustainable operations.

See our latest analysis for Veolia Environnement.

Veolia’s latest Australian contract wins and its upbeat 2025 guidance have kept investor momentum building, with the stock now up 6.39% on a total return basis over the past year and an impressive 96% for the past five years. The combination of strong operational progress and long-term growth signals is clearly resonating with shareholders.

If Veolia’s latest moves spark your curiosity, now may be the perfect time to see what’s happening with other fast-growing stocks where insiders are confident. Discover fast growing stocks with high insider ownership

With Veolia’s shares already rallying and growth projections ahead, investors may be wondering if the stock is still undervalued at current levels, or if the market has already accounted for all of its future potential.

Most Popular Narrative: 16.6% Undervalued

Veolia’s most tracked narrative sees significant value versus its last close, suggesting the share price does not fully reflect the company’s long-term earnings power. The narrative sets the stage for a closer look at the growth engines driving this optimistic assessment.

Synergies from recent strategic M&A (e.g., Suez and CDPQ 30% Water Technologies stake) are expected to contribute €90 million in annual cost benefits by 2027. With further efficiency gains embedded in operations, this supports steady net margin expansion and boosts free cash flow generation at the group level.

Want to know what drives this valuation? There’s one bold forecast that could change everything for Veolia, combining efficiency, global ambitions, and powerful growth projections. Find out which financial lever could redefine its fair value. Read the full narrative to see what’s behind the numbers and why analysts are watching closely.

Result: Fair Value of $34.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if cost-saving synergies disappoint or revenue growth stalls in key markets, Veolia’s upside scenario could quickly come under pressure.

Find out about the key risks to this Veolia Environnement narrative.

Another View: What Do the Multiples Say?

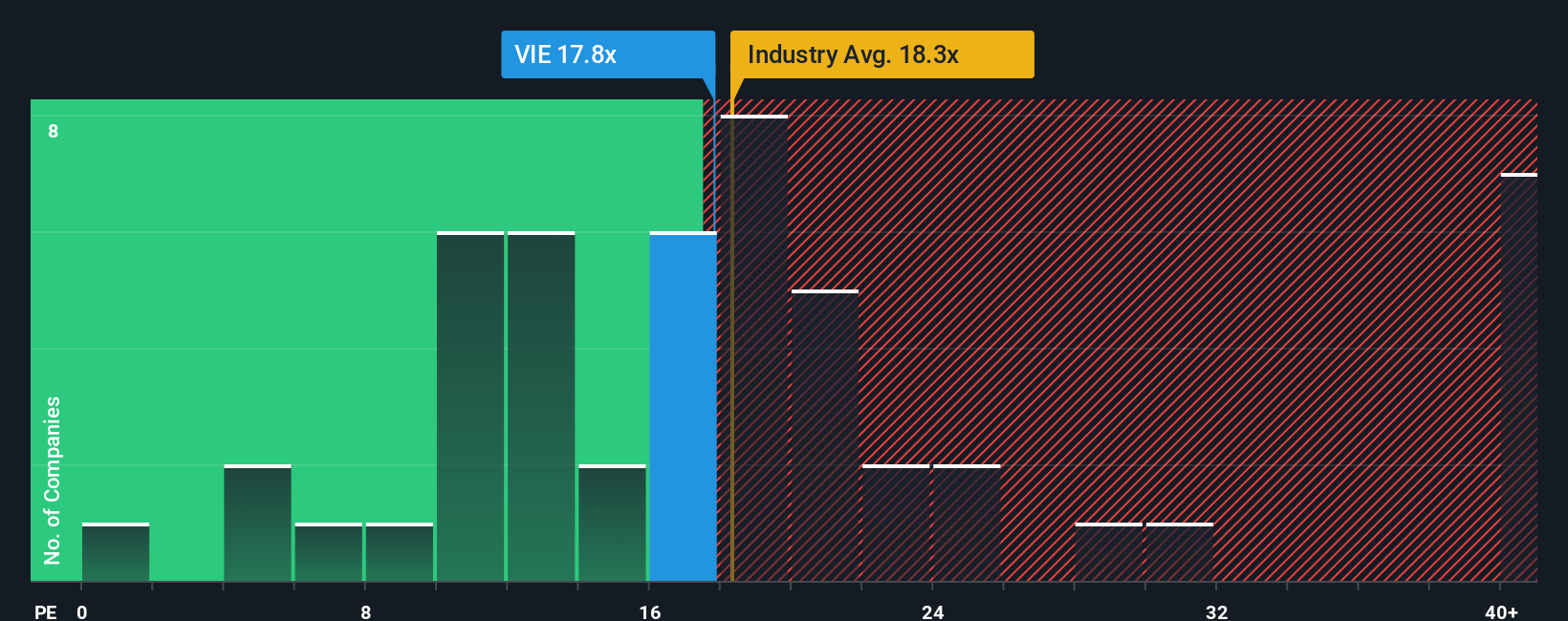

While the SWS DCF model suggests Veolia is significantly undervalued, a look at its price-to-earnings ratio paints a different picture. The shares trade at 17.6x earnings, which is lower than the industry average of 18.2x and also below peer averages of 19.7x. This makes it seem reasonably valued. However, it's slightly higher than the calculated fair ratio of 17.3x, highlighting subtle valuation risk if market expectations shift. Can this gap persist as new earnings data arrives?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Veolia Environnement Narrative

If you want to dig deeper or build your own perspective, you can easily create a personalized Veolia narrative in just a few minutes. Let the data guide your view. Do it your way

A great starting point for your Veolia Environnement research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that opportunities can come from unexpected places, so don't limit your search to a single company or sector. Uncover what you could be missing by checking these curated ideas:

- Explore the world of consistent income by reviewing these 16 dividend stocks with yields > 3% with yields above 3% for stable, reliable returns.

- Stay ahead of the curve and capture potential windfalls by checking out these 82 cryptocurrency and blockchain stocks in the fast-paced blockchain and cryptocurrency scene.

- Find undervalued gems positioned for a rebound by scouting these 878 undervalued stocks based on cash flows based on rigorous cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VIE

Veolia Environnement

Designs and provides water, waste, and energy management solutions.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives