- France

- /

- Other Utilities

- /

- ENXTPA:VIE

How Investors Are Reacting To Veolia Environnement (ENXTPA:VIE) Securing Holyoke AI Water Contract

Reviewed by Sasha Jovanovic

- Veolia recently secured a 10-year renewal to operate Holyoke, Massachusetts’ wastewater treatment plant, introducing its advanced AI-enabled Hubgrade digital platform to the city and supporting modernization efforts across infrastructure, energy, and asset management.

- This agreement signals greater adoption of data-driven, sustainability-focused technologies in municipal wastewater operations, further supported by Veolia's moves to expand industry partnerships and leadership in the North American market.

- We'll take a look at how the rollout of AI-powered digital water solutions shapes Veolia's investment outlook and growth drivers.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Veolia Environnement Investment Narrative Recap

Shareholders in Veolia Environnement need to believe in long-term growth fueled by rising global demand for advanced water, waste, and energy management, particularly as stricter environmental regulations and infrastructure upgrades continue. The recent Holyoke contract marks progress in digital transformation serving as proof of Veolia’s innovation in high-value municipal water projects, but does not significantly affect the most immediate catalyst: successfully executing integration and synergy gains from ongoing M&A activity. The primary short-term risk remains the challenge of margin expansion as cost synergies become harder to capture in mature businesses.

Among recent announcements, Veolia’s expanded partnership with TotalEnergies stands out for its relevance. By jointly advancing emission reduction and circular economy projects, Veolia demonstrates the broader application of its digital and sustainability solutions, aligning with catalysts such as growing international demand for climate adaptation and water reuse services.

However, while digital water solutions gain traction, investors should not overlook the potential for diminishing returns on efficiency gains in mature operations, as...

Read the full narrative on Veolia Environnement (it's free!)

Veolia Environnement is projected to reach €51.5 billion in revenue and €1.9 billion in earnings by 2028. This implies an annual revenue growth rate of 4.9% and a €0.7 billion increase in earnings from the current €1.2 billion level.

Uncover how Veolia Environnement's forecasts yield a €35.07 fair value, a 17% upside to its current price.

Exploring Other Perspectives

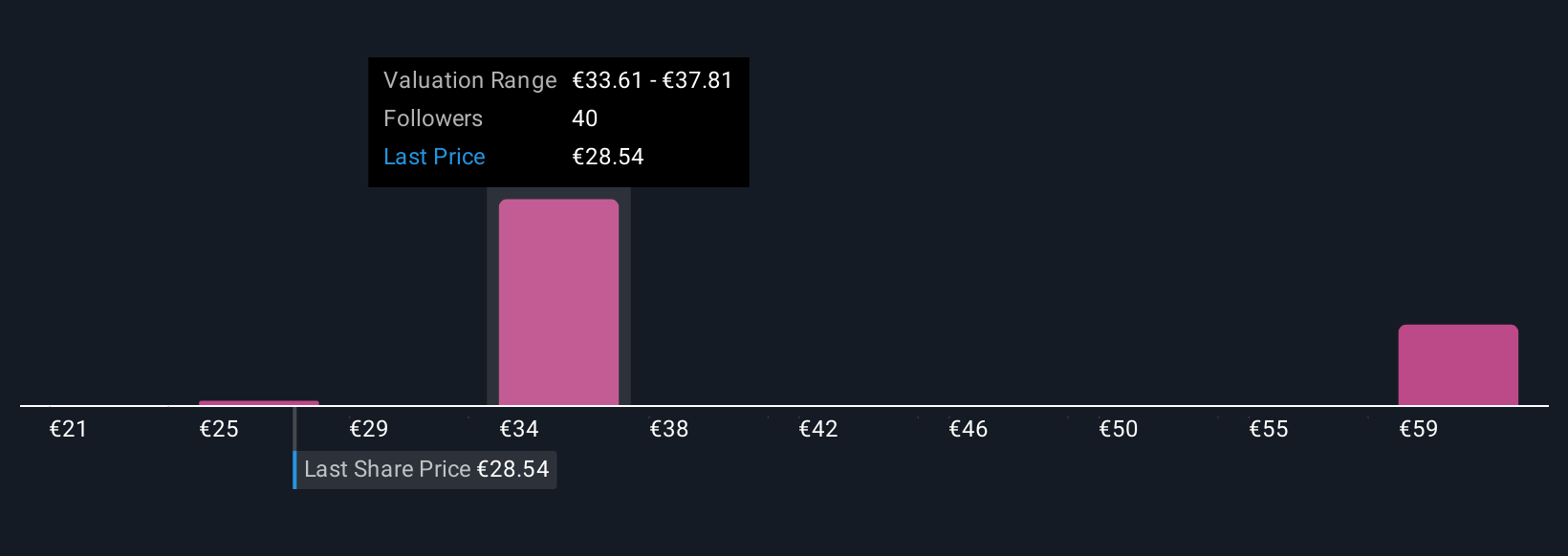

Eleven members of the Simply Wall St Community estimate Veolia’s fair value from €21.01 to €63.65, reflecting wide opinions on future growth. Many are watching how continued synergy realization and global contract wins could shape long-term profitability.

Explore 11 other fair value estimates on Veolia Environnement - why the stock might be worth over 2x more than the current price!

Build Your Own Veolia Environnement Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Veolia Environnement research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Veolia Environnement research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Veolia Environnement's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VIE

Veolia Environnement

Designs and provides water, waste, and energy management solutions.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives