- France

- /

- Other Utilities

- /

- ENXTPA:ENGI

How Investors Are Reacting To Engie (ENXTPA:ENGI) Lifting 2025 Earnings Guidance to Upper Range

Reviewed by Sasha Jovanovic

- Earlier this month, Engie SA confirmed its 2025 earnings guidance, projecting net recurring income at the upper end of the €4.4 billion to €5.0 billion range and EBIT (excluding nuclear) in the upper half of the €8.0 billion to €9.0 billion range.

- This confirmation points to stronger-than-expected recurring net financial results and performance-driven momentum for the remainder of 2025.

- We'll now assess how Engie's improved guidance and robust earnings expectations could influence its investment story and sector outlook.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Engie Investment Narrative Recap

To invest in Engie, you have to be confident in the company's ability to convert growing demand for renewables and infrastructure into sustained earnings, even as wholesale energy prices stabilize. The recent guidance upgrade is supportive for the near-term earnings outlook, but it doesn't fully remove sensitivities around hydro output and ongoing FX headwinds, which remain among the largest risks to hitting their upper earnings targets.

Of the company’s recent announcements, the commissioning of the Red Sea Wind Energy project is closely aligned with the positive momentum behind 2025 earnings guidance. Expanding clean energy generation in key markets not only increases revenue visibility but directly supports Engie’s capacity to offset potential headwinds in European power markets and climate risk exposures.

In contrast, investors should take note that exposure to weather-driven volatility and FX impacts could still cause shortfalls even when earnings guidance is reaffirmed…

Read the full narrative on Engie (it's free!)

Engie's outlook anticipates €75.8 billion in revenue and €4.5 billion in earnings by 2028. This reflects a -0.6% annual revenue decline and a €0.5 billion decrease in earnings from the current €5.0 billion.

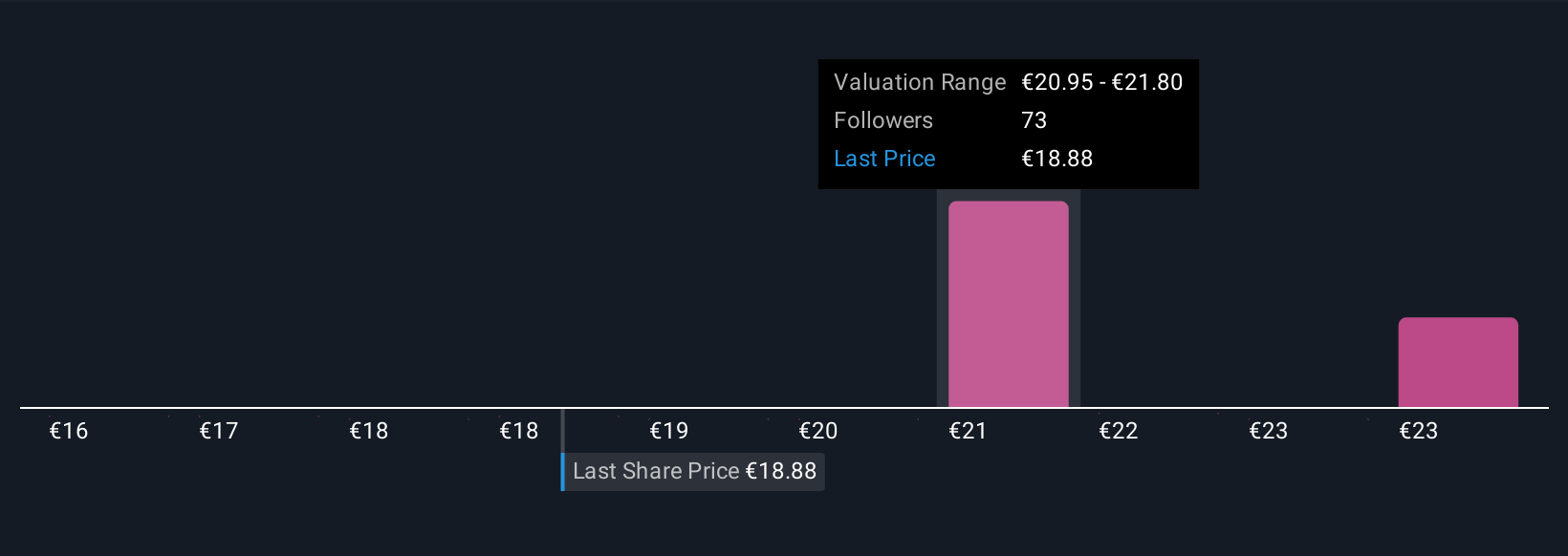

Uncover how Engie's forecasts yield a €21.48 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members produced 5 separate fair value estimates for Engie ranging from €17.51 to €22.00 per share. Against this backdrop of differing views, the company's ability to scale renewables and storage projects may serve as a key counterbalance to sector risks and drive future performance; see how your outlook compares to others in the community.

Explore 5 other fair value estimates on Engie - why the stock might be worth 20% less than the current price!

Build Your Own Engie Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Engie research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Engie research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Engie's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Engie might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ENGI

Engie

Operates as an energy company, engages in the renewables and decentralized, low-carbon energy networks, and energy services businesses in France, Europe, North America, Asia, the Middle East, Oceania, South America, Africa, and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives