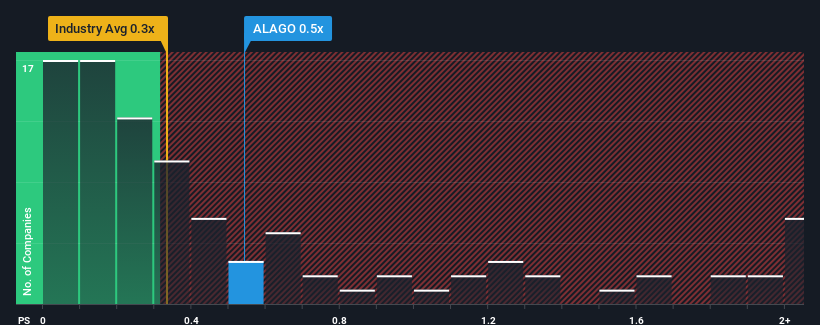

It's not a stretch to say that E-Pango SA's (EPA:ALAGO) price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" for companies in the Electric Utilities industry in France, where the median P/S ratio is around 0.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for E-Pango

How Has E-Pango Performed Recently?

While the industry has experienced revenue growth lately, E-Pango's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think E-Pango's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like E-Pango's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 34%. In spite of this, the company still managed to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company, but investors will want to ask why it is now in decline.

Shifting to the future, estimates from the two analysts covering the company are not good at all, suggesting revenue should decline by 95% over the next year. With the rest of the industry predicted to shrink by 9.2%, it's a sub-optimal result.

In light of this, it's somewhat peculiar that E-Pango's P/S sits in line with the majority of other companies. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. Maintaining these prices will be difficult to achieve as the weak outlook is likely to weigh down the shares eventually.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

E-Pango's analyst forecasts have revealed that its even shakier outlook against the industry isn't impacting its P/S as much as we would have predicted. It's not unusual in cases where revenue growth is poor, that the share price declines, sending the moderate P/S lower relative to the industry. We're also cautious about the company's ability to resist even greater pain to its business from the broader industry turmoil. A positive change is needed in order to justify the current price-to-sales ratio.

We don't want to rain on the parade too much, but we did also find 4 warning signs for E-Pango (2 can't be ignored!) that you need to be mindful of.

If you're unsure about the strength of E-Pango's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if E-Pango might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALAGO

Medium-low risk with weak fundamentals.

Market Insights

Community Narratives