- France

- /

- Infrastructure

- /

- ENXTPA:GET

Getlink (ENXTPA:GET) Valuation Check as Shares Trade in a Tight Range with Modest 1-Year Gain

Reviewed by Simply Wall St

Getlink (ENXTPA:GET) has been drifting in a tight range recently, and that kind of quiet tape often hides useful clues. Let us dig into what the latest returns suggest about sentiment and value.

See our latest analysis for Getlink.

Zooming out, the share price has been broadly range bound this year, yet a positive 1 year total shareholder return of 4.6 percent suggests the market still sees steady, if unspectacular, progress rather than a sharp re rating.

If Getlink has you thinking about transport infrastructure and long term cash flows, you might also want to explore aerospace and defense stocks as another set of resilient, capital intensive businesses to research.

With decent earnings momentum, a modest positive return and analyst targets sitting above the current price, the key question now is whether Getlink is quietly undervalued or if the market is already pricing in future growth.

Price-to-Earnings of 32.4x: Is it justified?

On a price-to-earnings ratio of 32.4 times and a last close of €15.37, Getlink screens as richly valued rather than overlooked.

The price-to-earnings multiple compares what investors pay today to each euro of current earnings. This can be especially important for mature, capital intensive infrastructure businesses where growth is typically steadier than in more dynamic sectors.

For Getlink, the current 32.4 times earnings tag is not only higher than the European infrastructure industry average of 16.7 times, it is also almost double the estimated fair price-to-earnings ratio of 16.9 times implied by our fair value work. This suggests the market is paying a substantial premium for its earnings stream.

That premium stands out sharply against sector peers, with Getlink trading at roughly twice the broader infrastructure multiple and well above where the SWS fair ratio indicates the market could eventually settle if sentiment cools or growth expectations ease.

Explore the SWS fair ratio for Getlink

Result: Price-to-Earnings of 32.4x (OVERVALUED)

However, setbacks such as weaker cross Channel traffic or regulatory changes to infrastructure returns could quickly challenge the premium valuation that investors are currently paying.

Find out about the key risks to this Getlink narrative.

Another View Using Our DCF Model

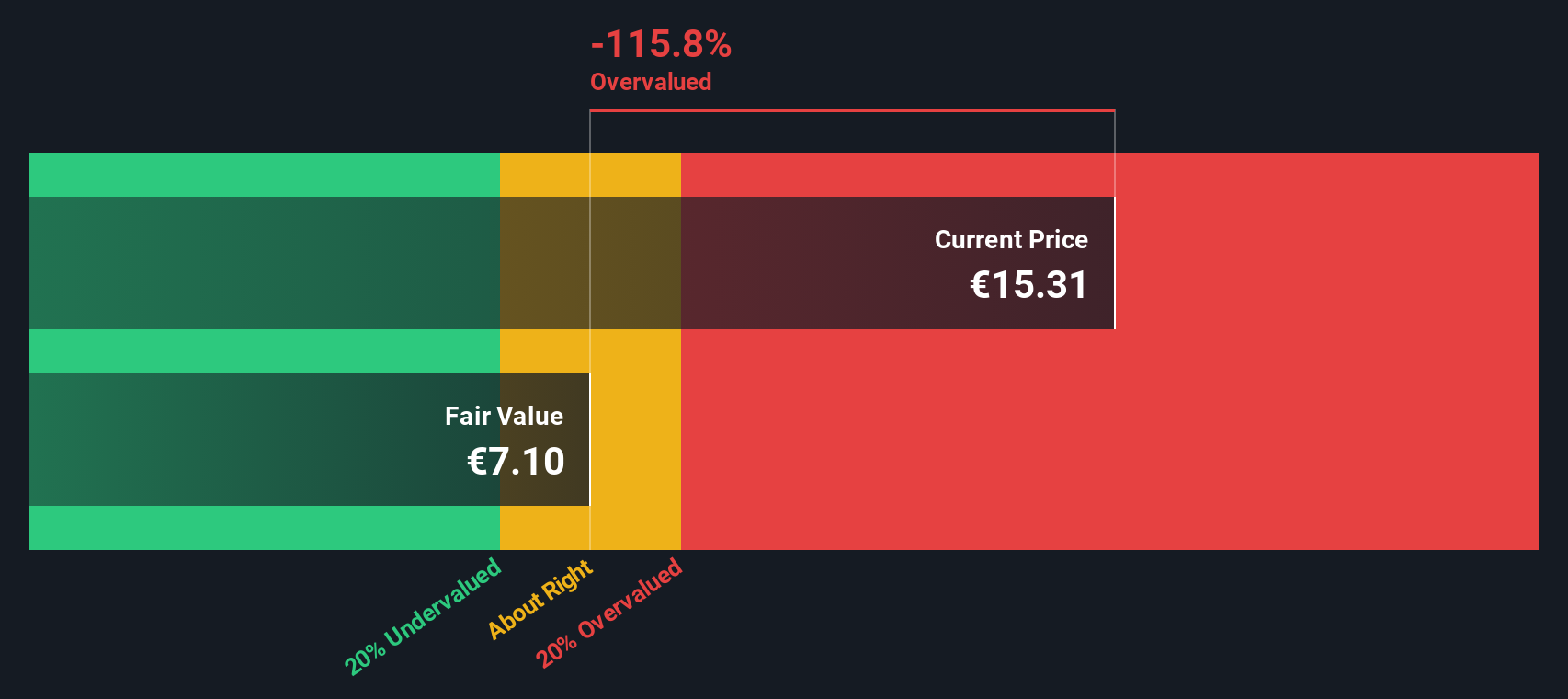

While the earnings multiple flags Getlink as expensive, our DCF model goes further and suggests the shares are trading well above an estimated fair value of €7.65. That implies material downside if growth or margins disappoint. Is the current premium really built to last?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Getlink for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Getlink Narrative

If you see things differently or want to dig into the numbers yourself, you can quickly craft a personalised story in just a few minutes: Do it your way.

A great starting point for your Getlink research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Smart investors never stop sharpening their edge, so use the Simply Wall St Screener now to uncover fresh opportunities before other people spot them.

- Capitalize on overlooked value by targeting companies trading below their cash flow potential through these 916 undervalued stocks based on cash flows that could re rate as sentiment shifts.

- Focus on dependable payers with attractive yields using these 13 dividend stocks with yields > 3% to support long term total returns.

- Track stocks shaping digital assets and blockchain infrastructure via these 80 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:GET

Getlink

Engages in the design, finance, construction, and operation of fixed link infrastructure and transport system in France and the United Kingdom.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion