What Do Recent Airline Alliances Mean for Air France-KLM Shares in 2025?

Reviewed by Simply Wall St

Are you puzzling over what to do with Air France-KLM shares after the rollercoaster year they have had? You are definitely not alone. Whether you already have the airline in your portfolio or you are circling it as a potential buy, there is a lot to unpack when it comes to this company. Its valuation story is especially intriguing right now.

Let’s start with how the stock has been behaving. Over the past year, Air France-KLM has soared, returning nearly 57%, and it is up even further, by more than 60%, since the start of this year. After such strong gains, it is normal to wonder if there is still room to run, or if you are arriving a little late to the party. On the flip side, you might have noticed the recent turbulence: the stock dropped by 1.7% over the last week and lost about 10% through the past month. These swings come as investors weigh the company’s long-term recovery prospects against broader industry headwinds and shifting market sentiment, including renewed optimism about international travel demand in Europe.

For investors focused on value, here is what catches the eye: based on six major checks covering key valuation measures, Air France-KLM scores a 5 out of 6 for being undervalued. That suggests there could be meaningful upside here, even after its recent gains, especially if market participants have not fully caught on yet.

Up next, let’s dig into how those valuations stack up using several classic methods, and why, when it comes to understanding what Air France-KLM is truly worth, there may be a smarter way than just looking at numbers alone.

Air France-KLM delivered 56.9% returns over the last year. See how this stacks up to the rest of the Airlines industry.Approach 1: Air France-KLM Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the true value of a company by projecting its future cash flows and then discounting them back to today’s value. This method aims to answer what Air France-KLM should be worth if you consider all the future euros it is expected to generate, expressed in today’s money.

Currently, Air France-KLM’s last twelve months free cash flow stands at nearly €1.03 billion. Analysts have provided forecasts for free cash flow up to 2028, with values expected to reach €1.07 billion by that year. For years beyond, estimates are extrapolated. For example, cash flows could rise as high as €2.33 billion by 2035, though these further-out numbers inherently carry more uncertainty.

- 2026 projected FCF: €620.4 million

- 2028 projected FCF: €1.07 billion

- 2035 projected FCF (extrapolated): €2.33 billion

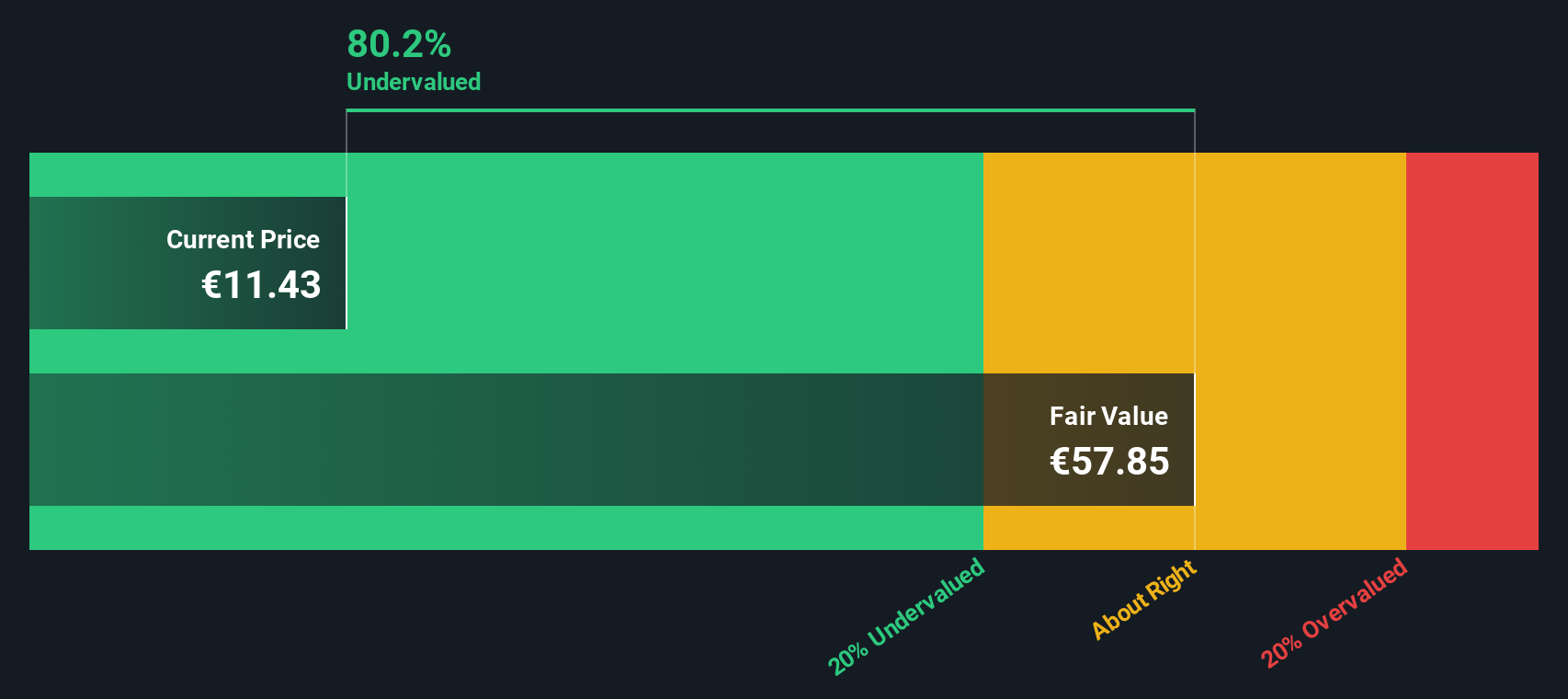

Based on these projections, the estimated intrinsic value per share is €57.85. The DCF suggests the stock is 77.6% undervalued compared to the market price. This points to substantial upside potential if the cash flow expectations are realized.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Air France-KLM.

Approach 2: Air France-KLM Price vs Earnings

The Price-to-Earnings (PE) ratio is often the go-to valuation metric for established, profitable companies like Air France-KLM. It provides a quick sense of how much investors are willing to pay for €1 of earnings, making it easier to compare across similar businesses.

In theory, a higher PE suggests investors expect stronger growth or are comfortable with lower risks. A lower PE might reflect more muted growth prospects or higher uncertainty. What is considered a "fair" PE ratio is shaped by the company’s own fundamentals as well as broader factors, such as industry averages, profit margins, and forecast growth.

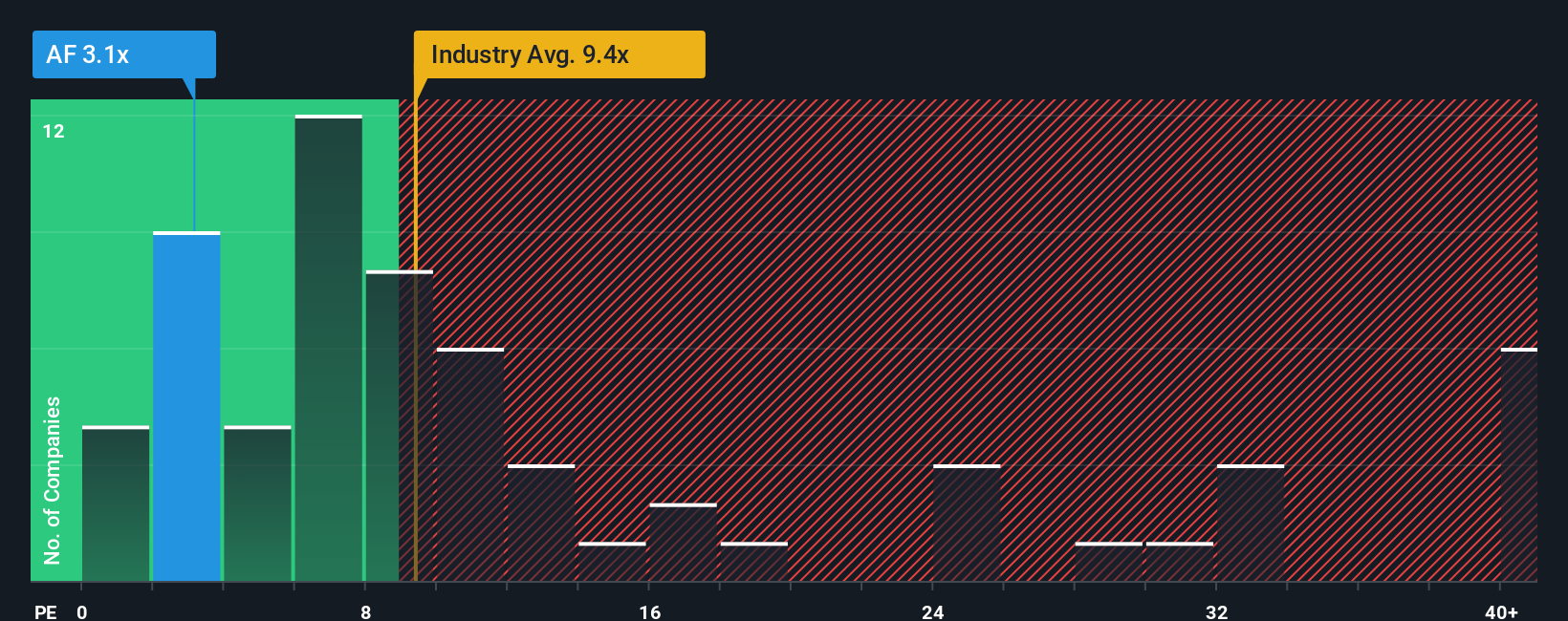

Currently, Air France-KLM trades at a PE ratio of just 3.56x. That is sharply below the airlines industry average of 10.01x and well under its peers’ average of 53.88x. At face value, this low multiple implies the stock is attractively priced or that the market expects ongoing challenges for the business.

To provide a more tailored benchmark, Simply Wall St calculates a "Fair Ratio" that reflects Air France-KLM’s growth prospects, profit margins, industry, market cap, and risks. This proprietary metric goes beyond simple peer or industry comparisons and is a robust indicator of appropriate valuation for this specific company.

For Air France-KLM, the Fair Ratio stands at 15.28x. Comparing this with the actual PE of 3.56x suggests that the stock remains significantly undervalued relative to what would be fair when accounting for its unique fundamentals and risks.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Air France-KLM Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative combines your personal take on a company with numbers, letting you turn your assumptions about Air France-KLM’s future revenue, earnings, and margins into a story-driven financial forecast and, ultimately, your own fair value estimate.

Rather than relying solely on static figures, Narratives link what is happening at the company to a real-time valuation that fits your view. This approach makes it easy to see when the market under or overvalues the stock. Narratives are simple to use and available within the Simply Wall St Community page, where millions of investors share their perspectives.

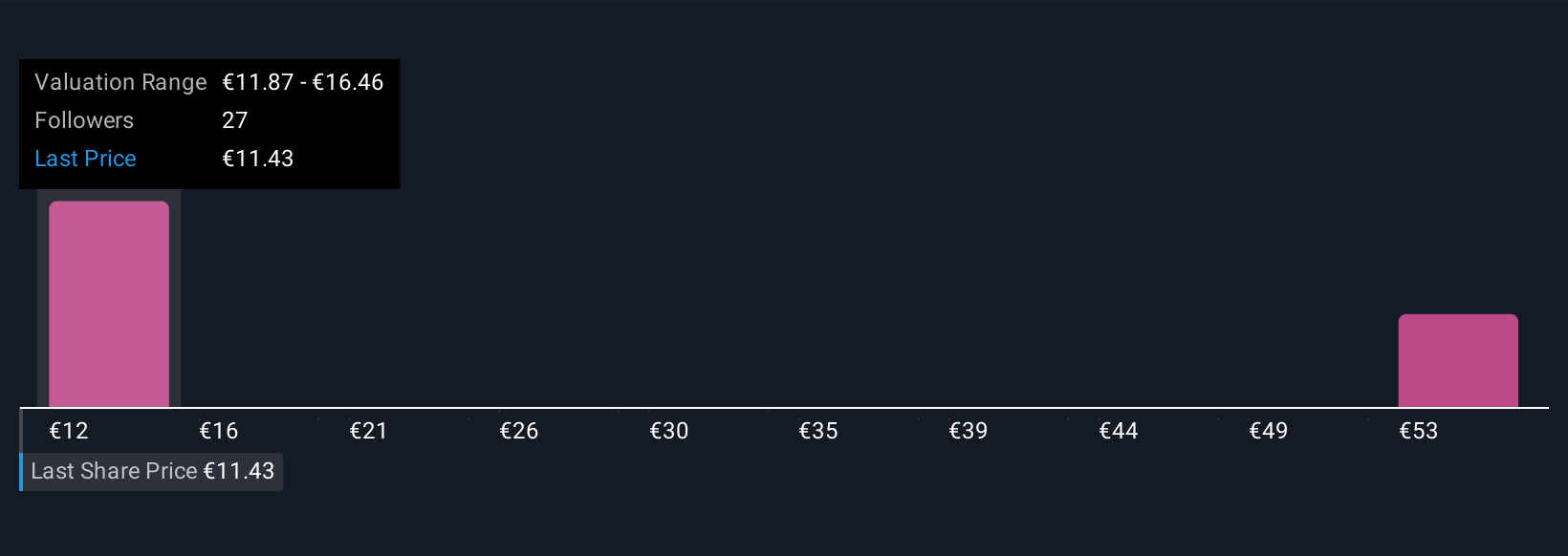

When news breaks or earnings are reported, Narratives update automatically so your valuations stay relevant. This helps you decide whether it is time to buy, sell, or hold, all with the confidence that comes from connecting story to numbers. For example, two Air France-KLM Narratives might predict a fair value as high as €80 or as low as €30, depending on how optimistic or cautious the investor’s story is.

Do you think there's more to the story for Air France-KLM? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AF

Air France-KLM

Provides passenger and cargo transportation services worldwide.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives