Does Air France-KLM’s 2025 Capacity Expansion Reaffirm Its Long-Term Growth Strategy (ENXTPA:AF)?

Reviewed by Sasha Jovanovic

- In early November 2025, Air France-KLM reported its third-quarter and year-to-date results, highlighting sales of €9.21 billion for the quarter and a sharp increase in year-to-date net income to €1.04 billion, alongside reconfirmed plans to grow group capacity by 4% to 5% in 2025.

- An interesting insight is that while third-quarter net income dipped slightly year-over-year, strong passenger growth and higher capacity drove a very large year-to-date net income increase for the group.

- We’ll take a closer look at how Air France-KLM’s robust capacity projections might shape its investment narrative going forward.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Air France-KLM's Investment Narrative?

For those considering Air France-KLM, the investment case often hinges on confidence in the company’s ability to profitably expand capacity, manage costs, and maintain flexible operations through shifting conditions. The latest reported results reinforce this narrative: while third-quarter net income slipped slightly, strong passenger growth and a reaffirmed plan to boost group capacity by 4% to 5% in 2025 signal ongoing ambition. This guidance may act as a short-term catalyst, giving investors tangible evidence of management’s focus on growth, though the Q3 dip in profit highlights persistent cost or competitive pressures. In light of recent share price volatility, these updates could impact sentiment but may not materially alter the company’s core medium-term challenges, rising costs, debt levels, and the sensitivity of demand to economic cycles. The balance between expanding capacity and sustaining margins remains a central risk in the current outlook.

However, unexpected cost increases could still reshape the profit story ahead for Air France-KLM.

Exploring Other Perspectives

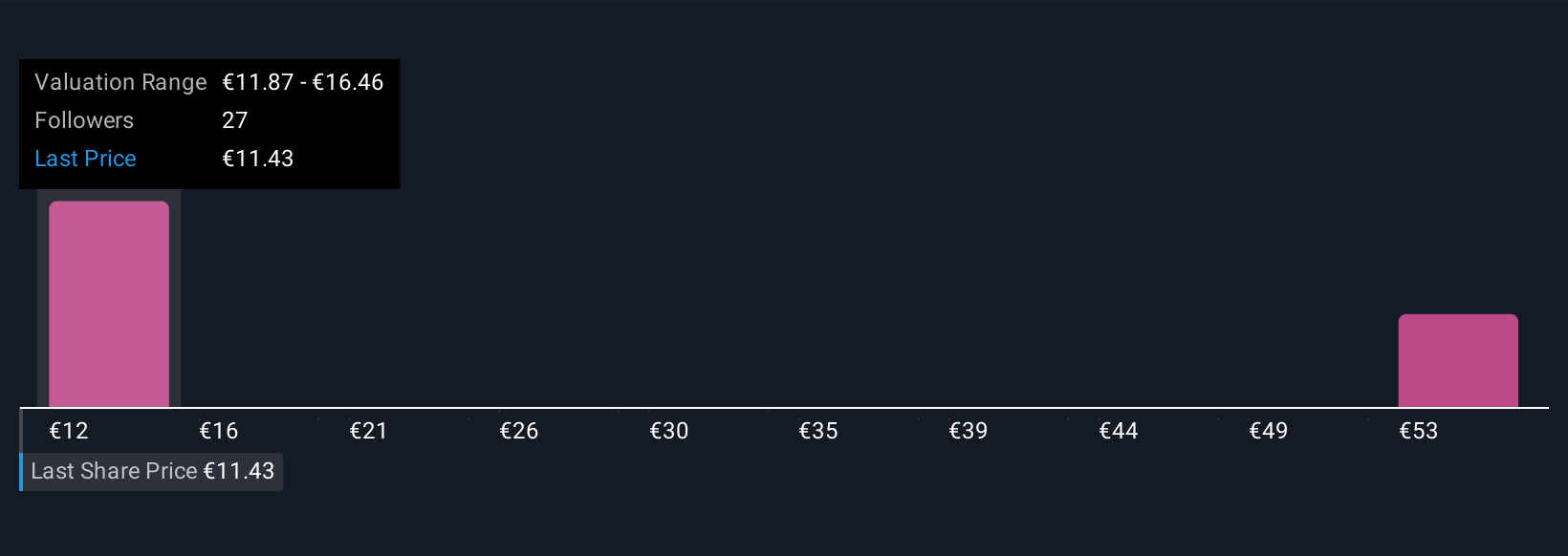

Explore 6 other fair value estimates on Air France-KLM - why the stock might be worth over 3x more than the current price!

Build Your Own Air France-KLM Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Air France-KLM research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Air France-KLM research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Air France-KLM's overall financial health at a glance.

No Opportunity In Air France-KLM?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AF

Air France-KLM

Provides passenger and cargo transportation services worldwide.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives