Assessing Air France-KLM (ENXTPA:AF) Valuation Following Recent Share Price Movements

Reviewed by Simply Wall St

Air France-KLM (ENXTPA:AF) shares have been quietly shifting over the past month, dipping around 4% even as the company maintains positive year-to-date gains. Investors appear to be weighing recent performance against longer-term expectations.

See our latest analysis for Air France-KLM.

Despite a modest dip over the past month, Air France-KLM’s 39.1% year-to-date share price return points to strong momentum as the travel sector regains altitude. While recent pullbacks may reflect shifting market sentiment, longer-term total shareholder returns remain in negative territory. This reminds investors that growth potential and volatility often go hand in hand.

If you’re curious about what other sectors are gaining pace, now’s a great opportunity to broaden your search and discover fast growing stocks with high insider ownership

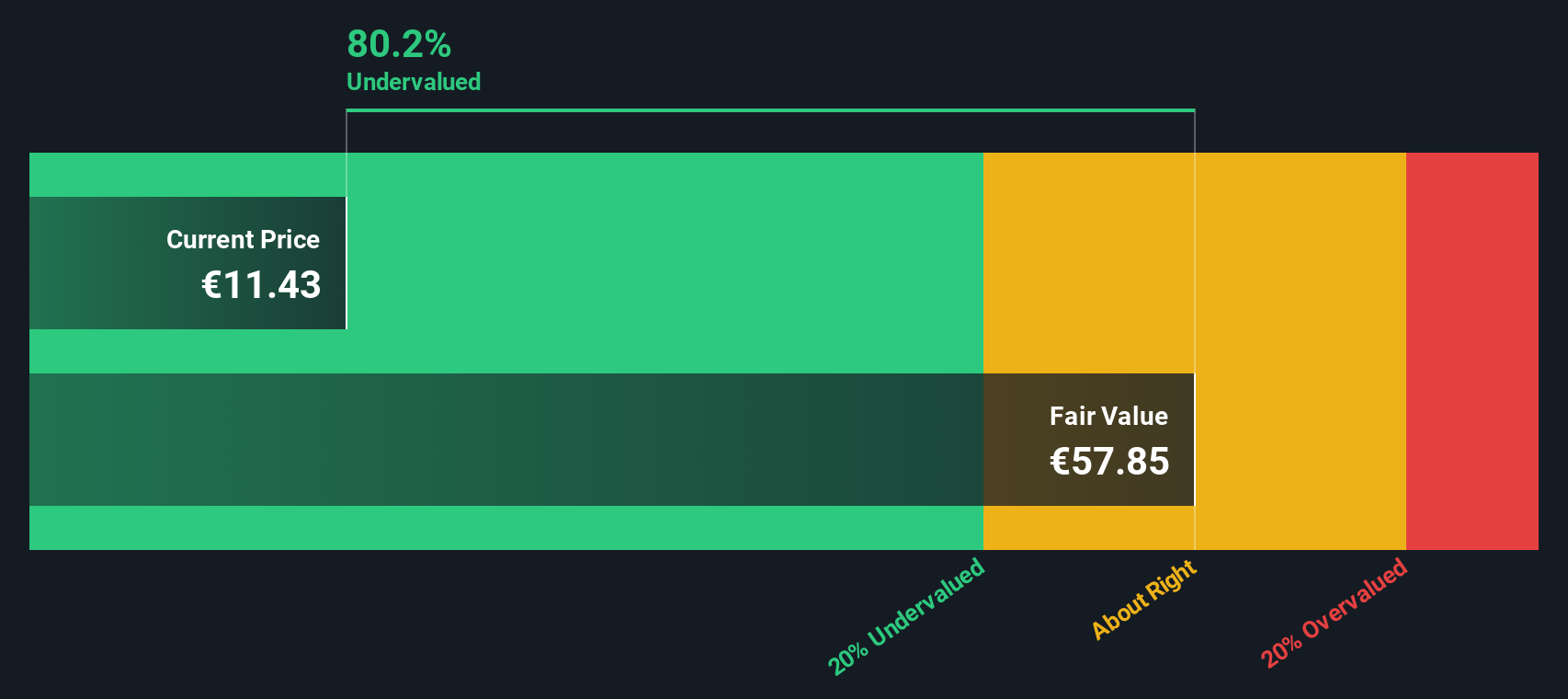

The big question investors now face is whether Air France-KLM’s recent share price slide signals an undervalued opportunity, or if the market has already factored in all foreseeable growth. Is this the start of a bargain, or a sign that expectations are already high?

Price-to-Earnings of 3.1x: Is it justified?

Air France-KLM is trading at a price-to-earnings (P/E) ratio of just 3.1x, which is substantially lower than its peers. With a last close price of €11.25, this figure signals a significant valuation gap, especially when considering the stock’s recent momentum.

The price-to-earnings ratio highlights how much investors are willing to pay for each euro of earnings. For an established airline like Air France-KLM, this multiple is significant, especially since strong earnings growth can be a marker of operational recovery or broader sector tailwinds.

At 3.1x, Air France-KLM’s P/E lags far behind both the peer average (55.7x) and the global airline industry average (8.8x). This deep discount suggests the market may be underestimating its earnings prospects or maintaining heightened caution around sector volatility. Compared to the estimated fair P/E of 13.9x, there is notable room for the multiple to re-rate if fundamentals hold up.

Explore the SWS fair ratio for Air France-KLM

Result: Price-to-Earnings of 3.1x (UNDERVALUED)

However, ongoing sector volatility and unpredictable macroeconomic shifts may quickly challenge the current optimism around Air France-KLM’s valuation.

Find out about the key risks to this Air France-KLM narrative.

Another View: What Does the SWS DCF Model Indicate?

Looking at Air France-KLM through the lens of our DCF model, the stock appears to trade significantly below fair value, about 70% less than the intrinsic value estimate of €37.94 per share. This paints a much more optimistic picture than what the current market price suggests.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Air France-KLM for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Air France-KLM Narrative

If you see the numbers differently or prefer to chart your own course, you can dive into the data and shape your own view in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Air France-KLM.

Looking for More Investment Ideas?

Seize your edge in the market by taking your next step beyond Air France-KLM. Stay ahead and don’t miss out on stocks with unique strengths and huge potential.

- Boost your growth strategy by targeting these 881 undervalued stocks based on cash flows, quietly positioned for strong gains based on robust cash flows and attractive entry points.

- Power up your portfolio with these 27 AI penny stocks, at the forefront of artificial intelligence innovation, riding enormous industry momentum and transformative market trends.

- Lock in reliable yields and strengthen your income approach with these 17 dividend stocks with yields > 3%, offering stable returns above 3% for greater financial confidence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AF

Air France-KLM

Provides passenger and cargo transportation services worldwide.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives