- France

- /

- Infrastructure

- /

- ENXTPA:ADP

Will Strong October Passenger Growth Redefine Aeroports de Paris' (ENXTPA:ADP) Investment Narrative?

Reviewed by Sasha Jovanovic

- Aeroports de Paris SA recently reported that group passenger traffic rose by 5.0% in October 2025, reaching 34,151,086 travelers, and year-to-date traffic also grew by 4.1% to 320,419,299 passengers.

- This uptrend in passenger numbers highlights ongoing recovery in air travel demand and suggests continued operational momentum across the company’s airports network.

- With passenger growth outpacing earlier trends, we'll explore how these traffic gains might reshape Aeroports de Paris's investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Aeroports de Paris Investment Narrative Recap

To be a shareholder in Aeroports de Paris, you have to believe in the long-term recovery and growth of global air travel and the group’s ability to leverage infrastructure projects and regulatory agreements for revenue stability. The November passenger traffic data strengthens the near-term catalyst of demand recovery, but its impact on the single largest risk, rising operating costs and debt levels, remains limited for now, as higher traffic alone does not offset margin pressures.

Of the company’s recent announcements, the upcoming earnings release on February 18, 2026, is most relevant. It will provide a clearer picture of whether sustained passenger growth is translating to improved revenues and margins, especially given that recent half-year profits fell despite rising sales, a key metric as operational momentum continues to build.

On the flip side, investors should be aware that escalating staff expenses and external costs could still…

Read the full narrative on Aeroports de Paris (it's free!)

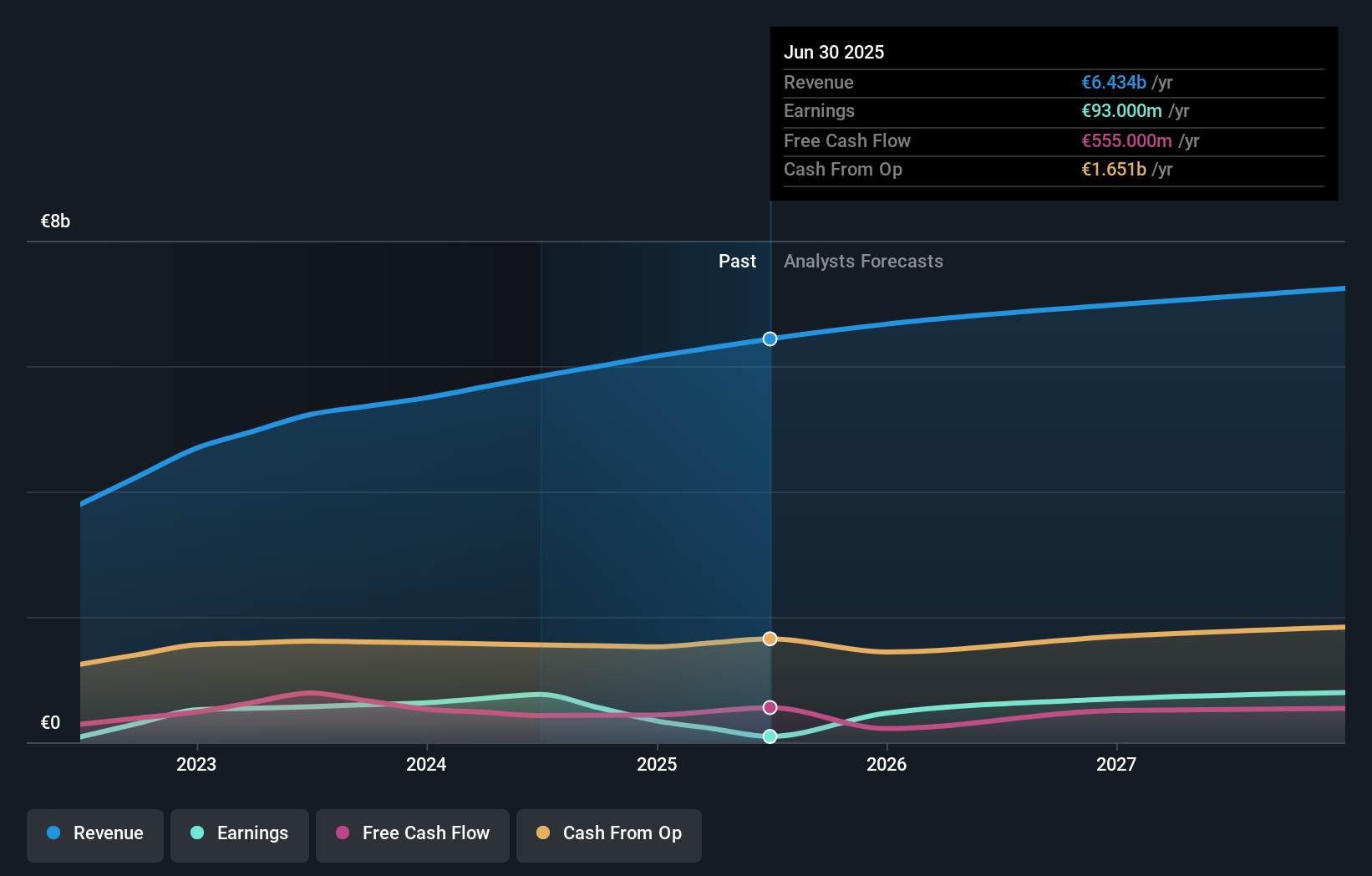

Aeroports de Paris is projected to reach €7.3 billion in revenue and €875.8 million in earnings by 2028. This outlook is based on an expected annual revenue growth rate of 4.4%, with earnings forecast to increase by €782.8 million from the current level of €93.0 million.

Uncover how Aeroports de Paris' forecasts yield a €122.73 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community analysts assigned fair values to Aeroports de Paris ranging widely from €49.67 to €122.73, based on two individual forecasts. With costs rising and profit margins under pressure, these differing viewpoints highlight just how much opinions can vary, see what other perspectives might reveal for your decision.

Explore 2 other fair value estimates on Aeroports de Paris - why the stock might be worth less than half the current price!

Build Your Own Aeroports de Paris Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aeroports de Paris research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Aeroports de Paris research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aeroports de Paris' overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ADP

Aeroports de Paris

Operates and designs airports in France, Turkey, Kazakhstan, Jordan, Georgia, and internationally.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives