- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:VU

VusionGroup (ENXTPA:VU) Boosts Market Position with Ace Hardware Alliance Despite Financial Challenges

Reviewed by Simply Wall St

VusionGroup (ENXTPA:VU) is navigating a dynamic period marked by strategic partnerships and financial challenges. The recent collaboration with Ace Hardware to deploy digital shelf label technology underscores VusionGroup's commitment to innovation and market expansion, despite ongoing profitability issues and valuation concerns. As the company prepares to release its Q3 2024 results, stakeholders should anticipate insights into how these developments are shaping VusionGroup's growth trajectory and operational efficiencies.

Click to explore a detailed breakdown of our findings on VusionGroup.

Core Advantages Driving Sustained Success for VusionGroup

VusionGroup's strategic focus on product innovation and market share expansion is evident from its 15% year-over-year revenue growth, as highlighted by CEO Thierry Gadou. The company's commitment to innovation, as noted by COO Thierry Lemaître, has led to successful product launches that exceed expectations, bolstering top-line growth. Additionally, the seasoned management team, with an average tenure of 7.4 years, provides stability and strategic insight, crucial for navigating market dynamics. Analysts' predictions of a 37% stock price increase reflect positive market sentiment, supported by a forecasted revenue growth of 28.5% annually, outpacing the French market's 5.6% growth.

To gain deeper insights into VusionGroup's historical performance, explore our detailed analysis of past performance.Critical Issues Affecting the Performance of VusionGroup and Areas for Growth

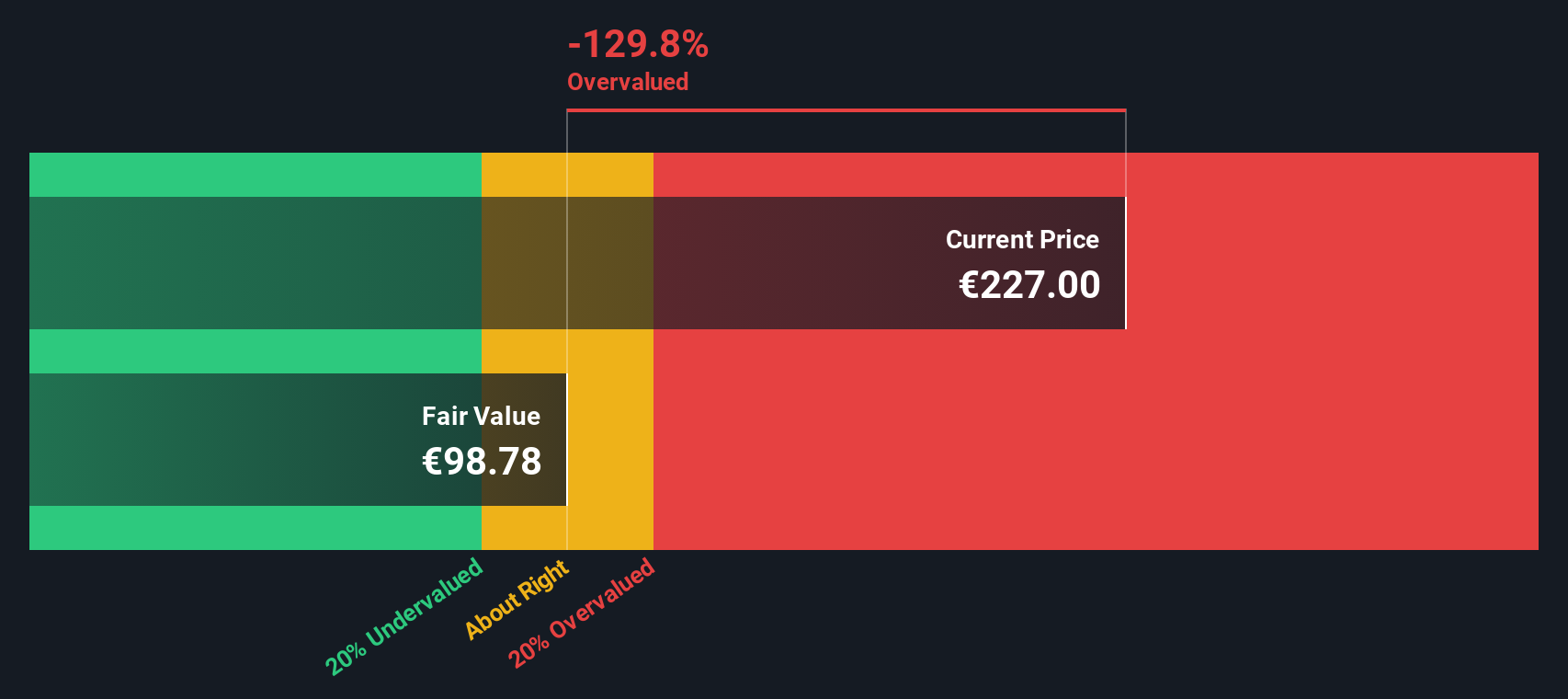

VusionGroup faces financial challenges, including a negative Return on Equity of -14.26% and ongoing unprofitability. The company's low dividend yield of 0.21% also falls short of industry standards, raising concerns about its appeal to income-focused investors. Operational inefficiencies, such as supply chain disruptions, have been acknowledged by Gadou, indicating areas needing improvement. Moreover, the stock's current trading above its estimated fair value suggests it may be considered expensive relative to peers, highlighting potential valuation concerns.

To dive deeper into how VusionGroup's valuation metrics are shaping its market position, check out our detailed analysis of VusionGroup's Valuation.Potential Strategies for Leveraging Growth and Competitive Advantage

The partnership with Ace Hardware to implement digital shelf label technology is a significant strategic alliance, enhancing VusionGroup's market position in the DIY sector. This collaboration not only boosts operational efficiency but also strengthens customer relationships, as evidenced by a 20% increase in repeat business, according to CFO Olivier Gernandt. Such strategic moves align with analysts' bullish outlook, presenting opportunities for substantial revenue growth and market expansion.

See what the latest analyst reports say about VusionGroup's future prospects and potential market movements.Market Volatility Affecting VusionGroup's Position

Economic headwinds and competitive pressures pose significant threats to VusionGroup's market position. Gadou's awareness of potential downturns affecting consumer spending underscores the need for proactive risk management. Additionally, intense competition necessitates continuous innovation and differentiation to maintain leadership. Regulatory changes also present challenges, requiring agility and compliance to ensure business continuity.

Explore the current health of VusionGroup and how it reflects on its financial stability and growth potential.Conclusion

VusionGroup's impressive 15% year-over-year revenue growth and strategic focus on innovation underscore its potential for sustained success, as evidenced by analysts' optimistic forecasts of a 37% stock price increase. However, the company's current financial challenges, including negative Return on Equity and low dividend yield, coupled with its stock trading above estimated fair value, suggest caution. These factors indicate that while VusionGroup is poised for growth, particularly through strategic alliances like the one with Ace Hardware, it must address profitability and operational inefficiencies to justify its current market valuation and ensure long-term competitiveness amidst economic and regulatory pressures.

Where To Now?

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About ENXTPA:VU

VusionGroup

Engages in the provision of digitalization solutions for commerce in Europe, Asia, and North America.

Exceptional growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives