- China

- /

- Electronic Equipment and Components

- /

- SZSE:000988

High Growth Tech Stocks To Explore This December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious Federal Reserve commentary and political uncertainties, small-cap stocks have faced significant challenges, with the Russell 2000 index reflecting a notable decline. Amid this backdrop, identifying high-growth tech stocks requires careful consideration of their potential for innovation and resilience in an evolving economic environment.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1271 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America with a market capitalization of €2.82 billion.

Operations: VusionGroup S.A. generates revenue primarily through installing and maintaining electronic shelf labels, contributing €830.16 million to its financials. The company's operations span Europe, Asia, and North America, focusing on digitalization solutions for the retail sector.

VusionGroup is making significant strides in the tech industry with its recent partnership with The Fresh Market to implement Vusion 360 technology solutions across 166 locations. This move, set for a full rollout in 2025, will enhance inventory management and efficiency through innovations like multicolor electronic shelf labels and Captana’s AI technology. Financially, VusionGroup exhibits robust growth prospects with an expected annual revenue increase of 23.4% and earnings projected to surge by approximately 81.8%. Moreover, the company's strategic use of existing Cisco Meraki infrastructure underscores a commitment to sustainability by minimizing additional hardware needs, aligning operational enhancements with environmental responsibility.

- Click to explore a detailed breakdown of our findings in VusionGroup's health report.

Understand VusionGroup's track record by examining our Past report.

Huagong Tech (SZSE:000988)

Simply Wall St Growth Rating: ★★★★★☆

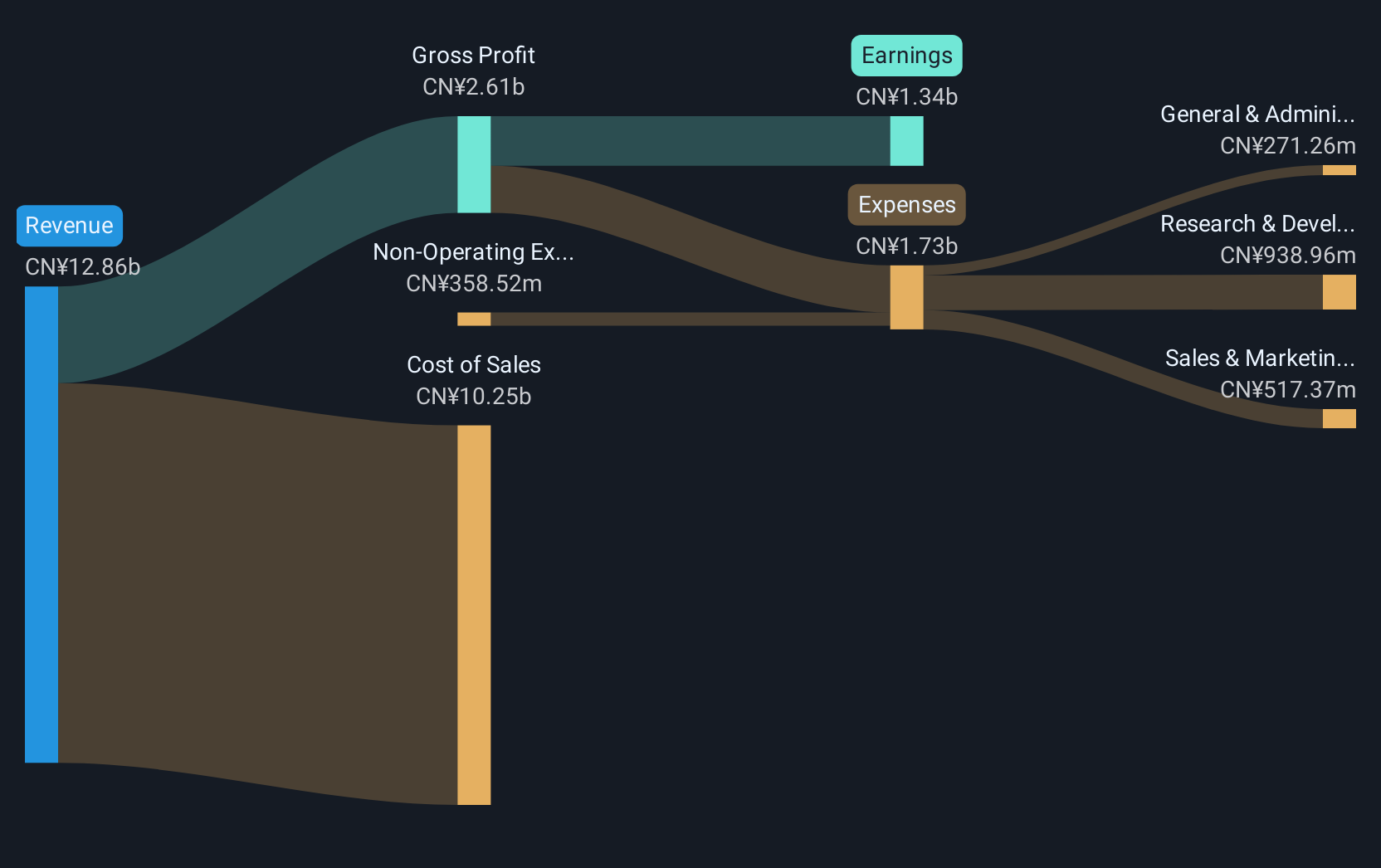

Overview: Huagong Tech Company Limited is engaged in the manufacturing and sale of laser equipment, hologram products, optical communication devices, and electronic components both in China and internationally, with a market capitalization of CN¥40.19 billion.

Operations: The company generates revenue through the production and sale of laser equipment, hologram products, optical communication devices, and electronic components. It operates both domestically in China and internationally.

Huagong Tech is navigating an evolving landscape with strategic modifications, including a recent shareholder meeting aimed at broadening its business scope and enhancing subsidiary support. This follows a notable financial performance, with revenues climbing to CNY 9.0 billion, up 23% from the previous year, and net income rising to CNY 937.6 million. These figures underscore a robust growth trajectory in tech, further evidenced by an earnings growth forecast of 28.3% annually. The company's commitment to adapting its operational framework while maintaining strong revenue growth positions it well amidst competitive tech markets.

- Unlock comprehensive insights into our analysis of Huagong Tech stock in this health report.

Assess Huagong Tech's past performance with our detailed historical performance reports.

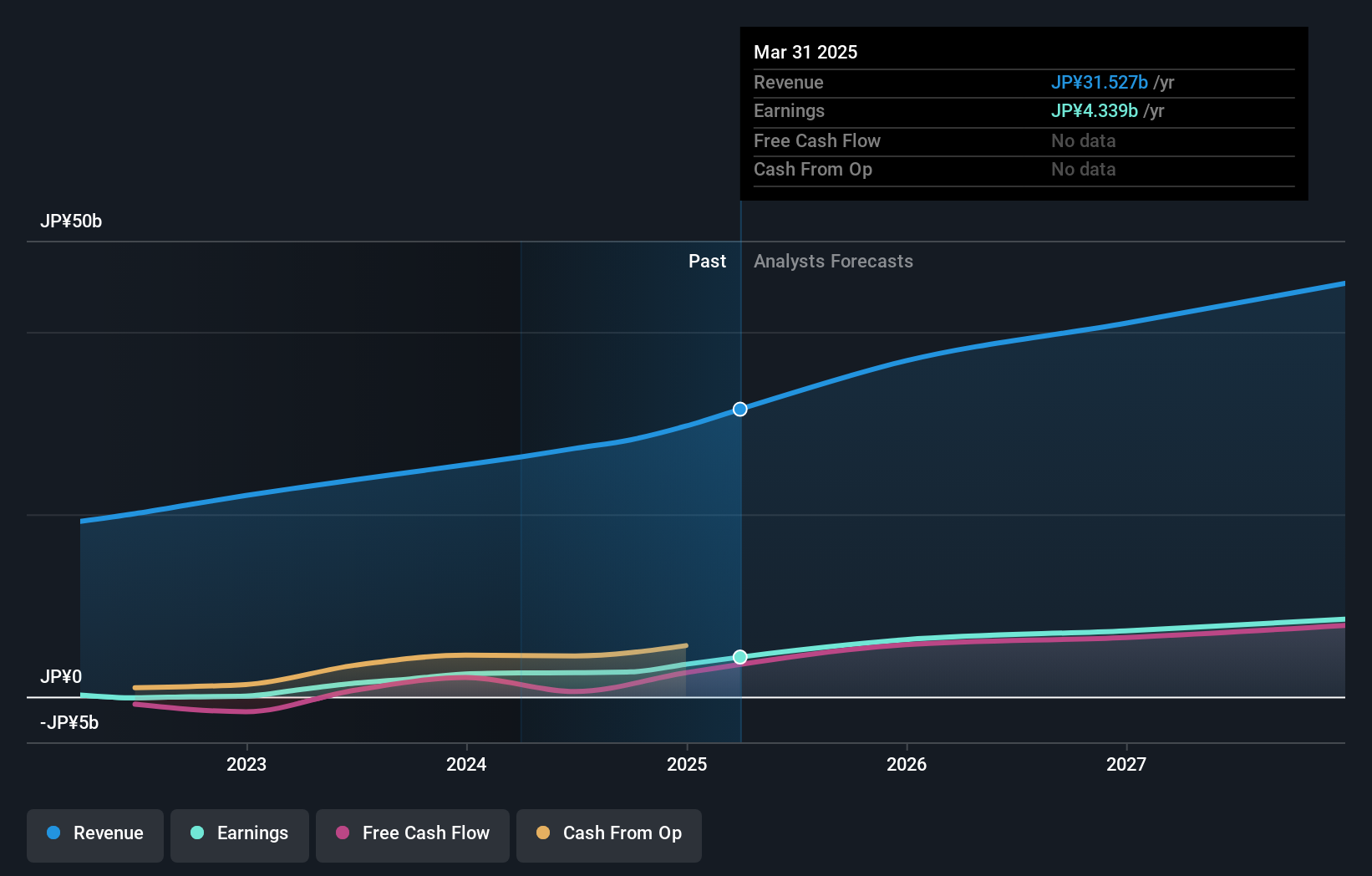

Cybozu (TSE:4776)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cybozu, Inc. is a company that develops, sells, and operates groupware solutions across several countries including Japan, China, Vietnam, Taiwan, Malaysia, Australia, and the United States with a market capitalization of ¥137.10 billion.

Operations: Cybozu generates revenue primarily through its software development and sales segment, which accounts for ¥28.16 billion. The company focuses on providing groupware solutions across multiple international markets.

Cybozu's trajectory in the tech sector is marked by a robust financial and strategic posture, with a 39.3% earnings growth over the past year outpacing the software industry's average of 12.7%. This performance is underpinned by significant investment in R&D, crucial for maintaining its competitive edge in developing innovative software solutions. The company also recently completed a share repurchase program, buying back shares worth ¥2,929.77 million, reflecting confidence in its financial health and future prospects. With expected earnings to grow at an annual rate of 20.5%, Cybozu is positioned to leverage its technological advancements and market position effectively.

- Take a closer look at Cybozu's potential here in our health report.

Explore historical data to track Cybozu's performance over time in our Past section.

Where To Now?

- Click this link to deep-dive into the 1271 companies within our High Growth Tech and AI Stocks screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huagong Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000988

Huagong Tech

Manufactures and sells laser equipment, hologram products, optical communication devices, and electronic components in China and internationally.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives